What's new or changed for India GST in 10.0.07 (January 2020)

This article includes a summary of the new features and critical bug fixes released in Dynamics 365 Finance version 10.0.07 for India GST localization.

New features

Create tax component with pre-defined rules

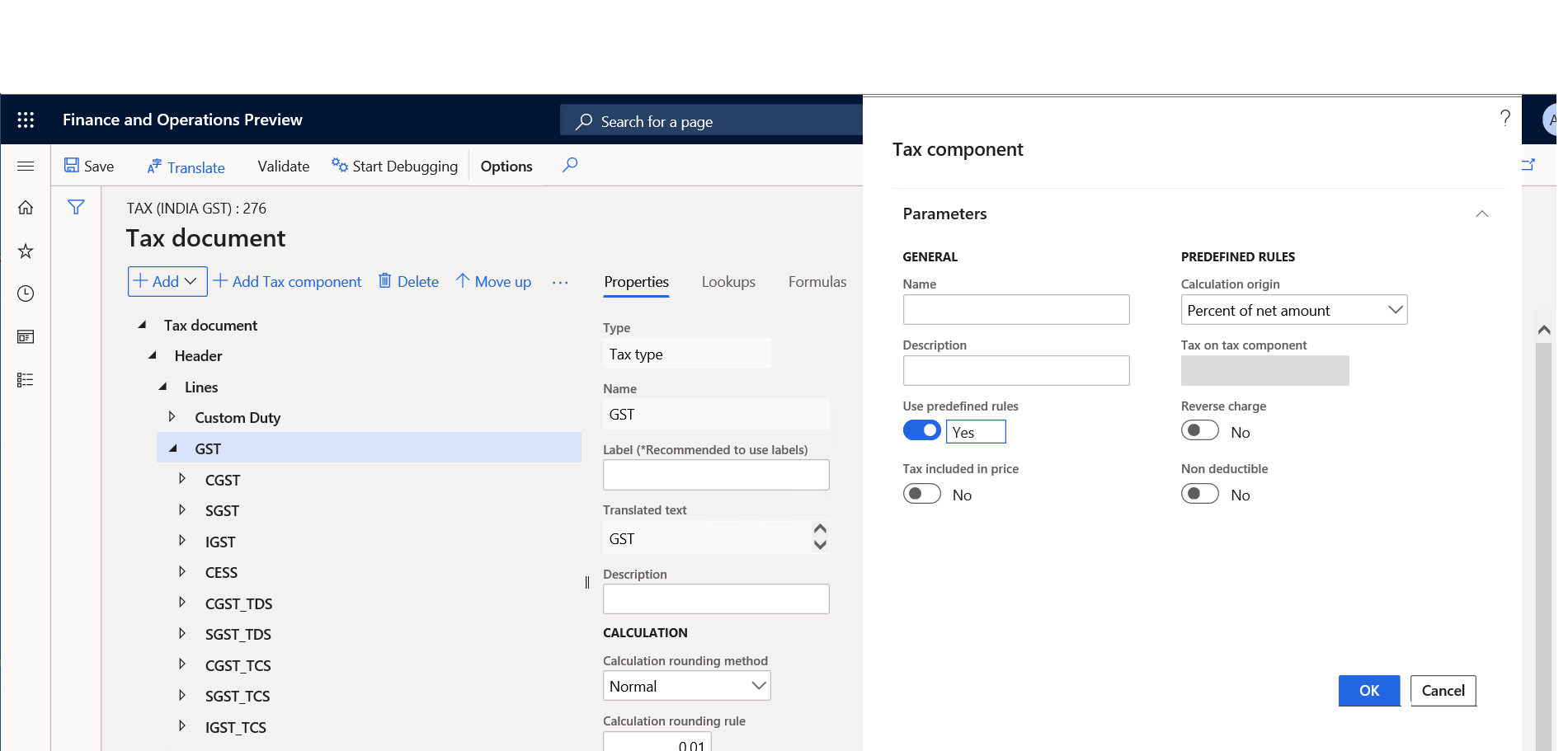

You can create a new component with pre-defined rules that support GST behaviors including non-deductible and reverse charge for purchases and sales. With this feature, you do not need to create a tax component, which includes adding tax measures, configuring the tax calculation formula, and configuring a tax posting profile.

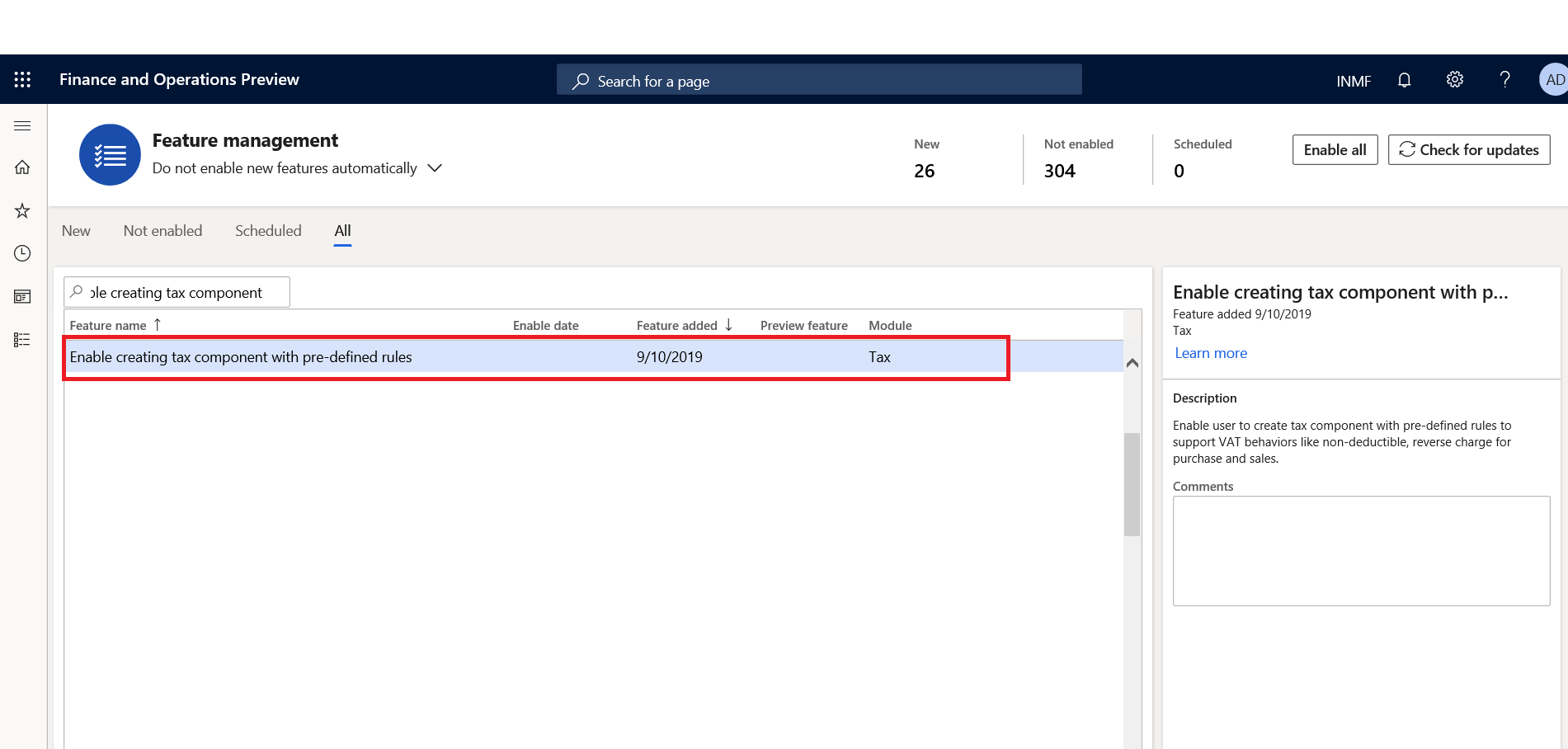

You can enable the feature in Feature management workspace. The feature name is Enable creating tax component with pre-defined rules.

With the feature enabled, there are several controls enabled in the dialog box. You can use them to control the behavior of the tax component. For more information, see Create tax components.

Critical fixes

- Printing multiple copies of the Sales invoice report by using print management is not working.

- Invoice address is not automatically populating in the customer tax information included in the timesheet.

- Importing customer data to a free text invoice is not updating for the Indian legal entity.

- Transactions posted through the Tax journal are not showing in open vendor transactions for settlement.

- Sales tax settlement might have an update conflict when the TaxsalesTaxpaymentHistory detail is updated multiple times.

- Incorrect Withholding tax (TDS/TCS) posting in the reporting currency when the exchange rate is changed at the time of payment with the transaction settled for foreign vendor transactions.

- Incorrect calculation of GST for credit note.

- Lines that are imported using the VendorInvoiceLine entity are not visible on the Pending vendor invoice page in the India entity.

- The Business verticals field on the GST registration numbers page should always be editable.

Upcoming fixes in 10.0.8

- Tax amount showing in purchase order totals and purchase invoice total is posted with 100 percent reverse charges.

- TDS transactions are not updated in the Withholding tax transaction (TDS/TCS) report when settled in the Prepayment with invoice report.

- Assessable value is updated after the charge code is removed from the Purchase order invoice line.

- When you change the selected vendor on a purchase requisition, vendor tax information is not updated on the Tax information page.

- Incorrect Free on board (FOB) and Cost, insurance, and freight (CIF) calculation on exported sales orders.

- Assessable value is not updated correctly on the Vendor invoice page when posted changes are incorporated in the Excel import file and published to Dynamics 365 Finance.

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for