Revise a purchase invoice that has taxable goods

- Go to Accounts payable > Purchase orders > All purchase orders.

- Create a purchase order for a taxable item.

Validate the tax details

On the Action Pane, on the Purchase tab, in the Tax group, select Tax document.

On the Tax details FastTab, review the tax calculation.

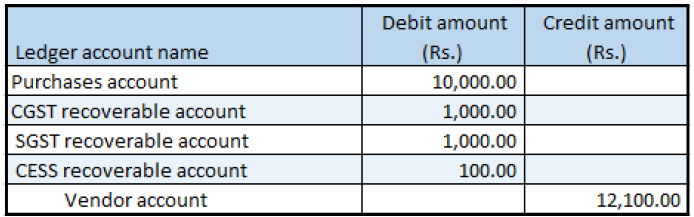

What you see might resemble the following example:

- Line amount: 10,000.00

- CGST: 10 percent

- SGST: 10 percent

- CESS: 1 percent

Select Close, and then select Confirm.

Post the purchase invoice

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- In the Default quantity for lines field, select Ordered quantity.

- On the Lines FastTab, enter the invoice number.

- In the Invoice type field, select Revised.

- In the Original invoice number field, select a value.

- Verify that the Original invoice date field is automatically set, based on the original invoice number that you selected.

- On the Action Pane, on the Vendor invoice tab, in the Actions group, select Post > Post.

- On the Action Pane, on the Invoice tab, in the Journals group, select Invoice.

- On the Overview tab, select Voucher.

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for