Inventory Control in Dynamics GP - Parts 4-6

You can use Inventory Control to help manage your company's inventoried items. Many Inventory Control tasks help you create records for your items, such as how the items are to be tracked and what pricing should be used for the items that are sold. this article continues where Inventory Control in Dynamics GP - Parts 1-3 stopped.

The manual is divided into the following parts:

Part 1: Setup, describes the tasks you must complete to set up inventory, such as specifying system settings and setting up unit of measure schedules and item classes. For more information, see Part 1: Setup.

Part 2: Cards, includes information about basic inventory records. Refer to that part to learn how to define, modify, and remove items, sites, and kits. Information about setting up pricing structures also is included. For more information, see Part 2: Cards.

Part 3: Transactions, contains information about entering and posting inventory transactions and transfers. For more information, see Part 3: Transactions.

Part 4: Inquiries and reports, describes windows and reports you can use to view your inventory information.

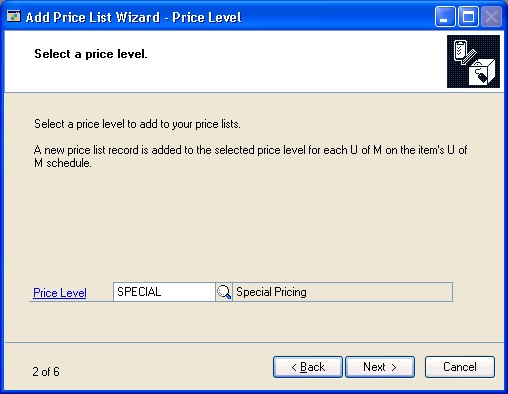

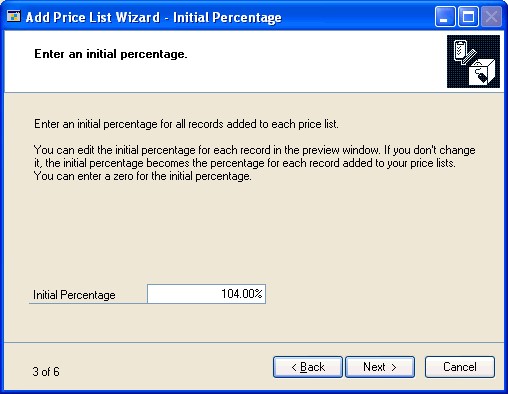

Part 5, Utilities, includes information about completing special tasks, such as using price list wizards, reconciling inventory, removing history records, and adjusting average costs of items.

Part 6, Routines, describes how you can use inventory checklists. Information about year-end closing tasks is also included.

Part 4: Inquiries and reports

This part of the documentation includes information about Inventory Control inquiries and reports. Analyzing your item records and transactions is an important part of your computerized accounting system. With Inventory Control, you can view important information about your item activity on-screen using the Inquiry windows. These windows provide easy access to detailed and summarized Inventory Control information.

Inventory Control also includes several reports that summarize information about your inventory records. You can use Inventory Control reports to verify transaction entry and posting. You also can print reports that analyze inventory activities.

The following information is discussed:

Chapter 26, "Item inquiries," includes information about viewing item records, including windows for viewing more detailed information about items tracked by lot and serial numbers. If you're using multiple bins, you also can view information about bin quantities.

Chapter 27, "Standard pricing inquiries," describes how you can use the Item Price List Inquiry window to view information about the pricing structures you've set up for your inventoried items, if you're using standard pricing.

Chapter 28, "Extended pricing inquiries," describes how you can view information about the extended pricing structures you've set up for your items.

Chapter 29, "Transaction inquiries," contains information about viewing records for inventory transactions and transfers. Information about viewing purchase receipt information also is included.

Chapter 30, "Reports," describes how you can print reports based on inventory records. Key reports for the module also are listed.

Chapter 26: Item inquiries

If you want to find information in your system but don't need to change the information, you can use the windows in the Inquiry menu. With those windows, you can search your inventory records to see quantity information for inventoried items, to view the lot and serial numbers assigned to items at specific sites, and to review pricing information.

The following information is discussed:

Viewing item information

Viewing item allocation information

Viewing bin quantity information

Viewing item stock information

Viewing serial number information

Viewing lot number information

Viewing lot attribute information

Viewing planning information for an item

Viewing a life cycle serial or lot number trace

The bill of materials trace tree view

Viewing a bill of materials trace

Viewing a recall serial or lot number trace

Viewing inventory available to promise information

Viewing item information

To view general information about items, use the inquiry windows. You can view quantity information for inventoried items, lot and serial numbers assigned to items at specific sites, pricing, and stock count information. If you're using multiple bins, you also can view information about the quantities of items in bins.

To view item information:

Open the Item Inquiry window. (Inventory >> Inquiry >> Item)

Enter or select the item to view.

Decide which site's information to view.

To view quantity information for all sites Mark All. Information in the window will include quantity information across all sites.

To view site-specific information Mark Site ID, then select a specific site. Information about the item quantities for the specific item-site combination are displayed in the window.

- Review the information. If needed, you also can review serial number information, or go to related windows to make changes. If you're using multiple bins, you can view information about bin quantities.

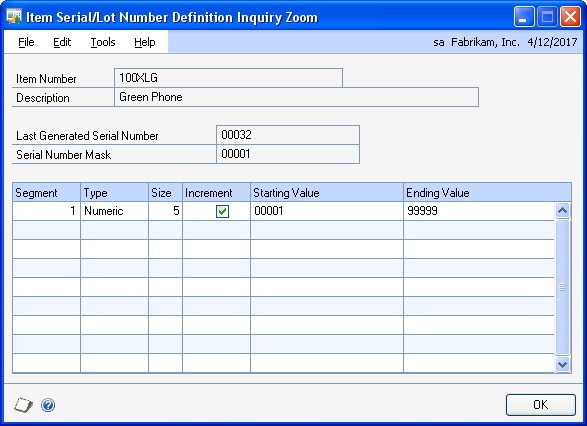

To view serial or lot number information If the item is tracked by serial or lot numbers, choose the expansion button on the Track field to open the Item Serial/Lot Number Definition Inquiry Zoom window.

To go to the Item Maintenance window If you need to change item information, click the Item Number link to open the Item Maintenance window. Refer to Chapter 10, "Item cards," for more information about using the Item Maintenance window.

To go to the Site Maintenance window If you need to change site information, click the Site ID link to open the Site Maintenance window. Refer to Chapter 14, "Sites and beginning quantities," for more information about using the Site Maintenance window.

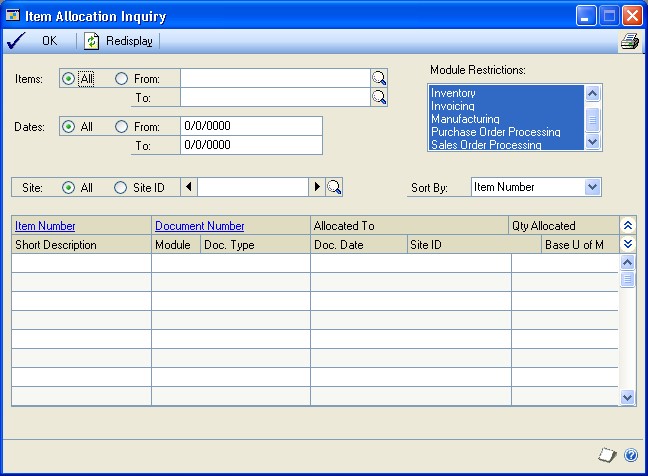

To view item allocation information If you need to view where item quantities have been allocated, click the Allocated link to open the Item Allocation Inquiry window. Refer to Viewing item allocation information for more information.

To view on-order information If you need to view the on-order quantity on purchase orders, click the On Order link to open the Purchase Order Processing Item Inquiry window. Refer to the Purchase Order Processing documentation for more information.

To view attachments If you need to view attachments for an item, choose the Attachment Management icon to open the Document Attachment Inquiry window. Refer to the System Manager documentation for more information.

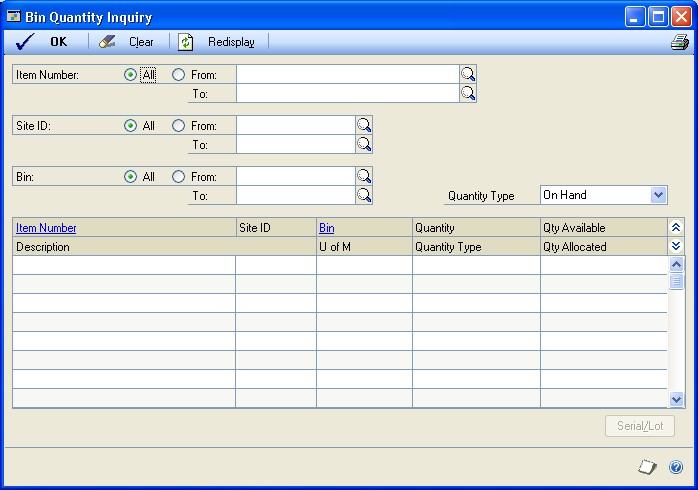

To view bin quantity information If you're using multiple bins, you can use the Bin Quantity Inquiry window to view information about the quantities in bins at a specific site. From the Go To button, choose Bin Quantity Inquiry to open the Bin Quantity Inquiry window. Refer to Viewing bin quantity information for more information.

To view stock count information If you need to view stock count information for an item, choose Stock Count to open the Item Stock Count Inquiry window.

- When you've finished reviewing information, close the windows.

Viewing item allocation information

Use the Item Allocation Inquiry window to view where item quantities have been allocated.

To view item allocation information:

- Open the Item Allocation Inquiry window. (Inventory >> Inquiry >> Item Allocation)

Select All to view all items or select a range of items.

Select a range of dates to restrict the information in the scrolling window.

Select which modules to view allocated item information for. You can select any or all of the modules listed.

Select whether to display items at all sites or a specific site.

Select a sorting order for the items displayed in the scrolling window.

Choose Redisplay to display the items in the scrolling window.

You can choose File >> Print to print the Item Allocation Inquiry Report, if needed.

When you've finished reviewing information, close the window.

Viewing bin quantity information

If you're using multiple bins, you can use the Bin Quantity Inquiry window to view information about the quantities in bins at a specific site.

To view bin quantity information:

- Open the Bin Quantity Inquiry window. (Inventory >> Inquiry >> Bin Quantities)

Specify a range to restrict information. You can limit the items, sites, bins, and quantity type information that is displayed.

Choose Redisplay to update information in the scrolling window.

To view information about the serial and lot numbers of items, highlight a record in the scrolling window and choose Serial/Lot.

If the item is tracked by serial numbers, the Inventory Serial Number/Bin Inquiry window opens.

If the item is tracked by lot numbers, the Inventory Lot Number/Bin Inquiry window opens.

When you've finished viewing information, close the windows.

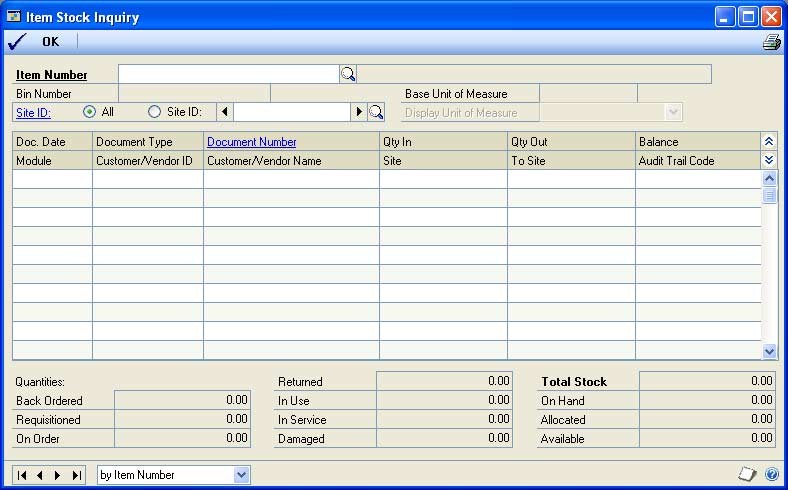

Viewing item stock information

Use the Item Stock Inquiry window to view the transactions that affected the stock quantity of an inventoried item and to view the total stock quantity balance of that item. You also can view the balance of each quantity type for the item, such as the quantity on hand and quantity allocated.

Stock information can be displayed for all the sites that the item is assigned to or for a specific site. You also can select the unit of measure to display the stock information in.

To view item stock information:

- Open the Item Stock Inquiry window. (Inventory >> Inquiry >> Item Stock)

Enter or select the item to view.

Select whether to display all sites or at a specific site for the item.

Select the unit of measure to display the item stock information in.

You can choose File >> Print to print the Item Stock Inquiry Report, if needed.

When you've finished reviewing information, close the window.

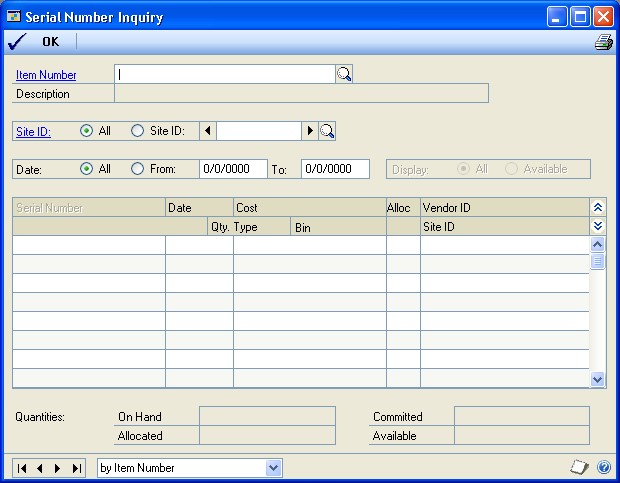

Viewing serial number information

If you're using serial-numbered items, you can use the Serial Number Inquiry window to view information about the items. For example, you can use this window to view the serial numbers of available items at a specific site. If you're using multiple bins, you also can view the bin where each item is stored.

To view serial number information:

- Open the Serial Number Inquiry window. (Inventory >> Inquiry >> Serials)

- Enter or select an item.

Use the browse buttons to move among only serial-numbered items.

- Decide which site information you want to view.

To view information for all sites For the Site ID, mark All.

To view information for a specific site For the Site ID, mark Site ID, then select a site.

Select a range of dates to restrict the information in the scrolling window by date, if needed.

If you're viewing information for a specific site, decide if you want to see serial number information for all items at the site, or for only those items whose item type is Available.

To view all serial numbers For Display, mark All.

To view serial numbers of Available items only For Display, mark Available.

- Review information as needed. You also can go to other windows to make changes, if needed.

To make changes to the item record Click the Item Number link to open the Item Maintenance window, where you can modify the item record. Refer to Chapter 10, "Item cards," for more information about using the Item Maintenance window.

To make changes to the site record Click the Site ID link to open the Site Maintenance window, where you can modify the site record. Refer to Chapter 14, "Sites and beginning quantities," for more information about using the Site Maintenance window.

You can choose File >> Print to print the Serial Number Inquiry Report, if needed.

When you've finished reviewing information, close the window.

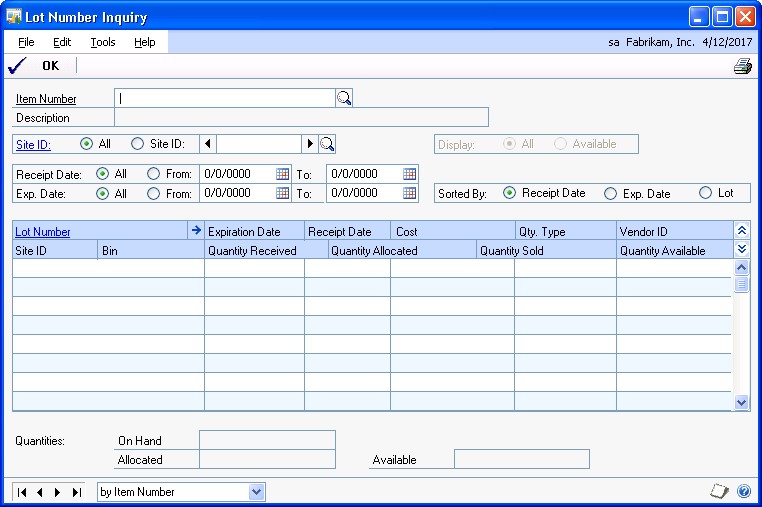

Viewing lot number information

If you use lot-numbered items, you can use the Lot Number Inquiry window to view information about those items. For example, you can use this window to view the available quantity in a particular lot. If you're using multiple bins, you also can view information about the bins where lot quantities are stored.

You also can consolidate lot numbers by selecting to sort them by lot. Lot numbers can be consolidated if the lot number, site, bin, quantity type, manufactured date, and expiration date are the same.

To view lot number information:

- Open the Lot Number Inquiry window. (Inventory >> Inquiry >> Lots)

- Enter or select the item to view.

Use the browse buttons to move among lot-numbered items only.

- Decide which site information to view.

To view information for all sites For the Site ID, mark All.

To view information for a specific site For the Site ID, mark Site ID, then select a site.

- If you're viewing information for a specific site, decide if you want to see lot number information for all items at the site, or for only those items whose item type is Available.

To view all lot numbers For Display, mark All.

To view lot numbers of Available items only For Display, mark Available.

Select a range of receipt dates and expiration dates to restrict the information in the scrolling window by date, if needed.

Select the order to display information in the scrolling window

Review information as needed. You also can go to other windows to make changes, if needed.

To make changes to the item record Click the Item Number link to open the Item Maintenance window, where you can modify the item record. Refer to Chapter 10, "Item cards," for more information about using the Item Maintenance window.

To make changes to the site record Click the Site ID link to open the Site Maintenance window, where you can modify the site record. Refer to Chapter 14, "Sites and beginning quantities," for more information about using the Site Maintenance window.

You can choose File >> Print to print the Lot Number Inquiry Report, if needed.

When you've finished reviewing information, close the window.

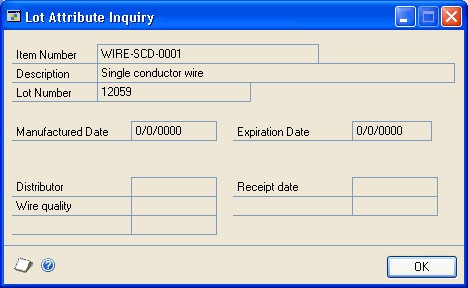

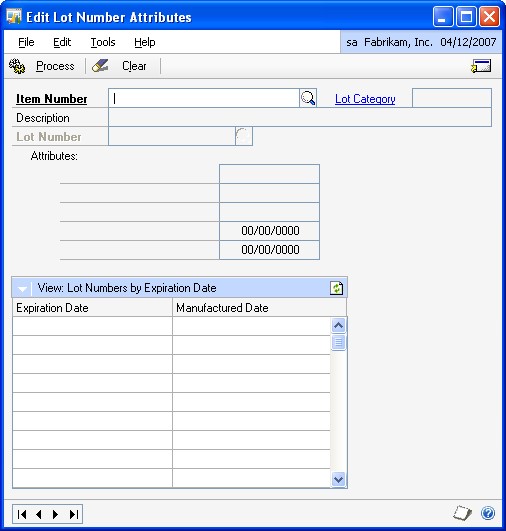

Viewing lot attribute information

You can use the Lot Attribute Inquiry window to see a manufactured date, an expiration date, and lot category characteristics for a specific lot.

To view lot attribute information:

Open the Lot Number Inquiry window. (Inventory >> Inquiry >> Lots)

Enter or select a lot numbered item.

Use options in the Lot Number Inquiry window to find the specific lot you want to review. Refer to Viewing lot number information for more information.

Select the lot and choose the Lot Number expansion button to open the Lot Attribute Inquiry window.

Review the information as needed.

When you've finished, close the windows.

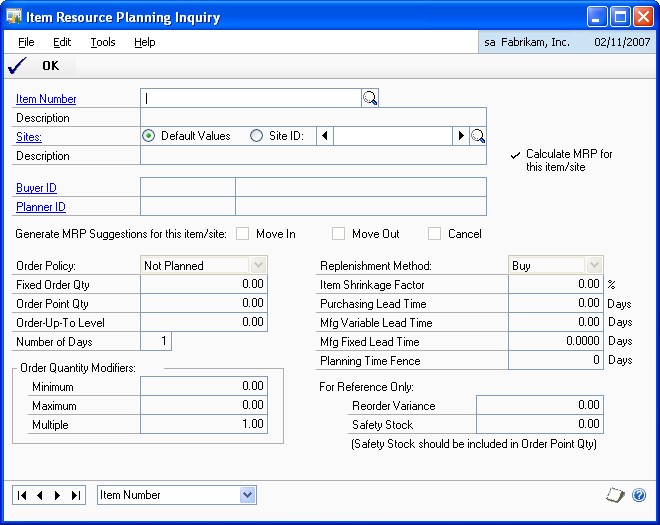

Viewing planning information for an item

Use the Item Resource Planning Inquiry window to view planning information for a site.

To view planning information for an item:

- Open the Item Resource Planning Inquiry window. (Inventory >> Inquiry >> Item Resource Planning)

- Enter or select an item.

Information about the item that is the same for all sites—such as the item's order policy—will be displayed.

To view site-specific information, be sure the Site ID option in the Sites field is marked, and then enter or select a site.

When you've finished viewing the information, close the window.

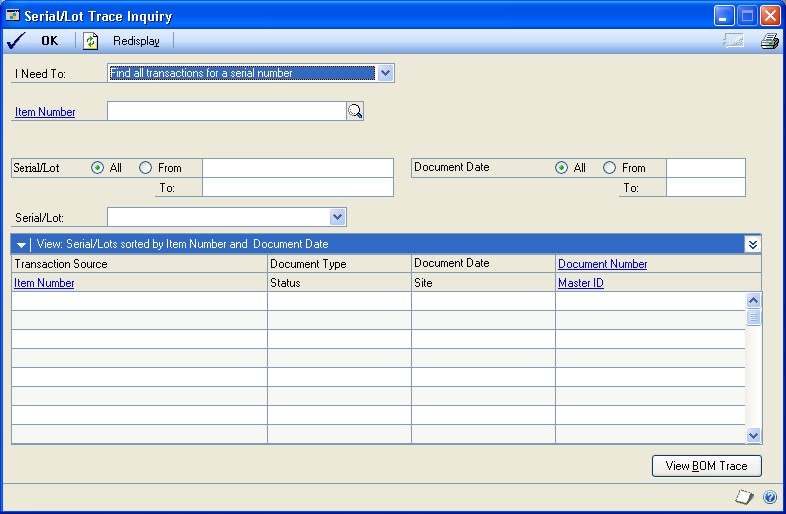

Viewing a life cycle serial or lot number trace

You can use the Serial/Lot Trace Inquiry window to trace the life cycle of serial or lot numbers. For instance, you can view how a serial- or lot-numbered item is used from the day it was received or assembled by your business to the day it left your business.

A life cycle trace allows you to view all the transactions that have serial- or lotnumbered items by their document date. You can use a life cycle trace to find a specific serial or lot number, find items with serial or lot numbers received from a specific vendor, or find items with serial or lot numbers shipped to a specific customer.

To view a life cycle serial or lot number trace:

- Open the Serial/Lot Trace Inquiry window. (Inventory >> Inquiry >> Serial/Lot Trace)

Select one of the following life cycle trace options from the I Need To field.

Find all transactions for a serial number

Find all transactions for a lot number

Find serial numbers shipped to a customer

Find lot numbers shipped to a customer

Find serial numbers received from a vendor

Find lot numbers received from a vendor

The type of life cycle trace you select determines the type of information displayed in the window.

Select or enter an item number if you know the number of the item to trace serial or lot information for.

Depending on the life cycle trace you've selected in the I Need To field, enter or select a customer ID or vendor ID.

Enter or select the range of serial or lot numbers to trace. Select All to include all lot or serial numbers.

The time it takes to process the serial and lot information will depend on if you selected to trace all serial or lot numbers without an item number.

You can select a range of dates to restrict the information in the scrolling window by date.

Choose Resdisplay to display the serial and lot number information in the scrolling window.

The first serial or lot number found during the trace is displayed in the Serial/ Lot field and the transactions associated with that serial or lot number will be displayed in the scrolling window. To view different serial or lot information, select another serial or lot from the Serial/Lot field.

- To view additional information, select the transaction and click on a link to open another window. The window that opens depends on the transaction source and the link that you click.

Refer to the table for more information.

| If the transaction source is ... | ... and you click on this link ... | ... this window opens: |

|---|---|---|

| Any transaction source | Item Number | Item Maintenance |

| Assembly Entry | Document Number | Assembly Inquiry Zoom |

| Invoice Entry | Document Number | Invoice Inquiry |

| Item Transfer Entry | Document Number | Inventory Transaction Inquiry |

| Item Transaction Entry | Document Number | Inventory Transaction Inquiry |

| Manufacturing | Document Number | Manufacturing Component |

| Manufacturing Order | Document Number | Manufacturing Order Receipt |

| Receivings Transaction | Document Number | Receivings Transaction Inquiry |

| Sales Transaction Entry | Document Number | Sales Transaction Inquiry Zoom |

| In-Transit Transfer Entry | Document Number | In-Transit Transfer Inquiry Zoom |

| Assembly Entry | Master ID | Item Maintenance |

| Manufacturing | Master ID | Item Maintenance |

| Manufacturing Order | Master ID | Item Maintenance |

| Sales Transaction Entry | Master ID | Customer Maintenance |

| Invoice Entry | Master ID | Customer Maintenance |

| Receivings Transaction | Master ID | Vendor Maintenance |

(posted transactions only)

(posted transactions only)

Component Transaction

Entry

Transaction Inquiry

Receipt Entry

Inquiry Detail

Entry

Zoom

Component Transaction

Entry

Receipt Entry

Entry

The Document Number link isn't available for the Purchasing Return Entry and Stock Count Entry transaction sources.

If a transaction is a manufacturing or assembly transaction, choose the View BOM Trace button to open the Serial/Lot Bill of Materials Trace window, where you can view additional serial- or lot numbered items used by or assembled from the serial or lot number that you are tracing. Refer to Viewing a bill of materials trace for more information.

You can choose File >> Print to print the Serial/Lot Trace Inquiry Report.

When you've finished reviewing information, close the window.

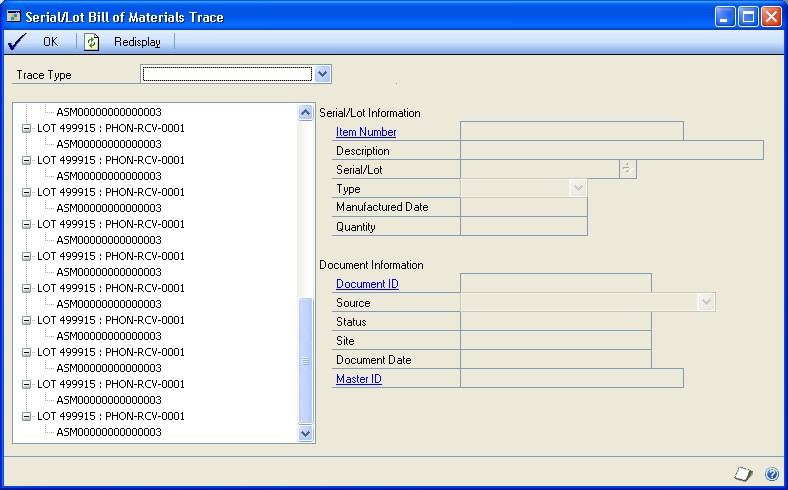

The bill of materials trace tree view

The Serial/Lot Bill of Materials Trace window uses a tree view to show the serial numbers, lot numbers, and transactions in a bill of materials trace. To view information in the tree view, select a trace type and choose Redisplay.

The trace type you select determines the information that is displayed in the tree view.

If you select Consumed into the serial/lot as the trace type, you can view serial- or lot-numbered items that were consumed (used) in a serial- or lot-numbered item.

If you select Produced from the serial/lot as the trace type, you can view serial- or lot-numbered items that were produced (assembled) from a serial- or lotnumbered item.

Objects in the tree view

Each line in the tree is called an object. When you select an object in the tree view, the information to the right of the window displays the information about the selected object.

The first object in the tree view is the serial or lot number that you are tracing, followed by the item number. The next object or objects are the transactions that consumed (used) or produced (assembled) serial- and lot-numbered items for the serial or lot number being traced. The following is an example of a tree view.

- SERIAL10 : CIRCUIT BOARD + ASM00078

You can choose the + symbol next to a manufacturing or assembly transaction object to view additional levels in the tree view. You can collapse and expand the entire tree or just portions of it.

If a lot number is used multiple times on a transaction, each occurrence of the lot number will be displayed in the tree view, as shown in the following example.

- LOT 10 : CIRCUIT BOARD - ASM00038 - LOT 55 : SWITCH SYSTEM ORDER005 INV015 ADJ029 + LOT 55 : SWITCH SYSTEM

If an item doesn't track serial or lot numbers, that information will be displayed in the tree view, as shown in the following example.

- LOT 12 : ITEM - ASM00038 <Not Tracked> : Brush

For assembly transactions, a link icon might appear next to a specific serial or lot number that is matched to another serial or lot number, as shown in the following example.

- LOT 10 : CIRCUIT BOARD - ASM00038 +

LOT 55 : SWITCH SYSTEM + <Not Tracked> : PANEL

For more information about linking serial and lot numbers, refer to the Bill of Materials documentation.

Consumed into the serial/lot trace type example

If you selected Consumed into the serial/lot, you can expand a manufacturing or assembly transaction object to display all documents that were involved with placing the serial- or lot-numbered item into inventory. The following is an example of how information is displayed in the tree view if you selected Consumed into the serial/lot as the trace type.

| Tree view | Description |

|---|---|

| - SERIAL10 : CIRCUIT BOARD | Serial number being traced. |

| - ASM00078 | Transaction that placed SERIAL10 in inventory. |

| - LOT 34 : MULTI COLOR WIRE | Lot number used in creating Serial10. |

| - RCV00067 | Transaction that placed LOT 34 in inventory. |

| - LOT 55 : SWITCH SYSTEM | Lot number used in creating SERIAL10. |

| - ASM00078 | Transaction that placed LOT 55 in inventory. |

| - LOT A95 : CIRCUIT PANEL | Lot number used in creating LOT 55. |

| - RCV00089 | Transaction that placed LOT A95 in inventory. |

| - LOT T15 : TRANSISTOR | Lot number used in creating LOT 55. |

| - RCV00123 | Transaction that placed LOT T15 in inventory. |

Produced from the serial/lot trace type example

If you selected Produced from the serial/lot, you can expand a manufacturing or assembly transaction to display all documents that were involved with taking the serial or lot numbered item from inventory. The following is an example of how information is displayed in the tree view if you selected Produced from the serial/ lot as the trace type.

| Tree view | Description |

|---|---|

| - LOT A95 : CIRCUIT PANEL | Lot number being traced. |

| - ASM00078 | Transaction that took LOT A95 from inventory. |

| - LOT 55 : SWITCH SYSTEM | Lot number used in creating LOT A95. |

| - ASM00078 | Transaction that took LOT 55 from inventory. |

| - SERIAL10 : CIRCUIT BOARD | Serial number used in creating LOT 55. |

| - INV00178 | Transaction that took SERIAL10 from inventory. |

Viewing a bill of materials trace

If a transaction in a life cycle trace is a manufacturing or assembly transaction, you can use the Serial/Lot Bill of Materials Trace window to view the serial- or lotnumbered items that were consumed (used) in creating a serial- or lot-numbered item. You also can view serial- or lot-numbered items that were produced (assembled) from a serial- or lot-numbered item. This window is available if a transaction in a life cycle trace is a manufacturing or assembly transaction.

The Serial/Lot Bill of Materials Trace window uses a tree view to show the serial numbers, lot numbers, and transactions in a bill of materials trace. For more information about the tree view, see The bill of materials trace tree view.

To view a bill of materials trace:

Open the Serial/Lot Trace Inquiry window. (Inventory >> Inquiry >> Serial/Lot Trace)

Create a life cycle trace. See Viewing a life cycle serial or lot number trace for more information.

Highlight a manufacturing or assembly transaction in the scrolling window and choose the View BOM Trace button to open the Serial/Lot Bill of Materials Trace window.

Select Consumed into the serial/lot or Produced from the serial/lot as the serial/lot trace.

You can highlight a serial number, a lot number, or a transaction in the tree view to view additional information.You also can collapse and expand the tree view to control the amount of information you see.

For an item that doesn't track serial or lot numbers, <Not Tracked> will be displayed next to the item number.

For assembly transactions, a link icon might appear next to a specific serial or lot number that is matched to another serial or lot number. Refer to the Bill of Materials documentation for more information about linking serial and lot numbers.

When you've finished reviewing information, close the window.

Viewing a recall serial or lot number trace

You can use the Serial/Lot Trace Inquiry window to trace the recall of serial or lot numbers. A recall trace can show which customers purchased an item with a specific serial or lot number. You also can use a recall trace to show where the items with serial or lot numbers are located, including the bin.

If you are going to recall serial or lot numbers, you can choose the Go To button to open the Item Transfer Entry window, where you can change the On Hand quantity type of the item to another quantity type. For more information about changing quantity types, see Changing the quantity type of an item.

To view a recall serial and lot number trace:

Open the Serial/Lot Trace Inquiry window. (Inventory >> Inquiry >> Serial/Lot Trace)

Select one of the following recall trace options from the I Need To field.

Recall serial numbers shipped to customers

Recall lot numbers shipped to customers

Recall serial numbers where stocked

Recall lot numbers where stocked

The type of recall trace you select determines the type of information displayed in the window.

Select or enter an item number.

Enter or select a vendor ID if you know the vendor that you want to trace serial or lot information for.

Enter or select the range of serial or lot numbers to trace. Select All to include all lot or serial numbers.

You can select a range of dates to restrict the information in the scrolling window by date.

Choose Resdisplay to display the serial and lot number information in the scrolling window.

All of the serial or lot numbers found during the trace are displayed in the scrolling window. To view information about a specific serial or lot number, select the serial or lot number from the Serial/Lot field.

- To view additional information, select the transaction and click on a link to open another window. The window that opens depends on the transaction source and the link that you click.

Refer to the table for more information.

| If the recall trace is for ... | ... and you click on this link ... | ... this window opens: |

|---|---|---|

| Serial or lot numbers shipped to customers | Customer ID | Customer Maintenance |

| Serial or lot numbers shipped to customers | Document Number | Invoice Inquiry |

| Serial or lot numbers shipped to customers | Document Number | Sales Transaction Inquiry Zoom |

| Serial or lot numbers where stocked | Site ID | Item Inquiry |

You can choose the Go To button to open the Item Transfer Entry window to change the On Hand quantity type of the item to another quantity type. For more information about changing quantity types, see Changing the quantity type of an item.

In the Serial/Lot Trace Inquiry window, you can choose File >> Print to print the Serial/Lot Trace Inquiry Report.

When you've finished reviewing information, close the window.

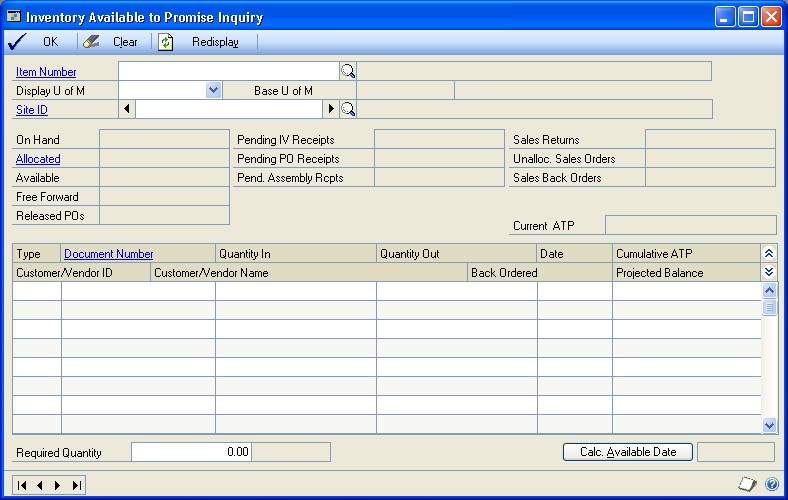

Viewing inventory available to promise information

If you're using Available To Promise, use the Inventory Available to Promise Inquiry window to view available to promise information, such as inventory onhand quantity, allocated quantity, available quantity, and free-forward quantity.

Free-forward quantity is the total of available and pending quantities of an item, plus any additional quantities from purchase orders, assembly receipts, manufacturing orders, and sales returns displayed in the scrolling window. The total sum is reduced by the item quantities from unallocated sales orders, sales back orders, and unallocated manufacturing components displayed in the scrolling window.

You also can view pending purchase orders, pending purchase order receipts, and pending inventory receipts.

To view inventory available to promise information:

- Open the Inventory Available to Promise Inquiry window. (Inventory >> Inquiry >> Available to Promise)

You can select to view items by various units of measure and at various sites.

Choose the Calc. Available Date button to view the date that the quantity of inventory will be available.

Available dates are not shown for inactive items.

- Choose OK to close the window.

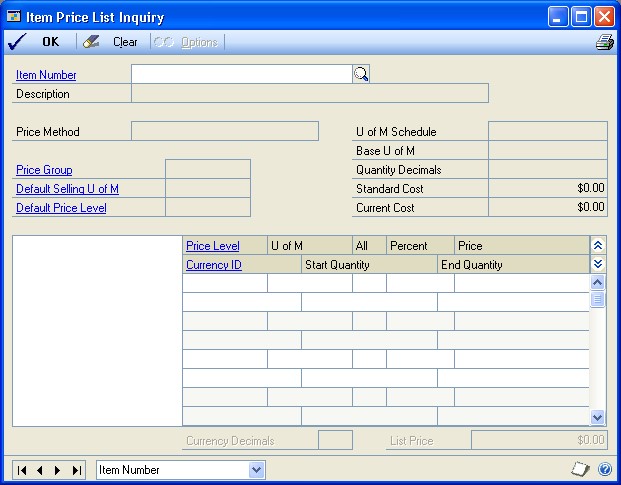

Chapter 27: Standard pricing inquiries

If you're using standard pricing, you can use the Item Price List Inquiry window to view information about the pricing structures you've set up for your items. You can use the window to view high-level price list information for an item—such as the unit of measure schedule, base unit of measure, and standard and current cost of the item. You also can use the tree view to control how much information is displayed in the scrolling window. For example, you can highlight the item number in the tree view to see all price list records for an item, or only those price list records for a specific currency, price level, or unit of measure. If you're using Multicurrency Management, you also can check pricing in different currencies, if that's been set up.

If you're using extended pricing, refer to Chapter 28, "Extended pricing inquiries," for information about viewing pricing information.

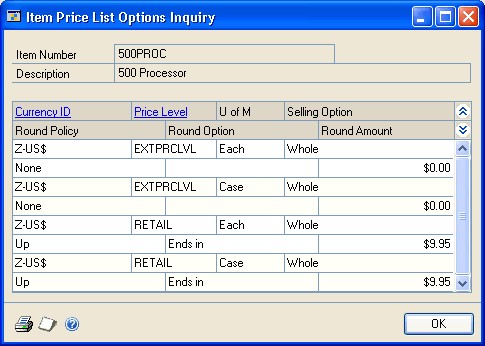

To review the rounding options for price list calculations, you can use the Item Price List Options Inquiry window. Price list records in the Item Price List Inquiry window also reflect the rounding options.

The following information is discussed:

Viewing price list information

Viewing pricing option information

Viewing price list information

If you're using standard pricing, use the Item Price List Inquiry window to view price levels and quantity breaks for a particular item. For example, if you wanted to offer different pricing alternatives to customers, you could use this window to view the different price levels available for a particular item.

To view price list information:

- Open the Item Price List Inquiry window. (Inventory >> Inquiry >> Price List)

Enter or select an item number.

In the tree view, you can click the plus and minus signs to expand and collapse the information. If you highlight an object in the tree view, the information for all levels at or below that level is displayed in the scrolling window. Refer to Using the price list tree view for more information about tree views.

If needed, you can go to other windows to view more information, or to make changes.

To view or change item record information Click the Item Number link to open the Item Maintenance window.

To view or change price group information Click the Price Group link to open the Price Group Setup window.

To view or change the default selling unit of measure Click the Default Selling U of M link to open the Unit of Measure Schedule Setup window.

To view or change the default price level Click the Default Price Level link to open the Price Level Setup window.

To view or change a price level Click the Price Level link to open the Price Level Setup window, if you're using Multicurrency Management.

To view or change a currency ID Click the Currency ID link to open the Item Currency Maintenance window.

To print the Item Price List Report, which displays the information displayed in the window, choose File >> Print.

When you've finished viewing information, close the windows.

Viewing pricing option information

If you're using standard pricing, you can use the Item Price List Option Inquiry window to view the rounding rules set up for a pricing calculation.

To view pricing option information:

- Open the Item Price List Inquiry window. (Inventory >> Inquiry >> Price List)

Enter or select an item number.

- Choose Options to open the Item Price List Options Inquiry window.

Review information in the window.

If needed, you can go to other windows to view more information, or to make changes.

To view or change multicurrency information If you're using Multicurrency Management, click the Currency ID field label to open the Item Currency Maintenance window.

To view or change price level information Click the Price Level field label to open the Price Level Setup window.

- When you've finished viewing information, close the windows.

Chapter 28: Extended pricing inquiries

If you're using extended pricing, you can trace how prices are calculated in your pricing structures. You also can view information about price sheets: the items and price groups that are assigned to a price sheet, and the customers, prospects, and price books that a price sheet is assigned to.

Some extended pricing information is better viewed with a report. To check pricing structures for missing prices, for example, you can use the Extended Pricing Error Reports window. Refer to Checking for missing prices.

If you're using standard pricing, refer to Chapter 27, "Standard pricing inquiries," for information about viewing pricing information.

This information is divided into the following sections:

Tracing a price calculation

Originating currency errors in price trace inquiries

Viewing the items and price groups in a price sheet

Viewing price sheets for a selected item or price group

Viewing promotions for a prospect or customer

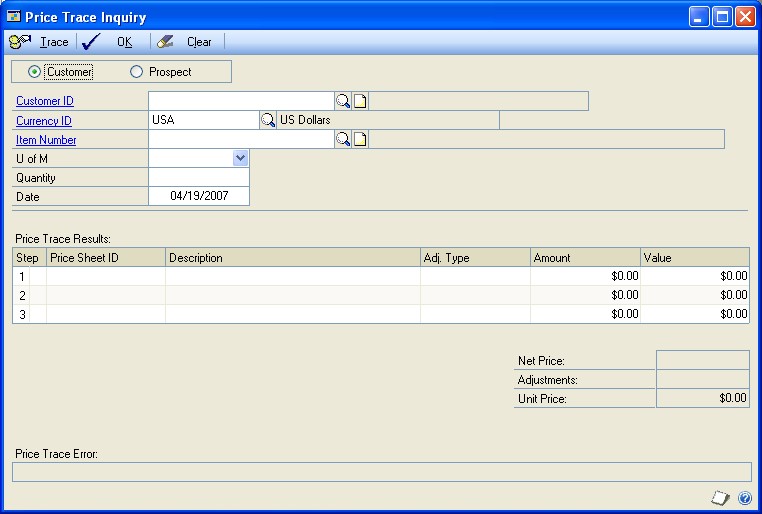

Tracing a price calculation

Use the Price Trace Inquiry window to find out how an item's price is calculated for a customer. You can use this window to view the total price, the steps taken to calculate the price, and the price sheets used to calculate the price. This is useful if you want to test the pricing structure before you enter transactions in the Sales Transaction Entry window.

The number of currency decimals used to display information in the Price Trace Inquiry window depends on the source of the information.

If pricing information comes from a price group, the net price and any adjustments to it are displayed with the number of currency decimals that have been specified for the price group.

If the pricing information comes from the items, the net price and any adjustments to it are displayed with the number of currency decimals that have been specified for the item.

The Unit Price and Promotion Unit Price information must be displayed with the number of currency decimals from the item. These fields also must match the Unit Price information for a sales document in the Sales Transaction Entry window.

To trace a price calculation:

- Open the Price Trace Inquiry window. (Inventory >> Inquiry >> Extended Pricing >> Price Trace)

Select Customer or Prospect, and enter or select a customer ID or prospect ID.

Enter or select a currency ID.

Enter or select an item number.

Select a unit of measure.

Enter a quantity, if you want. The quantity is used if quantity break pricing is set up for the selected item. The price per item will be calculated.

If a promotion exists for the item and quantity-break pricing is used on the promotional price sheet, it won't be displayed in the Price Trace Inquiry window if the quantity is zero or blank.

Enter a date for the price inquiry.

Choose Trace. The total price, steps taken to calculate the price, and the price sheets used will be displayed in the Price Trace Results scrolling window. If a promotion is available, information about it also is displayed.

Any errors encountered while calculating the price will be displayed in the

Price Trace Error field. Click the Price Sheet ID link to open the Price Sheet

Detail Maintenance window, where you can correct the errors. If you're using Multicurrency Management, you might have errors for the originating currency. Refer to Originating currency errors in price trace inquiries for more information.

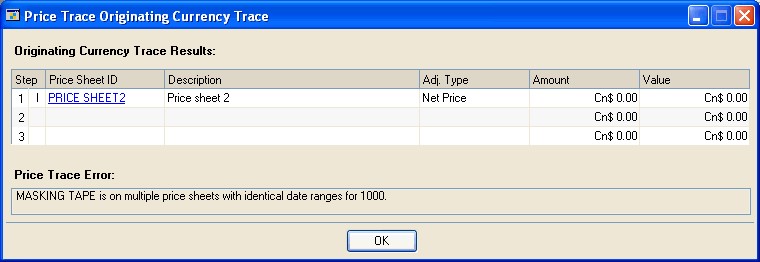

Originating currency errors in price trace inquiries

Price-trace errors—errors in how prices for items are calculated when you're using extended pricing—can be reported for the originating currency in certain situations.

If you've marked the Sales Order Processing setup option so that a price isn't required for each currency for an item, and if you've marked the option to convert the originating currency to the functional currency, then pricing calculations are "round-tripped" from the originating currency to the functional currency and back to the originating currency.

For example, suppose you've created price sheets for US dollars, but haven't created them for British pounds. If you have these options marked, you could enter a price trace inquiry in British pounds. The inquiry would calculate the pricing in US dollars, then convert it to British pounds based on your exchange tables.

Rules for price sheets still apply: you can't use two price sheets with identical date ranges, and you must have a net price for the items. If either of these rules are broken—and if you're using the "round-tripping" calculations—then the Originating Currency Errors button will appear on the Price Trace Inquiry window.

You can choose that button to open the Price Trace Originating Currency Trace window, where you can view information about the errors.

When you've finished viewing information, choose OK to close the window.

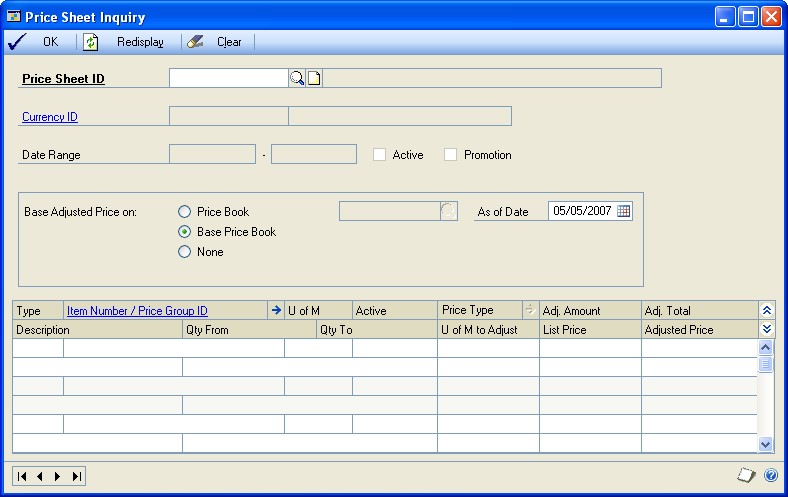

Viewing the items and price groups in a price sheet

The Price Sheet Inquiry window shows all items and price groups within a price sheet, with their units of measure and prices.

To view the items and price groups in a price sheet:

- Open the Price Sheet Inquiry window. (Inventory >> Inquiry >> Extended Pricing >> Price Sheets)

Enter or select a price sheet ID. The items and price groups assigned to the price sheet will be displayed in the scrolling window.

View additional information, if needed.

To view information about promotional free items When viewing information about a promotional price sheet, highlight a record for a giveawaytype promotion. Choose the Adjustment Type expansion button to open the Price Sheet Detail Free Item Inquiry window, where you can view more information about the giveaway.

To view details about the price sheet Select an item and use the Item Number/Price Group ID expansion button to open the Price Sheet Detail Maintenance window, where you can see quantity break pricing details for the item.

- Use the Base Adjusted Price On options to see the effects of price adjustment.

This selection will not be saved; it is for inquiry purposes only. For example, you might want to see a value off the base price at a future date, or you might want to see prices for a customer who receives discounts from a price book other than the base book.

For example, you might want to know the effect of a value off the base price at a date in the future, or you might want to set up a record for a customer who receives discounts from a price book other than the base book.

Mark a pricing element—price book, base price book, none, or price sheet ID—to see how prices would change based on that element. If you mark price book or price sheet ID, enter or select a specific price book or price sheet ID.

Enter an As of Date to see how pricing would be calculated on a specific date.

- When you've finished viewing information, close the window.

Viewing price sheets for a selected item or price group

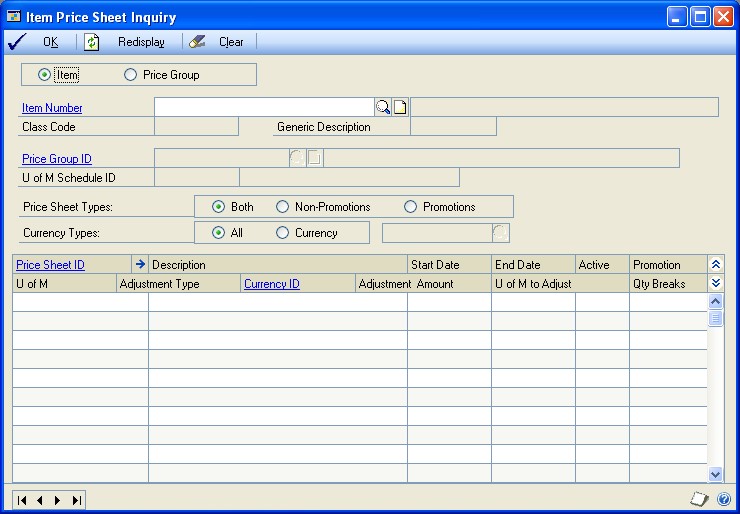

Use the Item Price Sheet Inquiry window to view the price sheets that have been set up for a specific item or price group.

To view price sheets for a selected item or price group:

- Open the Item Price Sheet Inquiry window. (Inventory >> Inquiry >> Extended Pricing >> Items)

Select to view an item or a price group.

Enter or select an item number or price group ID. Information about the item or price group automatically will be displayed when you select the item or price group.

Mark an option to restrict the price sheets displayed in the scrolling window based on whether the price sheets are promotional or not.

If you're using Multicurrency Management, mark an option to restrict the price sheets displayed in the scrolling window based on the currency of each price sheet. If you mark Currency, enter or select a currency.

View information in the scrolling window.

You also can view more information, if needed.

To view other items and price groups for a price sheet Highlight the price sheet in the scrolling window and click the Price Sheet ID link to open the Price Sheet Maintenance window, where you can view the items and price groups assigned to the price sheet.

To view price sheet details Highlight the price sheet in the scrolling window and choose the Price Sheet ID expansion button to open the Price Sheet Detail Maintenance window, where you can view and edit price sheet information.

- When you've finished viewing information, close the window.

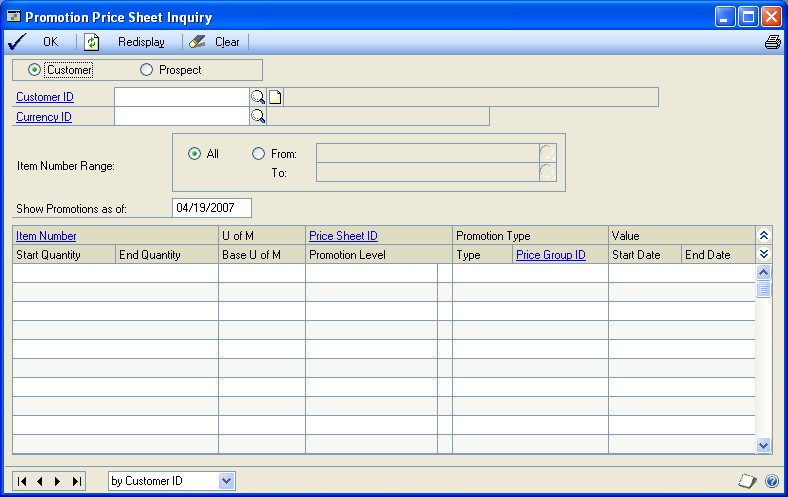

Viewing promotions for a prospect or customer

You can use the Promotion Price Sheet Inquiry window to view all the promotions that are in effect for a prospect or customer as of a certain date. You can choose to view information for all items or you can choose to view information for a range of items.

To view promotions for a prospect or customer:

- Open the Promotion Price Sheet Inquiry window. (Inventory >> Inquiry >> Extended Pricing >> Promotions)

Mark Customer or Prospect, depending on who's promotions you want to view.

Enter or select a customer or prospect.

If you're using Multicurrency Management, you can enter or select a Currency ID.

Choose the items to view. Mark All to see promotions for all items, or mark From and enter a range of items to view.

Enter a date in the Show Promotions as of field. Only promotions that are effective on that date will be displayed in the scrolling window.

Choose Redisplay to update the scrolling window, and then view the information in the scrolling window.

When you've finished, close the window.

Chapter 29: Transaction inquiries

You can use the inquiry windows to view information about your adjustment and variance transactions, transfers, and purchase receipts. If you're using other Microsoft Dynamics GP modules, you also can use links to open other windows that display more details about specific transactions.

The inquiry window you'll use to view transactions depends on the source of the transaction information you want to see.

To view transactions entered throughout the system Use the Item Transaction Inquiry window. Any posted transaction for an item—such as transactions from Sales Order Processing—will be available. Inventory Control transactions also can be viewed in the Item Transaction Inquiry window.

To view transactions entered in Inventory Control Use the Inventory Transaction Inquiry window to see transactions that are specific to Inventory Control: adjustments, variances, and transfers. If you're using multiple bins, you also can view information about the bins used for a transaction. You can use the InTransit Transfer History Inquiry window to view in-transit transfers.

To view transactions resulting from purchase receipts Use the Purchase Receipts Inquiry window.

The following information is discussed:

Viewing item transaction information

Viewing inventory transaction information

Viewing in-transit transfer transaction information

Viewing purchase receipt information

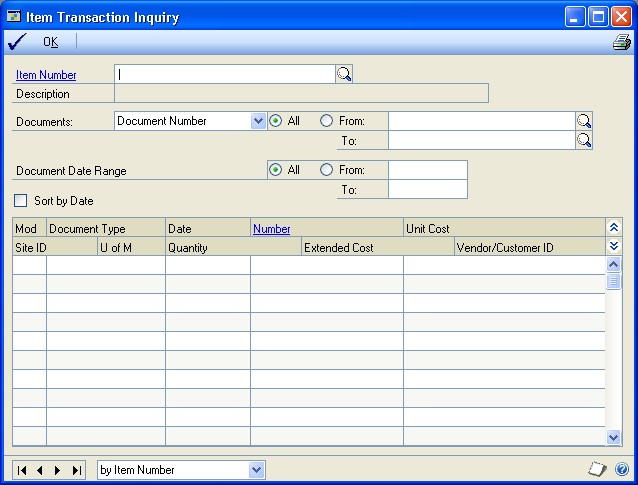

Viewing item transaction information

Use the Item Transaction Inquiry window to view posted inventory transactions for specific items. For example, you can view transactions for an item at a specific site— or you can see all transactions of a certain type that have been posted for a particular item number.

Transactions entered in Sales Order Processing, Purchase Order Processing, Bill of Materials, Inventory Control, and Invoicing are displayed in the window.

To view item transaction information:

- Open the Item Transaction Inquiry window. (Inventory >> Inquiry >> Item Transaction)

Enter or select an item number.

Determine which transaction records you want to view. You can select a range of records based on any of the following record attributes.

To see all item records Mark All.

To see a specific range of records Mark From. Select a type of document range—such as document number or module—and then select the beginning and ending values for the range.

Specify a document date range to restrict information. You can select to view all documents or mark From and then select the beginning and ending dates for the range.

Review information in the scrolling window.

Mark the Sort by Date check box to sort information in the scrolling window by date.

- To view more detailed information about a transaction, select the transaction and click the Number label to open another window.

Refer to the table for information about which window will open, based on the transaction type.

| Click this type transaction ... | ... to open this window: |

|---|---|

| Inventory transactions | Inventory Transaction Inquiry window |

| Sales Order Processing transactions | Sales Transaction Inquiry Zoom window |

| Purchase Order Processing transactions | Receivings Transaction Inquiry Zoom window |

| Invoicing transactions | Invoice Inquiry window |

| Bill of Materials transactions | Assembly Inquiry Zoom window |

You can use any of these windows to view the transaction information as it was entered.

You can choose File >> Print to print the Item Transaction Inquiry Report.

When you've finished viewing information, close the windows.

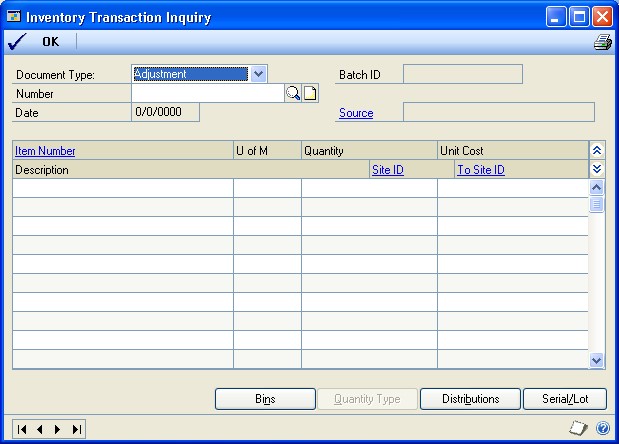

Viewing inventory transaction information

Use the Inventory Transaction Inquiry window to view any transaction that has been entered in Inventory Control. For example, you can use the window to view the transactions that have been posted to reflect stock count variance transactions.

To view inventory transaction information:

- Open the Inventory Transaction Inquiry window. (Inventory >> Inquiry >> Transaction)

- Select the transaction type you want to view. You can choose from these inventory transaction types:

Adjustment Select Adjustment to view adjustment transactions for an item—transactions to record an increase or decrease to inventory levels.

Variance Select Variance to view variance transactions for an item— transactions to bring inventory records in line with inventory levels. For example, if you're using stock counts, you might have variance transactions to record transactions made so inventory accounting records match actual inventory levels.

Transfer Select Transfer to view transfer transactions for an item— transactions that record the movement of items from one site to another, from one quantity type to another, or both.

Enter or select the document number of the specific transaction to view.

Review information in the window. You can open other windows, if needed, to view more detailed information or to make changes to records.

To view or change item records Select a transaction and click the Item Number field label to open the Item Maintenance window.

To view or change site records Select the transaction and click the field label for the Site ID or for the To Site ID to open the Site Maintenance window.

- You also can open other windows for viewing transaction information.

Refer to the table for more information.

| This button: | Opens this window: |

|---|---|

| Bins | Inventory Transaction Bin Inquiry window, if the item is not tracked by lot or serial numbers. You can view the quantity of the item for each bin involved in the transaction. (To view bin information for items tracked by lot or serial numbers, use the Serial/Lot button.) |

| Quantity Type | Inventory Transaction Quantity Types Inquiry window, where you can view information about the quantity types that were transferred. This option is available only if the pointer is on a line for a transfer transaction. |

| Distributions | Inventory Transaction Distribution Inquiry window, where you can view information about the accounts that were used when distributing the original transaction. |

| Serial/Lot | If the item is tracked by lot numbers Inventory Transaction Lot Inquiry window, where you can view information about the lot number and quantity for each bin involved in the transaction. If the item is tracked by serial numbers Inventory Transaction Serial Inquiry window, where you can view information about the serial numbers and bins for each bin involved in the transaction. |

You can choose File >> Print to print the Transaction Inquiry Report.

When you've finished viewing information, close the windows.

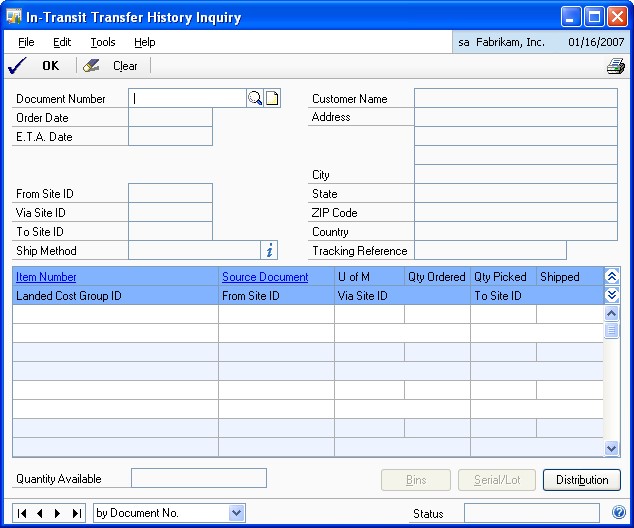

Viewing in-transit transfer transaction information

Use the In-Transit Transfer History Inquiry window to view an in-transit transfer that exists in history.

To view in-transit transfer transaction information:

- Open the In-Transit Transfer History Inquiry window. (Inventory >> Inquiry >> In-Transit Transfer History)

Enter or select the document number of the specific transaction to view.

Review information in the window.

You also can open other windows for viewing transaction information.

Refer to the table for more information.

| This button: | Opens this window: |

|---|---|

| Bins | Transfer Bin Inquiry window, if the item is not tracked by lot or serial numbers. You can view the quantity of the item for each bin involved in the transfer. (To view bin information for items tracked by lot or serial numbers, use the Serial/Lot button.) |

| Distributions | Inventory Transfer Distribution History Inquiry window, where you can view information about the accounts that were used when distributing the original transfer. |

| Serial/Lot | If the item is tracked by lot numbers In-Transit Transfer Lot Inquiry window, where you can view information about the lot number and quantity for each bin involved in the transaction. If the item is tracked by serial numbers In-Transit Transfer Serial Inquiry window, where you can view information about the serial numbers and bins for each bin involved in the transaction. |

You can print the Service Inventory Pack List - Reprint report.

When you've finished viewing information, close the windows.

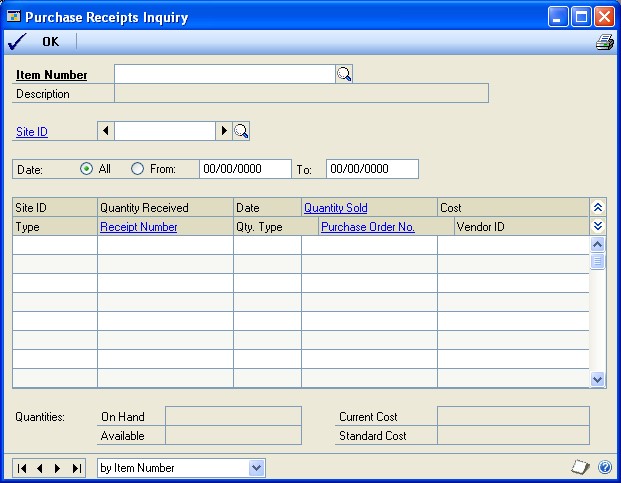

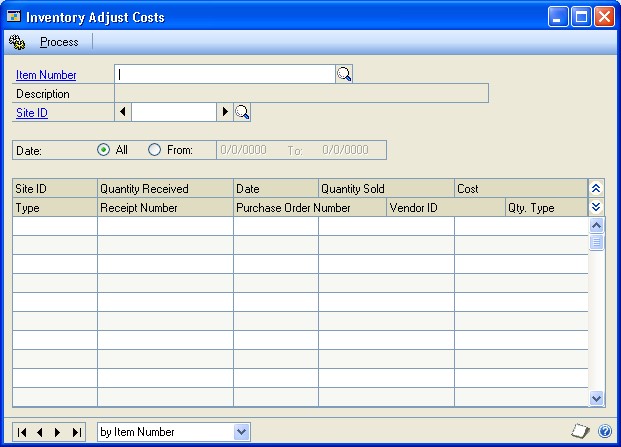

Viewing purchase receipt information

Use the Purchase Receipts Inquiry window to view all the purchase receipts that exist for a particular item. For example, you might use this window to find out the actual costs and quantities on a specific receipt. Or, if you suspect an item cost was entered incorrectly, you could use this window to verify the cost.

Information about split purchase receipts also is displayed in the window. Refer to Split purchase receipts for more information.

To view purchase receipt information:

- Open the Purchase Receipts Inquiry window. (Inventory >> Inquiry >> Receipts)

Enter or select an item number.

Enter or select a site.

Decide if you want to view transaction information for all dates or for a specific range of dates.

To view information for all dates Mark All.

To view information for a range of dates Mark From, then enter starting and ending dates for the period that includes the transactions you want to view.

Review information in the window.

To view additional information for a specific transaction, select the transaction and click on the Receipt Number link, Purchase Order No. link, or the Quantity Sold link to open a window with detailed information. The window that opens depends on the transaction source and the link you click.

Refer to the table for more information.

| If the transaction source is ... | ... and you click ... | ... this window opens: |

|---|---|---|

| Inventory Control | Receipt Number | Inventory Transaction Inquiry |

| Receipts | Receipt Number | Receivings Transaction Inquiry |

| Bill of Materials | Receipt Number | Assembly Inquiry Zoom |

| Sales Order Processing | Receipt Number | Sales Transaction Inquiry Zoom |

| Invoicing | Receipt Number | Invoice Inquiry |

| Purchase Order | Purchase Order No. | Purchase Order Inquiry Zoom |

| In-Transit | Purchase Order No. | In-Transit Transfer Inquiry Zoom |

| Not applicable | Quantity Sold | Purchase Receipts Quantity Sold |

Zoom

Processing

Details

You can choose File >> Print to print the Purchase Receipts Inquiry Report.

When you've finished reviewing information, close the windows.

Chapter 30: Reports

You can use Inventory Control reports to analyze inventory activity and identify errors in transaction entry. Use this information to guide you through printing reports and working with report options.

For more information about creating and printing reports, and the various reporting tools that you can use with Microsoft Dynamics GP, refer to your System User's Guide (Help >> Contents >> select Using The System).

The following information is discussed:

Inventory Control report summary

Accuracy Comparison report

Historical stock status report

Checking for missing prices

Printing extended pricing summary reports

Printing a purchase order generator item report

Specifying an Inventory Control report option

Microsoft SQL Server® Reporting Services reports for Inventory Control

Inventory Control report summary

You can print several types of reports using Inventory Control. Some reports automatically are printed when you complete certain procedures; for example, posting journals can be printed automatically when you post transactions, depending on how your posting options are set up. You can choose to print some reports during procedures; for example, you can print an edit list when entering transactions by choosing the Print button in the batch entry window. In order to print some reports, such as analysis or history reports, you must set up report options to specify sorting options and ranges of information to include on the report. For more information, refer to Specifying an Inventory Control report option.

If you're using extended pricing, standard item price list reports won't contain up-to-date pricing information. To print an accurate pricing report, you must use the Extended Pricing Reports window.

The following table lists the report types available in Inventory Control and the reports in each category.

| Report Type | Report | Printing method |

|---|---|---|

| Setup reports | Inventory Module Setup | Choose File >> Print in the setup windows or choose the print icon button in the setup windows or create report options in the Inventory Setup Reports window. |

| Item | Detailed Item List | Choose File >> Print in the cards windows or choose the print icon button in the cards windows or create report options in the Inventory Item Reports window. |

| Serial/Lot | Serial Number List | Create report options in the Inventory Serial-Lot Reports window. |

| Resource Planning | Planner List | Create report options in the Resource Planning Reports window. |

| Activity | Purchase Receipts† | Create report options in the Inventory Activity Reports window. |

| Inquiry | Serial Number Inquiry Report | Choose File >> Print in an inquiry window or choose the print icon button in an inquiry window. |

| * Indicates reports that can be printed with multicurrency information displayed. |

Unit of Measure Schedule

Price Group List

Lot Category List

Class

Class Currency List

Site

Bill of Materials Setup

Single-Level Bill of Materials

Indented Bill of Materials

Component Where Used

Stock Calendar List

Bin List per Site

Bin List per Item/Site

Landed Cost List

Landed Cost Group List

Item Currency List

Detailed Item List by Site

Item Price List*

Item Price List Options*

Item List by User Category

Item Purchasing Options List

Kit List

Lot Number List

Resource Planning Site Defaults

Report

Stock Status†

Physical Inventory Checklist

Vendor Activity Report

Stock Count List†

Bin Quantity

Historical Stock Status Report†

Historical Inventory Trial Balance

Lot Number Inquiry Report

Consolidated Lot Number Inquiry

Report

Purchase Receipts Inquiry Report

Item Transaction Inquiry Report

Transaction Inquiry Report

Item Period History

Item Allocation Inquiry Report

Item Stock Inquiry Report

Serial/Lot Trace Inquiry Report

† Indicates reports that can be assigned to named printers. See your System Administrator's Guide (Help >> Contents >> select System Administration) for more information.

| Report Type | Report | Printing method |

|---|---|---|

| Analysis | Turnover Report Purchase Advice Report Gross Requirements Report Item ABC Analysis Report Accuracy Comparison† | Create report options in the Inventory Analysis Reports window. |

| History reports | Transaction History Report Distribution History Report Sales Summary Report Item Period History Cost Change History Report | Create report options in the Inventory History Reports window. |

| Edit lists | Transaction Edit List Transfer Edit List | Choose File >> Print in the window you used to complete the procedure. |

| Posting reports | Transaction Posting Journal† Transfer Posting Journal† Cost Variance Journal Distribution Breakdown Register | Choose File >> Print in the window you use to complete the procedure or some will be printed automatically when you complete the procedure or create report options in the Reprint Inventory Journals window. |

| Utility reports | Reconcile Report Cost Adjustment Audit Report Valuation Method Change Audit Report Decimal Places Change Audit Report* Unit of Measure Schedule Audit Report Add Price List Wizard Audit Report* Update Price List Wizard Audit Report* Remove Price List Wizard Audit Report* Copy Price List Wizard Audit Report* Assign Currency Audit Report (available only if you're using Multicurrency Management) Replace Resource Planning Buyer/ Planner Exception Report Resource Planning Site Roll Down Exception Report | These reports will be printed when you complete the corresponding procedure. |

| Extended Pricing | Pricing Reports Error Reports | Enter report ranges and selections in the Extended Pricing Reports window. Refer to Checking for missing prices and Printing extended pricing summary reports. |

| Purchase Order Generator Item | Purchase Order Generator Item Report | Enter report ranges and selections in the Purchase Order Generator Item Report window. Refer to Printing a purchase order generator item report. |

* Indicates reports that can be printed with multicurrency information displayed. † Indicates reports that can be assigned to named printers. See your System Administrator's Guide (Help >> Contents >> select System Administration) for more information.

Accuracy Comparison report

The Accuracy Comparison report can be the most valuable result of performing stock counts. The report helps you spot trends in the accuracy of your inventory records over time, measured by the results of your stock counts.

For example, suppose your business has several warehouses and stores. For each site, you implement cycle counting and stock counts. Once you've completed several counts, you print the Accuracy Comparison report, which shows that all sites and warehouses have about the same inventory-record accuracy.

If you notice a sharp decrease in the accuracy at one site, you might need to investigate further. The change could be caused by changes in how inventory is managed at that site—perhaps more training is needed for those inventory personnel—or might be caused by employee theft. If you implement new inventory management policies, the Accuracy comparison report also can help you measure the success of those changes.

The Accuracy Comparison report is printed from the Inventory Analysis Reports window. You can print the report any time, but you must have processed at least one stock count for the report to include any data.

The following fields are of particular importance when analyzing your accuracy.

To Reconcile This field displays the absolute difference between the captured quantity and the counted quantity. Ideally, this difference should be zero, meaning that the captured quantity and the counted quantity are the same. A large number in this field doesn't necessarily mean that there was a large variance, however. If unposted transactions or transaction history showed that other entries in the system accounted for the amount, then your inventory records are still accurate.

Net Variance This field is the item quantity that was actually included in the variance transaction. A large number in this field might signify inventory control problems.

Accuracy % [Accuracy Percent] The Accuracy Percent is 100% - Relative Error Percent, where Relative Error Percent is Variance / Counted Quantity x 100. An accuracy percentage of 100.00% is perfect accuracy.

Approx Value Extended values for all quantities—captured, counted, to reconcile, and net variance—are the current cost of the item when the stock count was processed.

Historical stock status report

The Historical Stock Status Report can be printed at any time for a report of the status of your inventory on a certain day. You can print the report using the Inventory Activity Reports window. To automatically print the report, you can use Named Printers or the Distributed Process Server (DPS). Refer to your System Administrator's Guide (Help >> Contents >> select System Administration) for more information.

The report can be used to report information about Sales Inventory and Discontinued items only. The report shows the quantity on hand, the unit cost, and the extended cost for each item. Information about returned, damaged, in use, and service quantities is not reflected in the report.

To generate a Historical Stock Status Report, you must be maintaining transaction history for the items in the report. To set options to maintain history for an item class, refer to Creating an item class. To set options to maintain history for an item, refer to Entering item options.

For an item with a LIFO Perpetual valuation method or a FIFO Perpetual valuation method, the extended cost of inventory as of a certain day is calculated in two steps. First, the extended cost is calculated at the time the report is run, much like the regular Stock Status Report. Then, transactions posted since the "as of date" are added to or subtracted from the extended cost. However, only transactions that affect the quantity on hand are listed in the report. A transaction that affected a different quantity type—such as a sales return document that added items to the returned quantity—would not be included in the report.

Inventory cost (extended cost) calculations for the Historical Stock Status Report are influenced by the valuation method for an item. For more information about valuation methods and item costs, refer to Valuation methods.

If you change the valuation method for an item sometime between the point in time you choose for the report—the As of Date—and the date you generate the report, values in the report might not be accurate.

Refer to the following table for more information.

| Valuation method | Calculation |

|---|---|

| FIFO perpetual | Layered cost using purchase receipts |

| LIFO perpetual | Layered cost using purchase receipts |

| Average perpetual | Quantity x Item's historical current cost for a selected date |

| FIFO periodic | Quantity x Item's historical standard cost for a selected date |

| LIFO periodic | Quantity x Item's historical standard cost for a selected date |

When the current cost of an item that uses average perpetual valuation method changes or when the standard cost of a LIFO periodic or FIFO periodic item changes, the new value is saved to history. When an item that uses LIFO perpetual or FIFO perpetual valuation method is received into stock, the transaction is valued at the actual cost. This becomes the "historical cost" for the item. The historical cost is always used for both increase transactions (receipts) and decrease transactions (issues) for items that have a LIFO Perpetual or FIFO Perpetual valuation method.

If your report includes items with an Average Perpetual or periodic valuation methods, however, you can choose to use either the historical cost or the standard cost (for items with periodic valuation methods) or the average cost (for items with the Average Cost valuation method). In those cases, the unit costs and extended values are calculated according to the following table:

| Valuation method | Cost type used | Calculations * |

|---|---|---|

| Average perpetual | Today's | Unit cost: Current cost for item on the user date |

| Average perpetual | Historical | Unit cost: Historical current cost for item on the selected date |

| FIFO periodic | Today's | Unit cost: Standard cost for item on the user date |

| FIFO periodic | Historical | Unit cost: Historical standard cost for item on the selected date |

| FIFO perpetual | Today's | Unit cost: Unit cost for transaction |

| FIFO perpetual | Historical | Unit cost: Historical unit cost for transaction Extended cost: Extended cost for transaction |

| LIFO periodic | Today's | Unit cost: Standard cost for item on the user date |

| LIFO periodic | Historical | Unit cost: Historical standard cost for item on the selected date |

| LIFO perpetual | Today's | Unit cost: Unit cost for the transaction |

| LIFO perpetual | Historical | Unit cost: Unit cost for the transaction Extended cost: Extended cost for transaction |

| * All calculations are converted to reflect the base unit of measure. |

Standard/

Average

Extended cost: Current cost for item on the user date x

Quantity on Hand on the user date

Extended cost: Historical cost for item x Quantity on

Hand from the historical date

Standard/

Average

Extended cost: Standard cost for item on the user date x

Quantity on Hand on the user date

Extended cost: Standard cost for item on the user date x

Quantity on Hand from the historical date

Standard/

Average

Extended cost: Extended cost for transaction

Standard/

Average

Extended cost: Standard cost for item on the selected date x Quantity on Hand on the user date

Extended cost: Standard cost for item on the selected date x Quantity on Hand on the selected date

Standard/

Average

Extended cost: Extended cost for transaction

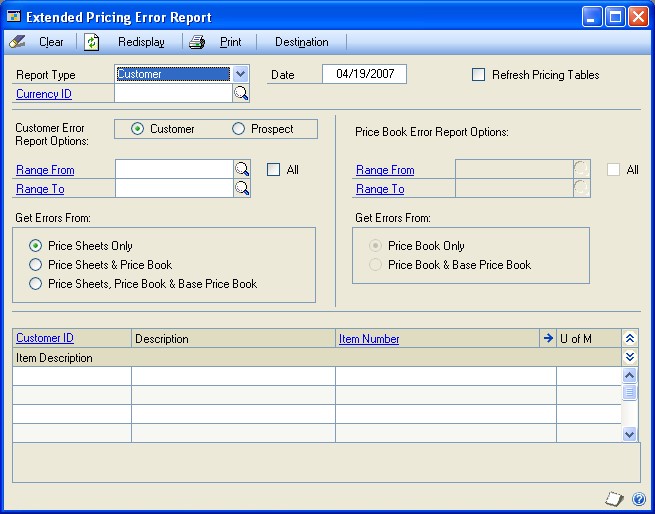

Checking for missing prices

If you're using extended pricing, you can use the Extended Pricing Error Report to identify the items for which prices cannot be calculated.

For example, if an item has a value-off price in a price sheet but no net price in the base price book, or if an item has entries in two price sheets with the same date range in the same price book, prices can't be calculated and errors will be reported.

You can view price error results on screen or on a printed report. When a pricing error report is generated, a complete price book is calculated for the date you enter. This price book is recalculated when an Extended Pricing report is generated for a different date or if the Refresh Pricing Tables option is marked.

To check for missing prices:

- Open the Extended Pricing Error Report window. (Inventory >> Reports >> Extended Pricing >> Error Reports)

Choose to report on errors for customers or price books.

Enter a date for which prices will be calculated.

Mark the Refresh Pricing Tables option to recalculate the prices in the price book when you generate the Extended Pricing error report.

If you intend to produce multiple price book reports for the same date, clear this option to reduce processing time. Select this option only if you have made changes to pricing setup since the last report was printed.

If you selected a Customer report type, choose to report on customers or prospects.

Enter or select the range of customers, prospects, or price books you want to print the report for.

Choose where to look for prices.

A customer report can be printed using the following options:

| Option | Description |

|---|---|

| Price Sheets Only | Prices will be reported for price sheets assigned directly to the customer or prospect. |

| Price Sheets and Price Book | Prices will be reported for price sheets assigned directly to the customer or prospect, and price sheets assigned to the customer or prospect's price book. |

| Price Sheets, Price Book and Base Book | Prices will be reported for price sheets assigned directly to the customer or prospect, price sheets assigned to the customer or prospect's price book, and price sheets assigned to the base price book. |

A price book report can be printed using the following options:

| Option | Description |

|---|---|

| Price Book Only | Prices will be reported for price sheets assigned to the price book. |

| Price Book and Base Book | Prices will be reported for price sheets assigned to the price book and price sheets assigned to the base price book. |

- To view the information on-screen, choose the Redisplay button. Highlight a record to display error details.

To print a report, choose Destination to select a report destination, then choose Print to print the report.

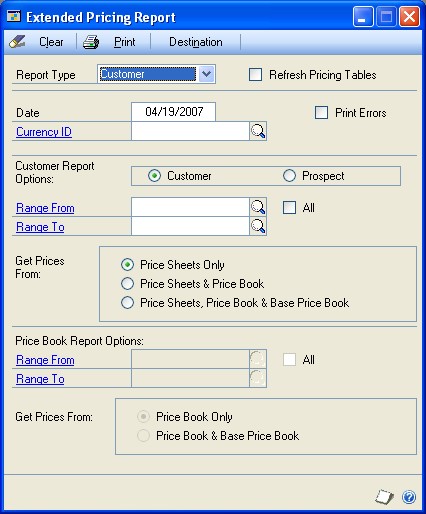

Printing extended pricing summary reports

If you're using extended pricing, you can use the Extended Pricing Report window to print reports that summarize pricing information for a customer or for a price book.

To print extended pricing summary reports:

- Open the Extended Pricing Report window. (Inventory >> Reports >> Extended Pricing >> Pricing Reports)

- Choose the report type: Customer or Price Book.

You can use the customer report type to print reports for prospects, as well.

Mark Refresh Pricing Tables to recalculate pricing in a price book. You shouldn't have to mark this option unless you have made changes to pricing information since the last time you generated the report.

Enter the date that information in the report should be based on.

Mark Print Errors if problems in calculating prices should be included in the report.

If you don't mark this option, the first net price that is found will be printed on the report.

If you're using Multicurrency Management, enter or select the currency ID for the report. If you don't select a currency, information about all currencies will be included on the report.

Enter additional information for the report, based on the kind of report you're printing.

Refer to the table for more information.

| Report Type | Information to enter |

|---|---|

| Customer | Mark Customer or Prospect |

| Enter or select a range of customer or prospect records to include in the report. To include all customers or all prospects, mark All. | |

| Mark the information to include in the report. The report can be based on price sheets only, price sheets and the price book for the customer or prospect, or price sheets, the price book, and the base price book. | |

| Price Book | Enter or select a range of price books to include in the report. To include all price books, mark All. |

| Mark the information to include in the report. The report can be based on information for each price book only, or on information for the price book and the base price book. |

Choose Destination to open the Report Destination window.

Choose the report destination.

If you don't choose a destination for the report at this point, you'll be prompted to select a destination when the report is generated.

Choose OK to save the report destination and close the Report Destination window.

In the Extended Pricing Report window, choose Print to generate the report.

When you've finished, close the window.

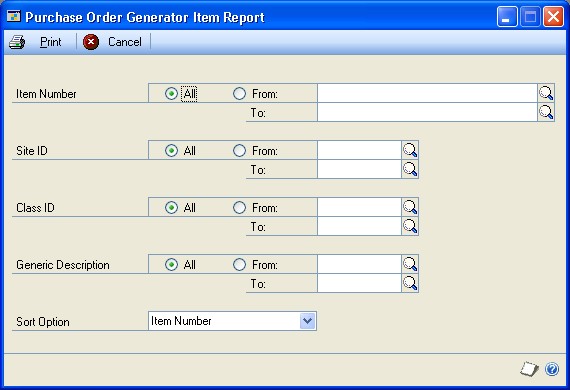

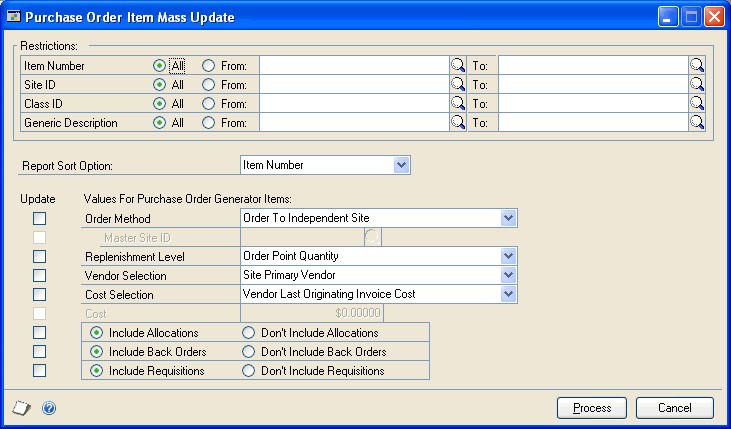

Printing a purchase order generator item report

You can use the Purchase Order Generator Item Report to print the Purchase Order Generator Item Report, which summarizes the purchase order generator options you've set up for items.

To print a purchase order generator item report:

- Open the Purchase Order Generator Item Report window. (Inventory >> Reports >> Purchase Order Generator Item)

Use the range fields to select the group of items to include in the report. You can select a range of items, sites, classes, or generic descriptions.

Choose how information in the report should be sorted. Choices are Item, Description, Site, Class, and Generic Description.

Choose Print. The Report Destination window opens, where you can choose where the report should be printed. For more information about report destinations and formats, refer to your System User's Guide (Help >> Contents >> select Using The System).

In the Report Destination window, choose OK. The report will be printed to the destination you selected.

When you've finished, close the window.

Specifying an Inventory Control report option

Report options include specifications for sorting options and range restrictions for a particular report. In order to print several Inventory Control reports, you must first create a report option. Each report can have several different options so that you can easily print the information you need. For example, you can create report options for the Purchase Receipts Report that show either detailed or summary information.

A single report option can't be used by multiple reports. If you want identical options for several reports, you must create them separately.

Use the Inventory Control report options windows to create sorting, restriction, printing, and email options for the reports that have been included with Inventory Control.

To specify an Inventory Control report option:

Open an Inventory Control reports window. There are separate windows for each report type. (Inventory >> Reports >> Setup) (Inventory >> Reports >> Item) (Inventory >> Reports >> Serial/Lots) (Inventory >> Reports >> Activity) (Inventory >> Reports >> Analysis) (Inventory >> Reports >> History) (Inventory >> Reports >> Posting Journals) (Inventory >> Reports >> Resource Planning)

Select a report from the Reports list.

Choose New to open the report options window. Your selection in step 2 determines which report options window appears.

Name the option and enter information to define the option. The name you choose for the option won't appear on the report. The selections available for defining report options vary, depending on the report type you've selected.

Enter range restrictions. The Ranges list shows the available options for each report. The available ranges vary, depending on the type of report.

You can enter only one restriction for each restriction type. For instance, you can insert one item number restriction (item ABC-001 to ABC-999) and one date restriction (10/ 15/05 to 11/15/05).

Choose Insert to insert the range in the Restrictions List. To remove an existing range from the list, select the range and choose Remove.

Choose Email Options to enter email options for the report option. Once the email options are set up, you'll be able to send the report in an email message from this window by choosing Email. You can also send this report from any list view where the report option is displayed.

Choose Destination to select a printing destination. Reports can be printed to the screen, to the printer, to a file, or to any combination of these options. If you select Ask Each Time, you can select printing options each time you print this report option.

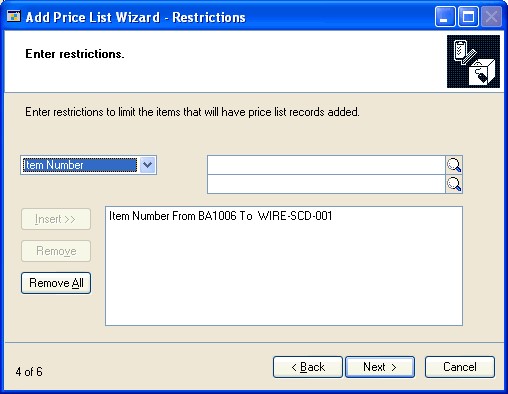

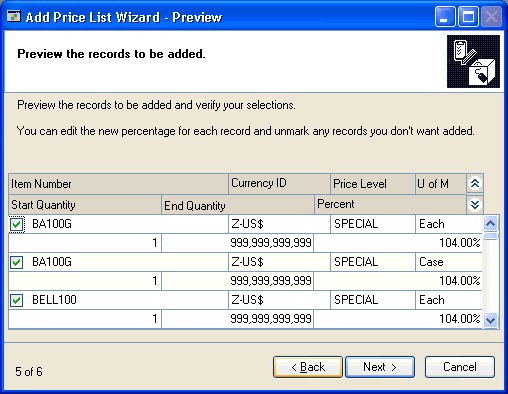

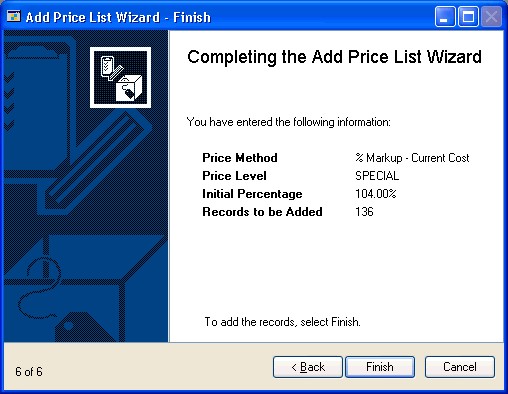

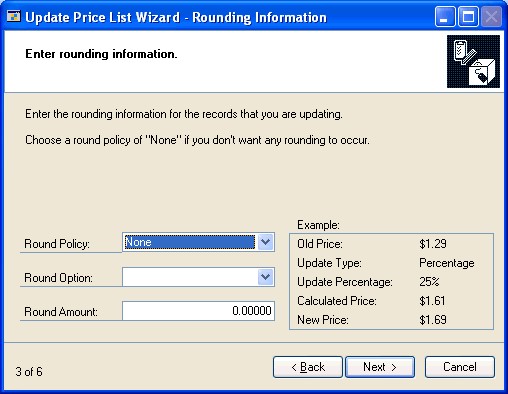

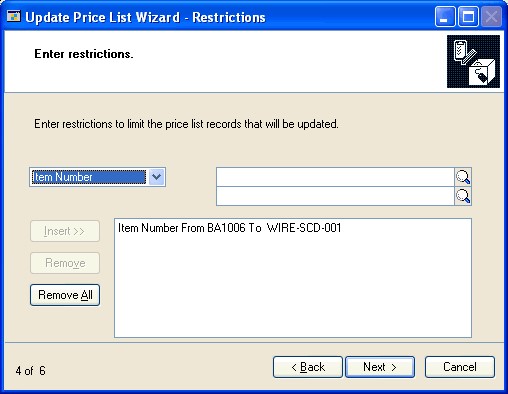

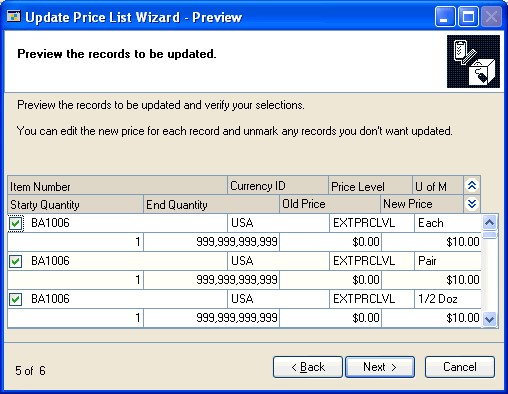

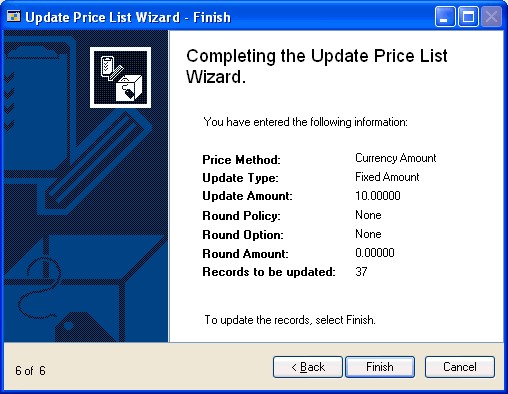

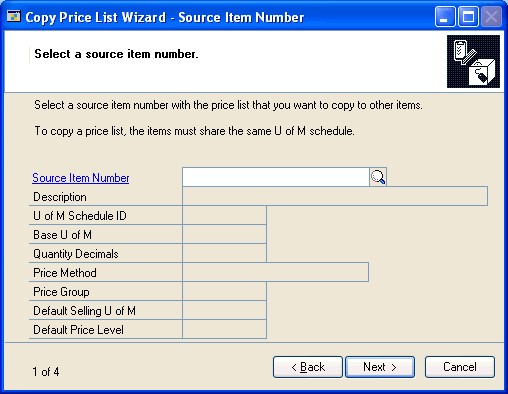

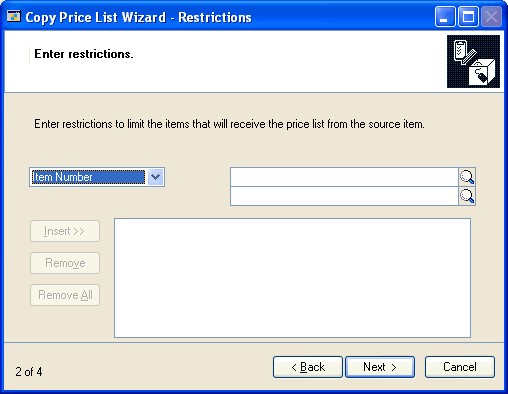

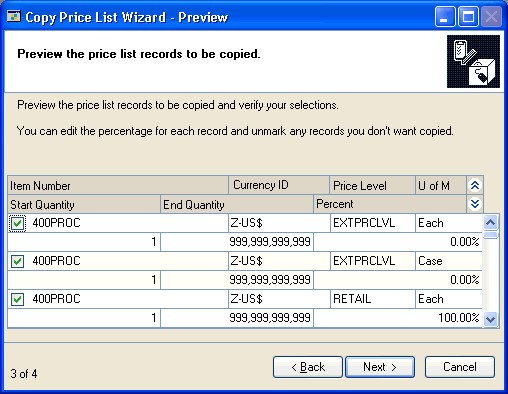

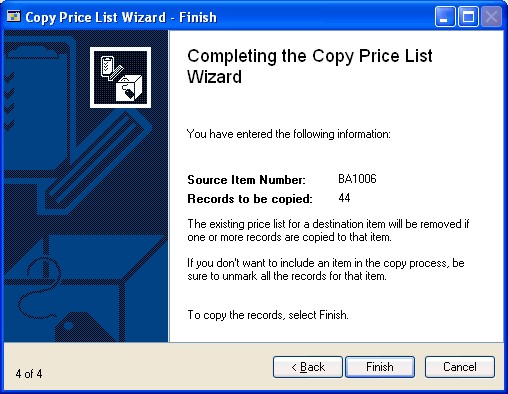

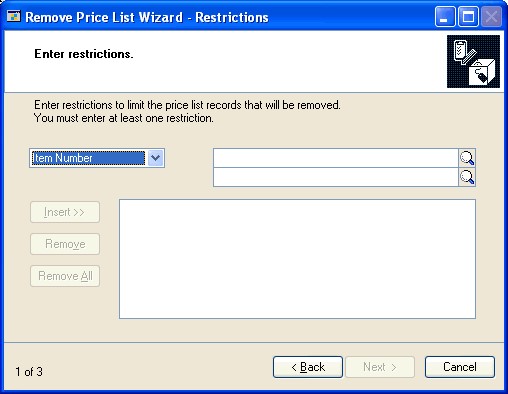

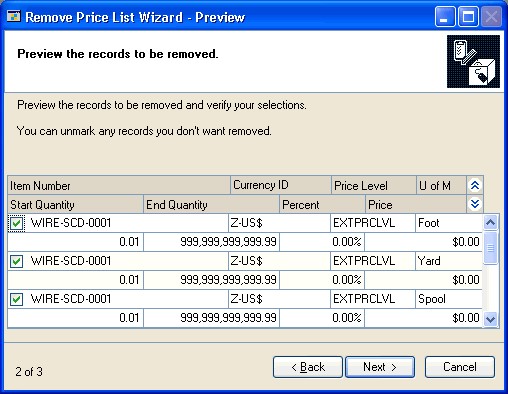

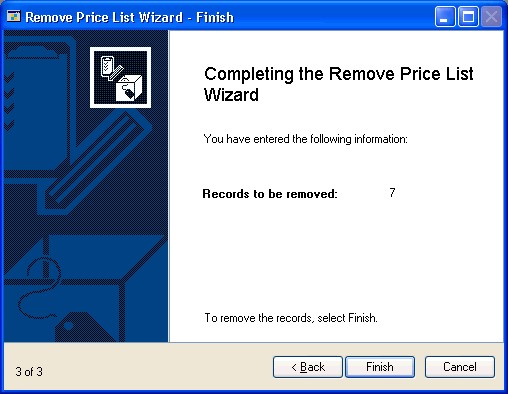

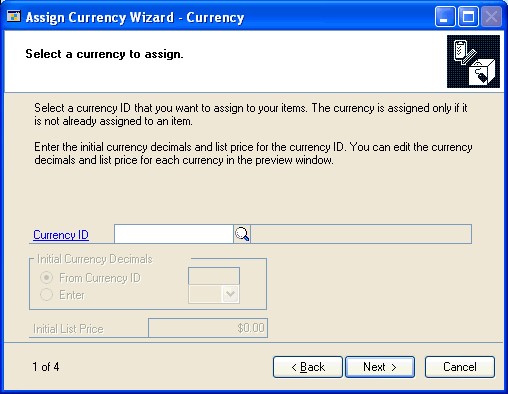

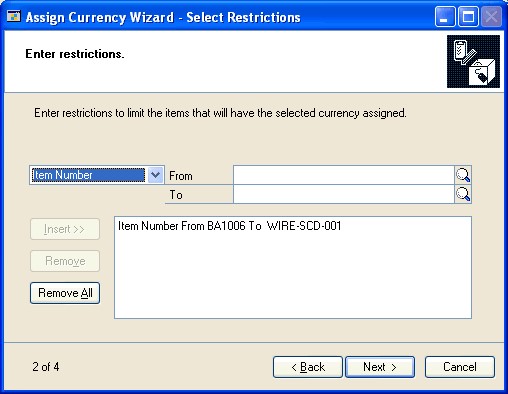

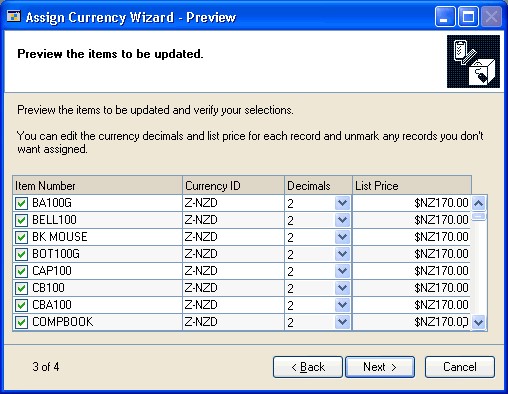

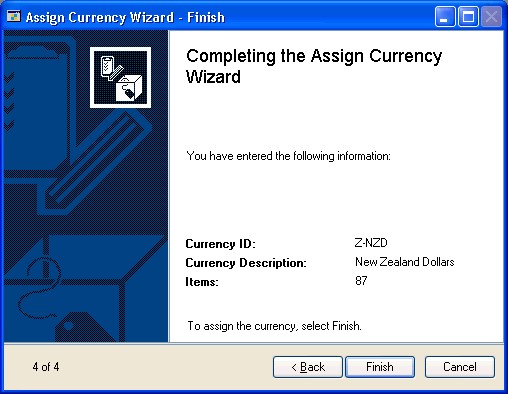

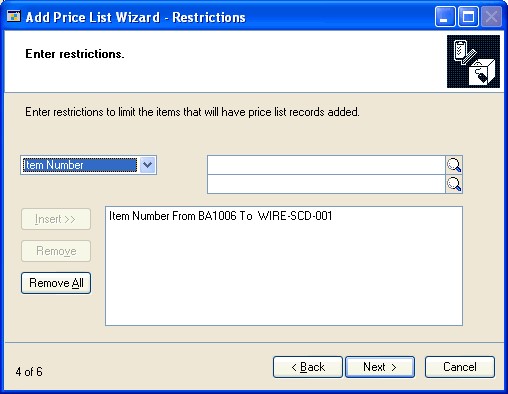

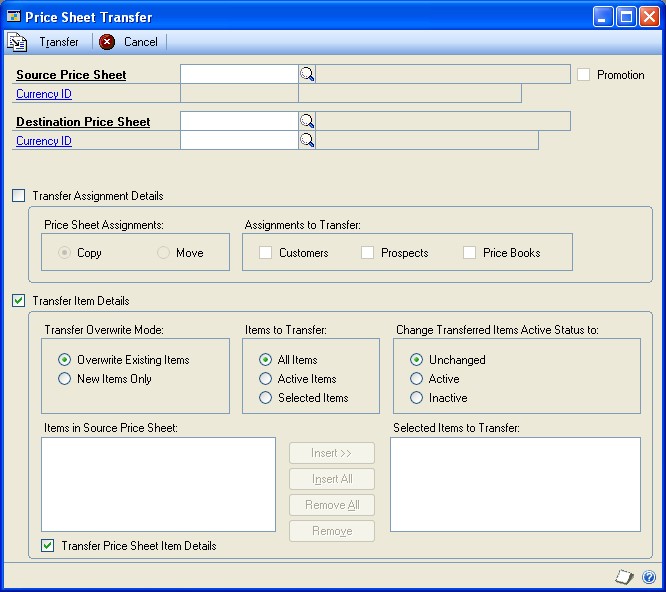

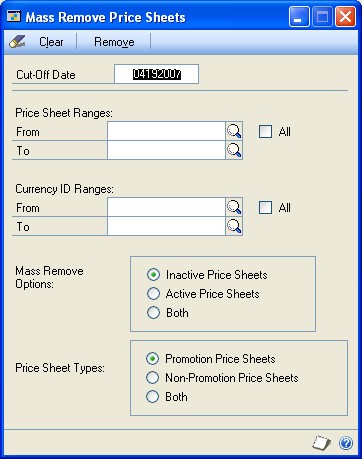

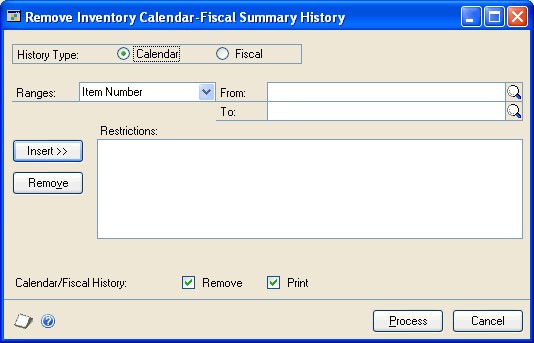

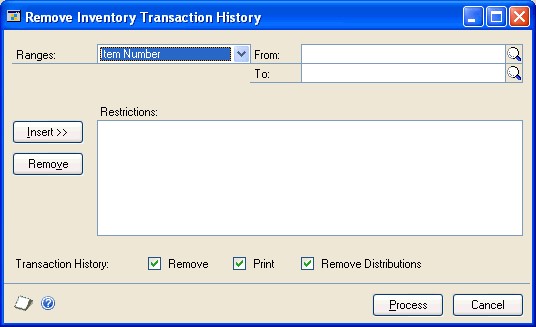

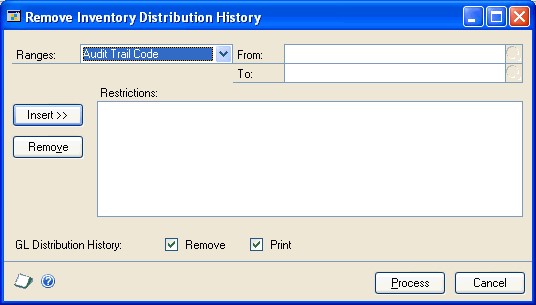

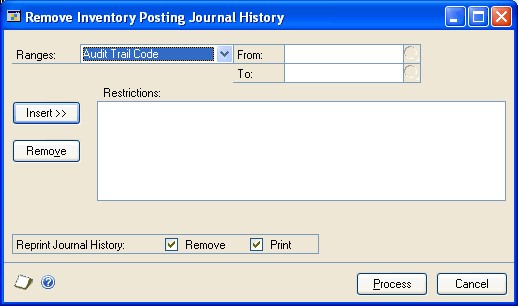

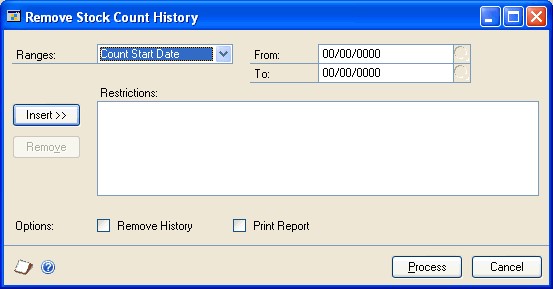

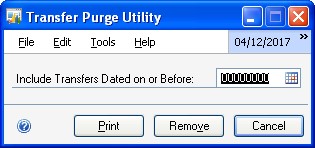

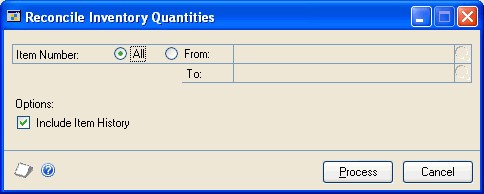

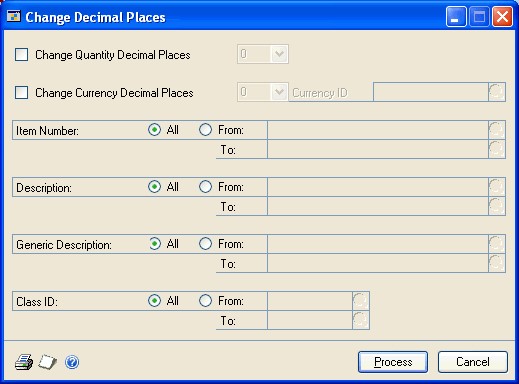

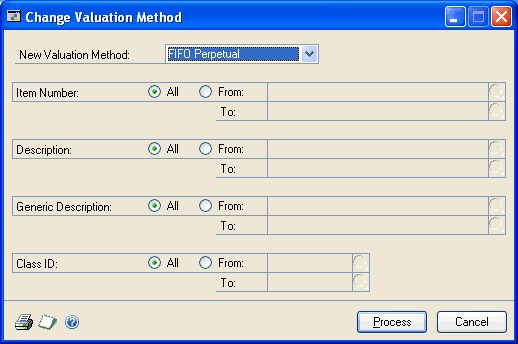

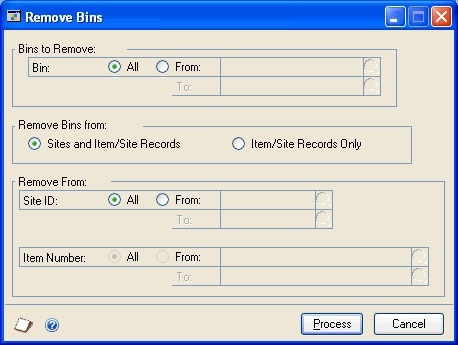

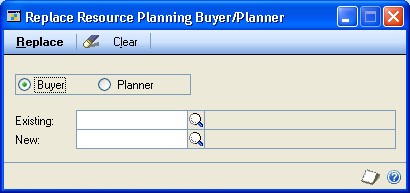

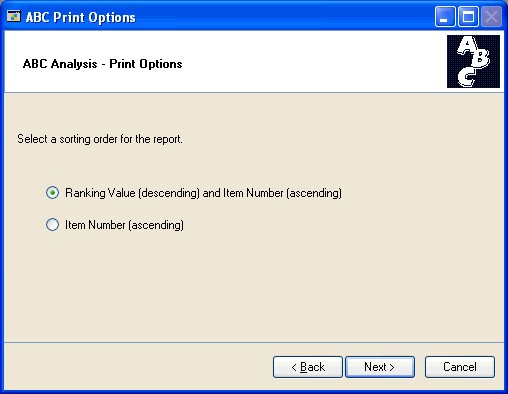

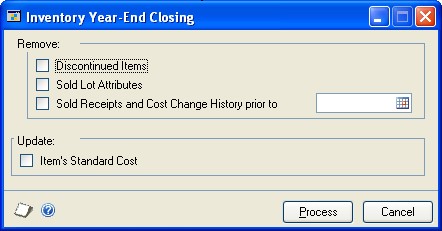

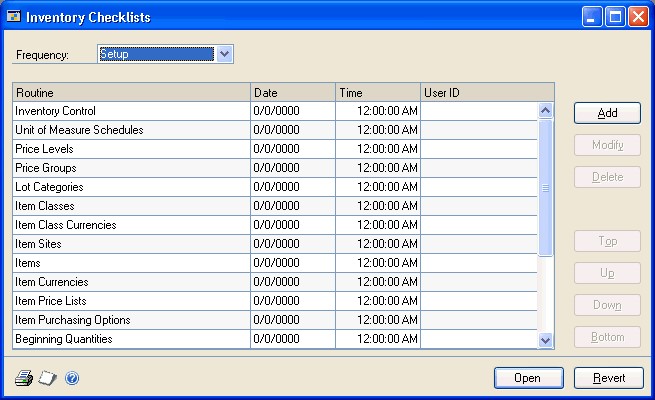

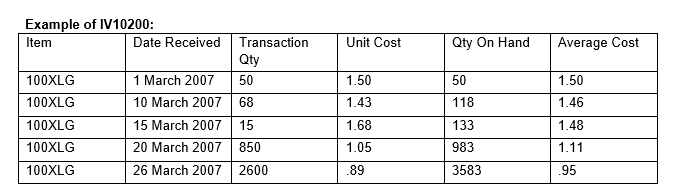

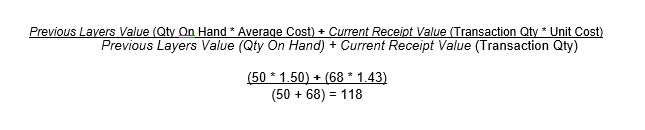

For more information about printing report options, refer to your System User's Guide (Help >> Contents >> select Using The System).