Project Accounting - Accounting Control Guide

Introduction

The Project Accounting Accounting Control Guide includes information for accounting managers about how to use Microsoft Dynamics® GP Project Accounting to set up and control how credits and debits are posted to the Project Accounting chart of accounts and how to recognize revenue for projects. It also includes information about how to create, group, and print reports.

You can specify posting account numbers for cost categories in project budgets and for fees assigned to projects. You can create the batches to be used for transactions and, before posting, modify posting account distributions for transactions. You can enter adjusting transactions and delete posted cost and billing transactions.

You also can use revenue recognition cycles to recognize revenue for multiple customers, contracts, and projects at once.

Project Accounting Cost Management Guide Includes information about how to estimate and track project costs, and specify how billing amounts, revenue, and profit should be calculated, based on project costs.

Project Accounting Billing Guide Includes information about how to create billing invoices for customers.

Project Accounting Administrator’s Guide Includes information about how to set up user security and maintain your company databases for Project Accounting.

This introduction is divided into the following sections:

What’s in this manual

Symbols and conventions

Resources available from the Help menu

What’s in this manual

This manual is designed to give you an understanding of how to use the accounting control features of Project Accounting, and how it integrates with the Microsoft Dynamics GP system.

To make best use of Project Accounting, you should be familiar with systemwide features described in the System User’s Guide, the System Setup Guide, and the System Administrator’s Guide. Choose Help > Printable Manuals for more information.

You might also need to be familiar with features described in General Ledger, Bank Reconciliation, Multicurrency Management, Purchase Order Processing, Purchase Order Enhancements, Payables Management, Receivables Management, Inventory Control, United States Payroll, Canadian Payroll, or Report Writer

Some features described in the documentation are optional and can be purchased through your Microsoft Dynamics GP partner.

To view information about the release of Microsoft Dynamics GP that you’re using and which modules or features you are registered to use, choose Help > About Microsoft Dynamics GP.

The manual is divided into the following parts.

Part 1, Posting setup and control, includes information about how to specify posting account numbers for cost categories in project budgets and for fees assigned to projects. It also includes information about how to create batches for transactions manually, how to modify posting account distributions for transactions, and how to post multiple batches at once.

Part 2, Revenue recognition, includes information about how to create and use revenue recognition cycles to recognize revenue for multiple customers, contracts, and projects at once. It also includes information about how to modify revenue recognition transactions before posting and how revenue is calculated for recognition.

Part 3, Reports and utilities, includes information about reports in Project Accounting and how to create, group, and print them. It also includes information about how to enter adjusting transactions to reverse and correct cost transaction line item entries, and how to delete posted cost and billing transactions and Closed contracts. The documentation also includes information about how to use various accounting utilities.

Contents

Opens the Help file for the active Microsoft Dynamics GP component, and displays the main “contents” topic. To browse a more detailed table of contents, click the Contents tab above the Help navigation pane. Items in the contents topic and tab are arranged by module. If the contents for the active component includes an “Additional Help files” topic, click the links to view separate Help files that describe additional components.

To find information in Help by using the index or full-text search, click the appropriate tab above the navigation pane, and type the keyword to find.

To save the link to a topic in the Help, select a topic and then select the Favorites tab. Click Add.

About this window

Displays overview information about the current window. To view related topics and descriptions of the fields, buttons, and menus for the window, choose the appropriate link in the topic. You also can press F1 to display Help about the current window.

Lookup

Opens a lookup window, if a window that you are viewing has a lookup window. For example, if the Checkbook Maintenance window is open, you can choose this item to open the Checkbooks lookup window.

Show Required Fields

Highlights fields that are required to have entries. Required fields must contain information before you can save the record and close the window. To change the way required fields are highlighted, choose Microsoft Dynamics GP menu > User Preferences > Display, and specify a different color and type style.

What’s New

Provides information about enhancements that were added to Microsoft Dynamics GP since the last major release.

Microsoft Dynamics GP Online

Opens a Web page that provides links to a variety of Web-based user assistance resources. Access to some items requires registration for a paid support plan.

Part 1: Posting setup and control

This part of the documentation includes information for the accounting manager about how to specify posting account numbers for cost categories in project budgets and for fees assigned to projects. It also includes information about how to create batches for transactions manually, how to modify posting account distributions for transactions, and how to post multiple batches at once.

Chapter 1, “Posting setup,” includes information about the Project Accounting chart of accounts and how to specify posting account numbers for cost categories in project budgets and for fees assigned to projects. It also includes information about how to specify the posting account segment numbers to use when posting amounts for individual contracts and projects.

Chapter 2, “Posting control,” includes information about how to create batches for transactions, how to review and modify posting account distributions for transactions in batches, and how to post batches.

Chapter 1: Posting setup

This part of the documentation includes information for the accounting manager about the Project Accounting chart of accounts and how to specify posting account numbers for cost categories in project budgets and for fees assigned to projects. It also includes information about how to specify the posting account segment numbers to use when posting amounts for individual contracts and projects.

The following topics are discussed.

The Project Accounting chart of accounts

The Work In Progress posting account

Specify default posting account numbers for records and classes for cost transactions

Specify default posting account numbers for cost categories in project budgets

Specify posting account numbers for a cost category in a project budget

Specify default posting account numbers for records and classes for fees

Specify default posting account numbers for fees assigned to projects

Specify posting account numbers for a fee assigned to a project

Specify account segment numbers to use when posting amounts for a contract

Specify account segment numbers to use when posting amounts for a project

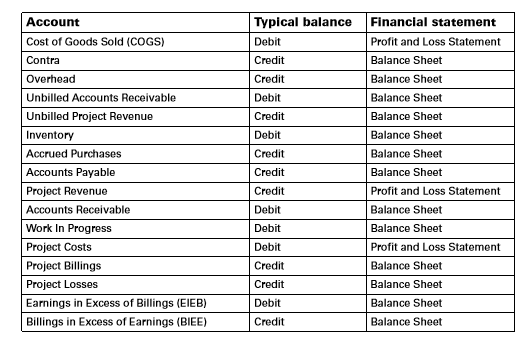

The Project Accounting chart of accounts

The following chart of accounts is used for Project Accounting.

| Account | Typical balance | Financial statement |

|---|---|---|

| Cost of Goods Sold (COGS) | Debit | Profit and Loss Statement |

| Contra | Credit | Balance Sheet |

| Overhead | Credit | Balance Sheet |

| Unbilled Accounts Receivable | Debit | Balance Sheet |

| Unbilled Project Revenue | Credit | Balance Sheet |

| Inventory | Debit | Balance Sheet |

| Accrued Purchases | Credit | Balance Sheet |

| Accounts Payable | Credit | Balance Sheet |

| Project Revenue | Credit | Profit and Loss Statement |

| Accounts Receivable | Debit | Balance Sheet |

| Work In Progress | Debit | Balance Sheet |

| Project Costs | Debit | Profit and Loss Statement |

| Project Billings | Credit | Balance Sheet |

| Project Losses | Credit | Balance Sheet |

| Earnings in Excess of Billings (EIEB) | Debit | Balance Sheet |

| Billings in Excess of Earnings (BIEE) | Credit | Balance Sheet |

The Work In Progress posting account

The WIP (Work In Progress) posting account is a holding account on the Balance Sheet. It has a typical debit balance and is used to track actual project costs that haven’t been billed for Time and Materials projects that use the When Billed accounting method, or actual project costs for Cost Plus and Fixed Price projects that haven’t been closed.

See Accounting methods and recognizing revenue for more information. See also Project types in the Project Accounting Cost Management Guide and Age work in progress amounts for projects that use the When Billed accounting method in the Project Accounting Billing Guide for more information.

Specify default posting account numbers for records and classes for cost transactions

For various types of records and classes, including customers, contracts, projects, cost categories, employees, vendors, equipment, and miscellaneous, you can specify the default posting account numbers to use for cost transactions. You can specify these settings for Time and Materials projects and for Cost Plus and Fixed Price projects.

You also can specify the type of record that will be used to determine the default posting account numbers for cost categories for various cost transaction types. See Specify default posting account numbers for cost categories in project budgets for more information.

- Open the window for the record or class that you’re specifying default posting account numbers to use for cost transactions.

The following table lists the windows and how to open them.

(IMAGE PACTAB.jpg)

In the Transaction Type list, select whether to specify settings for timesheets, employee expense transactions, equipment logs, miscellaneous logs, or purchases/materials transactions. Purchases/materials is for purchase orders, shipment receipts, shipment/invoice receipts, invoice receipts, and inventory transfers with non-inventoried items.

For each posting account, select the account number to use for the record or class for the cost transaction.

Click OK.

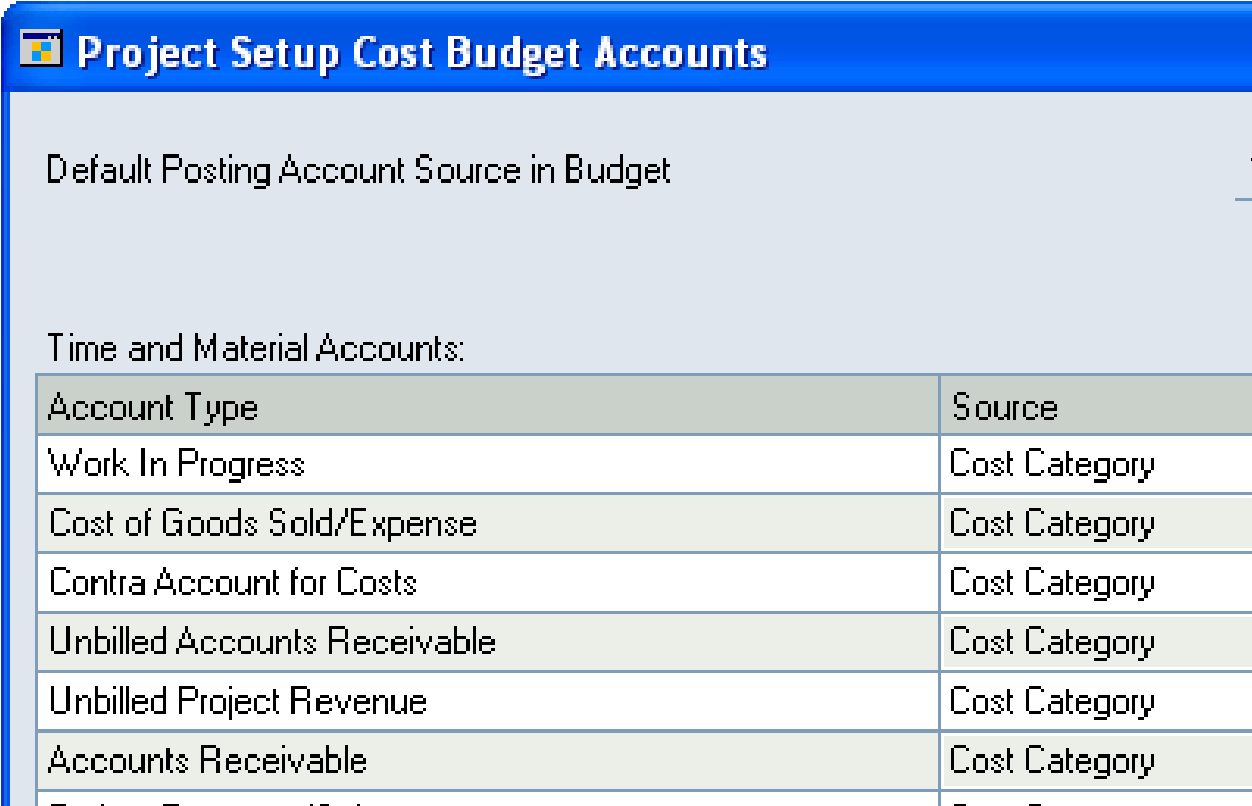

Specify default posting account numbers for cost categories in project budgets

You can specify the default posting account numbers to use for cost categories in project budgets, depending on the type of cost transactions that the cost categories are for. See Cost categories and cost transactions in the Project Accounting Cost Management Guide for more information.

For each type of cost transaction, you must specify the type of record that will be used to determine the default posting account numbers for cost categories for the transaction type. You can specify these settings for Time and Materials projects and for Cost Plus and Fixed Price projects. See Specify default posting account numbers for records and classes for cost transactions for more information.

You also can select specific default posting account numbers or select to use no default posting account numbers.

After you assign a cost category to a project budget, you can modify the posting account numbers to use for the cost category in the budget. See Specify posting account numbers for a cost category in a project budget for more information.

Open the Project Setup Cost Budget Accounts window.

Microsoft Dynamics GP menu > Tools > Setup > Project > Project > Accounts button

(IMAGE PACSET.jpg)

In the Transaction Type list, select whether to specify settings for cost categories that are for timesheets, employee expense transactions, equipment logs, miscellaneous logs, or purchases/materials transactions. Purchases/ materials is for purchase orders, shipment receipts, shipment/invoice receipts, invoice receipts, and inventory transfers with non-inventoried items.

For each posting account, in the Source column select whether to use the default account number that you’ve specified for the customer, contract, project, cost category, or transaction owner (Trx Owner) that the cost transaction is for. The transaction owner is the employee, equipment, miscellaneous, or vendor record that the cost transaction is for.

Select None if you won’t be updating General Ledger. No default account number will be used for the posting account.

To use this window to select a specific default account number to use for the posting account, select Specific and select the account number.

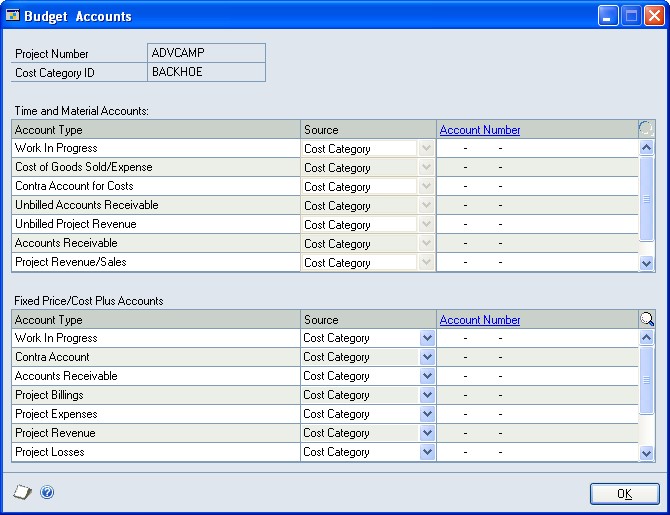

Specify posting account numbers for a cost category in a project budget

You can specify the posting account numbers to use for a cost category in a project budget, including the type of record that will be used to determine the default posting account numbers. See Specify default posting account numbers for records and classes for cost transactions for more information.

You also can select specific default posting account numbers or select to use no default posting account numbers.

You also can specify the default posting account numbers to use for cost categories in project budgets, depending on the type of cost transactions that the cost categories are for. See Specify default posting account numbers for cost categories in project budgets for more information.

- Open the Budget Accounts window. Cards > Project > Project > Budget Button > Cost Category expansion button > Accounts button

(IMAGE PACBUD.jpg)

- For each posting account, in the Source column select whether to use the default account number that you’ve specified for the customer, contract, project, cost category, or transaction owner (Trx Owner) for the type of cost transaction that the cost category is for. The transaction owner is the employee, equipment, miscellaneous, or vendor record that the cost transaction is for.

Select None if you won’t be updating General Ledger. No default account number will be used for the posting account.

To use this window to select a specific default account number to use for the posting account, select Specific and select the account number.

Specify default posting account numbers for records and classes for fees

For various types of records and classes, including customers, contracts, projects, and fees, you can specify the default posting account numbers to use for fees that are assigned to projects. You can specify these settings for Time and Materials projects and for Cost Plus and Fixed Price projects.

You also can specify the type of record that will be used to determine the default posting account numbers for fees. See Specify default posting account numbers for fees assigned to projects for more information.

Open the window for the record or class that you’re specifying default posting account numbers to use for cost transactions.

- For each posting account, select the account number to use for the record or class for the cost transaction and then Click OK.

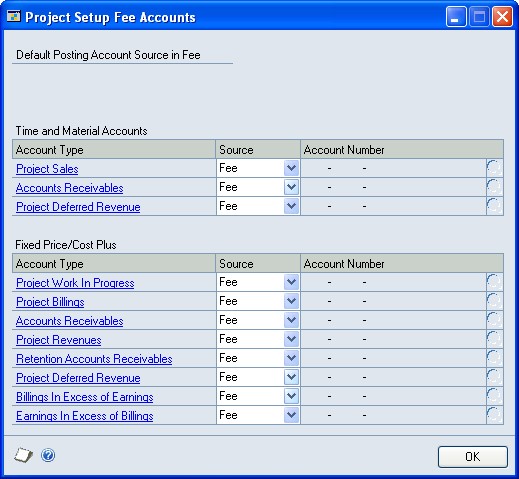

Specify default posting account numbers for fees assigned to projects

You can specify the default posting account numbers to use for fees assigned to projects. You must specify the type of record that will be used to determine the default posting account numbers. You can specify these settings for Time and Materials projects and for Cost Plus and Fixed Price projects. See Specify default posting account numbers for records and classes for fees for more information.

You also can select specific default posting account numbers, or select to use no default posting account numbers.

After you assign a fee to a project, you can modify the posting account numbers to use for the fee for the project. See Specify posting account numbers for a fee assigned to a project for more information.

- Open the Project Setup Fee Accounts window. Microsoft Dynamics GP menu > Tools > Setup > Project > Project > Fee Accounts button

(IMAGE PACFEE.jpg)

- For each posting account, in the Source column select whether to use the default account number that you’ve specified for the customer, contract, project, or fee.

Select None if you won’t be updating General Ledger. No default account number will be used for the posting account.

To use this window to select a specific default account number to use for the posting account, select Specific and select the account number.

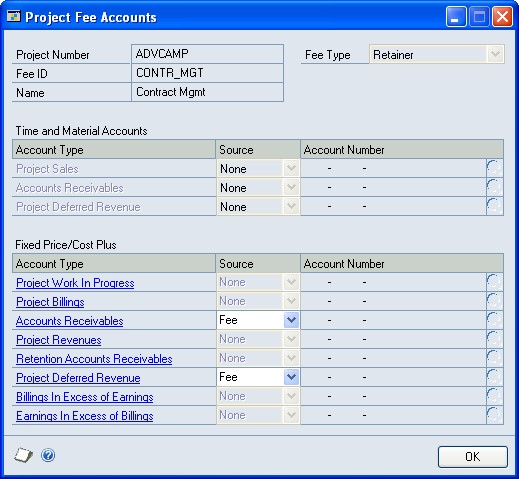

Specify posting account numbers for a fee assigned to a project

You can specify the posting account numbers to use for a fee assigned to a project, including the type of record that will be used to determine the default posting account numbers. See Specify default posting account numbers for records and classes for fees for more information.

You also can select specific default posting account numbers, or select to use no default posting account numbers.

You can specify the default posting account numbers to use for fees assigned to projects. See Specify default posting account numbers for fees assigned to projects for more information.

Open the Project Fee Accounts window.

Cards > Project > Project > Fees button > Fee ID expansion button > Accounts button

(IMAGE PACFEE2.jpg)

- For each posting account, in the Source column select whether to use the default account number that you’ve specified for the customer, contract, project, or fee.

Select None if you won’t be updating General Ledger. No default account number will be used for the posting account.

To use this window to select a specific default account number to use for the posting account, select Specific and select the account number.

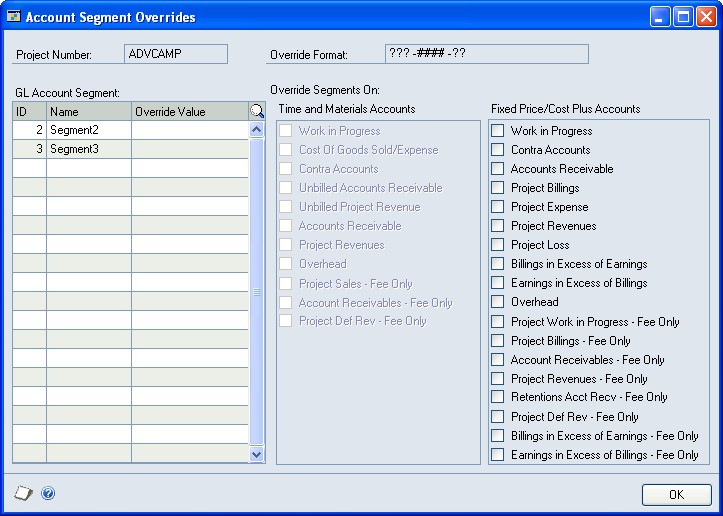

Specify account segment numbers to use when posting amounts for a contract

You can specify the account segment numbers to use for posting accounts when posting transactions for an individual contract.

An account segment is the portion of the account format that can be used to represent a specific aspect of a business. For example, accounts can be divided into segments that represent business locations, divisions, or profit centers.

An account segment number can represent a particular area of a business or an account category. Using account 01-200-1100, for example, account segment number 01 might represent a particular site, 200 might represent a department located at that site, and 1100 might represent the Cash account for that site and that department. To use specific account segment numbers to identify when amounts are posted to the Cash account for individual contracts handled by a specific department, for example, you might specify that 201 represents the first contract for a department and 202 the second contract.

Names can be entered for each account segment number to appear on General Ledger reports. Use the Account Format Setup window (Microsoft Dynamics GP menu > Tools > Setup > Company > Account Format) to enter names for account segments and to modify the account format.

- Open the Account Segment Overrides window. Cards > Project > Contract > Sub Acct Format expansion button

(IMAGE PACSEG.jpg)

For each account segment in the scrolling window, you can enter the account segment number to use when posting amounts for the contract.

Select the posting accounts that the account segment numbers will be used for and Click OK.

Specify account segment numbers to use when posting amounts for a project

You can specify the account segment numbers to use for posting accounts when posting transactions for an individual project.

An account segment is the portion of the account format that can be used to represent a specific aspect of a business. For example, accounts can be divided into segments that represent business locations, divisions, or profit centers.

An account segment number can represent a particular area of a business or an account category. Using account 01-200-1100, for example, account segment number 01 might represent a particular site, 200 might represent a department located at that site, and 1100 might represent the Cash account for that site and that department. To use specific account segment numbers to identify when amounts are posted to the Cash account for individual projects handled by a specific department, for example, you might specify that 201 represents the first project for a department and 202 the second project.

Names can be entered for each account segment number to appear on General Ledger reports. Use the Account Format Setup window (Microsoft Dynamics GP menu > Tools > Setup > Company > Account Format) to enter names for account segments and to modify the account format.

Open the Account Segment Overrides window. Cards > Project > Project > Sub Acct Format expansion button

For each account segment in the scrolling window, you can enter the account segment number to use when posting amounts for the project.

Select the posting accounts that the account segment numbers will be used for and Click OK.

Chapter 2: Posting control

This part of the documentation includes information for the accounting manager about how to create batches for transactions, how to review and modify posting account distributions for transactions in batches, and how to post batches.

The following topics are discussed.

Manually create a batch for transactions

Review and modify posting account distributions for transactions

Post batches

Manually create a batch for transactions

You can create batches manually for grouping cost, return from project, billing, and revenue recognition transactions. You can save transactions in batches and then post the entire batch of transactions at once.

Batches that you create manually in Project Accounting always use the Single Use frequency, meaning the batch is used once and is deleted after the batch is posted.

You can use billing cycles and revenue recognition cycles to create batches of billing and revenue recognition transactions. For more information, see Use a revenue recognition cycle to generate revenue recognition transactions and Use a billing cycle to generate billing invoices of the Project Accounting Billing Guide.

- Open a batch entry window.

The following table lists the windows and how to open them.

| Transaction | Window | Choose |

|---|---|---|

| Timesheets | Timesheet Batch Entry | Transactions > Project > Timesheet Batches |

| Employee expense transactions | Employee Expense Batch Entry | Transactions > Project > Employee Expense Batches |

| Equipment logs | Equipment Log Batch Entry | Transactions > Project > Equipment Log Batches |

| Miscellaneous logs | Miscellaneous Log Batch Entry | Transactions > Project > Miscellaneous Log Batches |

| Inventory transfers | Inventory Transfer Batch Entry | Transactions > Project > Inventory Batches |

| Return from project transactions | Return From Project Batch Entry | Transactions > Project > Returns from Project Batches |

| Billing invoices and billing returns | Billing Batch Entry | Transactions > Project > Billing > Billing Batches |

| Revenue recognition transactions | Revenue Recognition Batch Entry | Transactions > Project > Billing > Revenue Recognition Batches |

Enter a batch ID and comment. The comment is the reference for the batch in General Ledger.

If you selected Posting Date From: Batch in the Posting Setup window (Microsoft Dynamics GP menu > Tools > Setup > Posting > Posting), enter a posting date for the batch.

If the batch is for employee expense transactions or billing invoices or returns, select the checkbook for the batch.

In the Control column, you can enter the minimum number of transactions or the minimum total amount that must be entered in the batch before you can post the batch.

Click Transactions to open the transaction entry window, where you can enter transactions for the batch.

Click Save and close the window to save the batch.

Before you post the batch, you can print an edit list to review the transactions in the batch.

Click Post to post the batch.

Close the window.

Review and modify posting account distributions for transactions

You can print an edit list to review posting account distributions for transactions in a batch. You also can modify distributions before posting the batch.

See Manually create a batch for transactions and Use a revenue recognition cycle to generate revenue recognition transactions , and also Use a billing cycle to generate billing invoices in the Project Accounting Billing Guide for more information.

- Open a batch entry window.

The following table lists the windows and how to open them.

| Transaction | Window | Choose |

|---|---|---|

| Timesheets | Timesheet Batch Entry | Transactions > Project > Timesheet Batches |

| Employee expense transactions | Employee Expense Batch Entry | Transactions > Project > Employee Expense Batches |

| Equipment logs | Equipment Log Batch Entry | Transactions > Project > Equipment Log Batches |

| Miscellaneous logs | Miscellaneous Log Batch Entry | Transactions > Project > Miscellaneous Log Batches |

| Inventory transfers | Inventory Transfer Batch Entry | Transactions > Project > Inventory Batches |

| Return from project transactions | Return From Project Batch Entry | Transactions > Project > Returns from Project Batches |

| Billing invoices and billing returns | Billing Batch Entry | Transactions > Project > Billing > Billing Batches |

| Revenue recognition transactions | Revenue Recognition Batch Entry | Transactions > Project > Billing > Revenue Recognition Batches |

Enter the batch ID to review transactions for.

Click Transactions to open the transaction entry window.

Click the printer button to print a transaction edit list. The edit list will include information about posting account distributions for transactions in the batch.

In the transaction entry window, click Distributions to open the distributions entry window for the transaction that is displayed.

In the distributions entry window, the scrolling window will display how amounts have been distributed for the transaction, based on your posting setup. See Chapter 1, “Posting setup,” for more information.

You can change the debit or credit amounts for the accounts.

You can select additional accounts to enter distributions for, or select a line item and choose Edit > Delete Row to delete the line item. Click Default to restore distributions to the way they were before you opened the window and made changes.

Click OK. The distribution entry window will close.

In the transaction entry window, use the browse buttons to view information for other transactions in the batch. Click OK to close the transaction entry window.

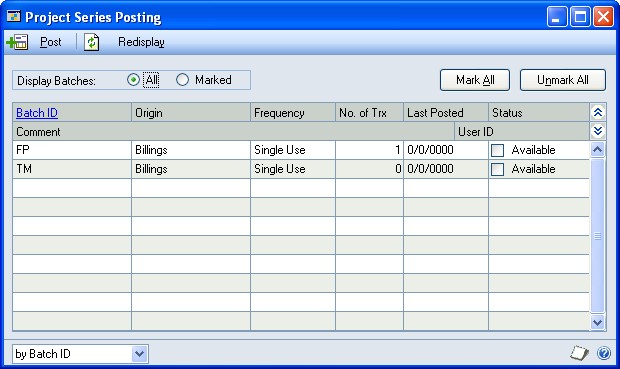

Post batches

You can post multiple batches of transactions at once, including batches of cost, billing, and revenue recognition transactions. See Manually create a batch for transactions and Use a revenue recognition cycle to generate revenue recognition transactions, and also Use a billing cycle to generate billing invoices in the Project Accounting Billing Guide for more information.

You also can use the Project Series Posting window to post batches of transactions that were entered using Personal Data Keeper or Time and Expense for Microsoft Dynamics GP Business Portal, and then processed using Personal Data Keeper. See the Personal Data Keeper and Time and Expense documentation for more information.

- Open the Project Series Posting window. Transactions > Project > Series Post

(IMAGE PACPOST.jpg)

- In the Status column, select the batches to post. You can select a batch and click the Batch ID link to view more information about the batch and then Click Post.

Part 2: Revenue recognition

This part of the documentation includes information for an accounting manager about how to create and use revenue recognition cycles to recognize revenue for multiple customers, contracts, and projects at once. It also includes information about how to modify revenue recognition transactions before posting and about how revenue is calculated for recognition.

Chapter 3, “Revenue recognition setup,” includes information about how to grant users permission to various data entry options for revenue recognition transactions and how to create revenue recognition cycles so that you can recognize revenue for multiple customers, contracts, and projects at one time.

Chapter 4, “Revenue recognition transactions,” includes information about how to use a revenue recognition cycle to generate a batch of revenue recognition transactions and how to modify those transactions before posting. It also includes information about how revenue is calculated for recognition.

Chapter 3: Revenue recognition setup

This part of the documentation includes information for an accounting manager about how to grant users permission to various data entry options for revenue recognition transactions and how to create revenue recognition cycles so that you can recognize revenue for multiple customers, contracts, and projects at one time.

The following topics are discussed:

Grant revenue recognition transaction entry permissions

Create a revenue recognition cycle record

Grant revenue recognition transaction entry permissions

You can grant all users permission to various data entry options for revenue recognition transactions. You also can require a password for each data entry option to limit user access.

Open the Revenue Recognition Setup Options window. Microsoft Dynamics GP menu > Tools > Setup > Project > Billing > RR Options button

Select the data entry tasks to grant permission for and Click OK.

Override Document Number Allow users to modify the document number for a revenue recognition transaction.

Override Recognized Revenue Amount Allow users to modify the amount of revenue to recognize in the To Recognize field in the Revenue Recognition Entry per Budget Item window and the Revenue Recognition

Entry per Fee Item window. See Specify revenue to recognize for cost categories in a project budget and Specify revenue to recognize for fees for more information.

Create a revenue recognition cycle record

You can create a revenue recognition cycle so that you can recognize revenue for multiple customers, contracts, and projects at one time. Revenue recognition is for Cost Plus and Fixed Price projects, and for Service fees used in Time and Materials projects.

Customers You can assign revenue recognition cycles to customers and customer classes when you set them up for billing. See Set up a customer class for billing and Set up a customer record for billing in the Project Accounting Billing Guide for more information.

Contracts You can assign revenue recognition cycles to contracts when you set them up for billing. See Specify billing settings for a contract in the Project Accounting Cost Management Guide for more information.

Projects You can assign revenue recognition cycles to projects when you set them up for billing. See Specify billing settings for a project in the Project Accounting Cost Management Guide for more information.

Open the RR Cycle Maintenance window. Cards > Project > Revenue Recognition Cycle

In the RR Cycle ID field, enter an alphanumeric name to identify the revenue recognition cycle.

Enter a description and Click OK.

Chapter 4: Revenue recognition transactions

This part of the documentation includes information for an accounting manager about how to use a revenue recognition cycle to generate a batch of revenue recognition transactions and how to modify those transactions before posting. It also includes information about how revenue is calculated for recognition.

The following topics are discussed:

Accounting methods and recognizing revenue

Percentage complete and revenue recognition calculations

Use a revenue recognition cycle to generate revenue recognition transactions

Enter or modify a revenue recognition transaction

Specify revenue to recognize for cost categories in a project budget

Specify revenue to recognize for fees

Accounting methods and recognizing revenue

Revenue is recognized for a project based on the accounting method used for the project. You must select the default accounting method to use for new projects in a contract, and you can select the accounting method to use for individual projects.

See Create a contract record and Create a project record in the Project Accounting Cost Management Guide for more information.

Completed

Revenue is recognized for a Cost Plus or Fixed Price project that uses the

Completed accounting method when the project status has been changed to Completed for all projects in the contract that the project is for. The Project Revenue account will be updated on the Profit and Loss Statement.

Cost-to-Cost

Revenue is recognized for a Cost Plus or Fixed Price project that uses the Cost-toCost accounting method when you post revenue recognition transactions for the project. Revenue will be determined by comparing total actual project costs to total forecast project costs. See Percentage complete and revenue recognition calculations for more information.

Effort-Expended

Revenue is recognized for a Cost Plus or Fixed Price project that uses the EffortExpended accounting method when you post revenue recognition transactions for the project. Revenue will be determined by comparing total actual project quantities to total forecast project quantities. See Percentage complete and revenue recognition calculations for more information.

Effort-Expended Labor Only

Revenue is recognized for a Cost Plus or Fixed Price project that uses the EffortExpended Labor Only accounting method when you post revenue recognition transactions for the project. Revenue will be determined by comparing total actual time quantities entered on timesheets to total forecast time quantities for the project. See Percentage complete and revenue recognition calculations for more information.

When Billed

Revenue is recognized for a Time and Materials project that uses the When Billed accounting method when you post a billing invoice for the project. The Cost of Goods Sold account will be updated on the Profit and Loss Statement and the Work In Progress account will be updated on the Balance Sheet.

When Performed

Revenue is recognized for a Time and Materials project that uses the When

Performed accounting method when you post a cost transaction for the project. The Cost of Goods Sold account will be updated on the Profit and Loss Statement.

Percentage complete and revenue recognition calculations

The amount of revenue that you will recognize for a Cost Plus or Fixed Price project and for the contract that the project is for depends on how you’ve selected to calculate revenue.

The default method for recognizing revenue is to recognize revenue based on the percentage complete calculation for individual cost categories in a project budget. This is the Segmented revenue recognition calculation method.

The percentage that a cost category is complete is based on the actual total costs incurred for the cost category divided by the forecast budgeted costs for the cost category. For example, if you have forecasted that you will spend $10,000 on outsourced administrative costs for a project and you have spent $7,500 to date, the percentage complete is 75%.

However, you can recognize revenue for a project based on the average percentage complete calculation for all cost categories in the project budget. You can select Combine for Revenue Recognition in the Project Maintenance window to indicate that you will recognize revenue for the project in this way. This is the Combined from Project revenue recognition calculation method. See Create a project record in the Project Accounting Cost Management Guide for more information.

You also can recognize revenue for a contract based on the average percentage complete calculation for all projects in the contract. You can select Combine for Revenue Recognition in the Contract Maintenance window to indicate that you will recognize revenue for the contract in this way. This is the Combined from Contract revenue recognition calculation method. See Create a contract record in the Project Accounting Cost Management Guide for more information.

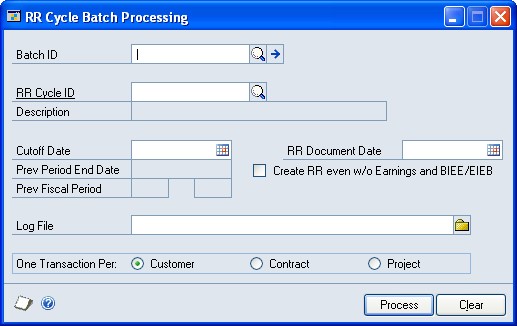

Use a revenue recognition cycle to generate revenue recognition transactions

You can use a revenue recognition cycle to generate a batch of revenue recognition transactions to recognize revenue for multiple customers, contracts, and projects at one time. See Create a revenue recognition cycle record for more information.

Revenue recognition is for Cost Plus and Fixed Price projects, and for Service fees used in Time and Materials projects.

You can generate revenue recognition transactions for Open, Completed, or Closed contracts and projects. See Contract, project, and cost category statuses in the Project Accounting Cost Management Guide for more information.

- Open the RR Cycle Batch Processing window. Transactions > Project > Billing > Cycle Revenue Recognition

A screenshot of a cell phone Description automatically generated

(IMAGE PACRR.jpg)

Enter or select a batch ID. See Manually create a batch for transactions for more information.

Select a revenue recognition cycle.

You can modify the revenue recognition transaction date and cutoff date. Revenue recognition transactions will be created for project costs and fees with dates on or before the cutoff date.

Select Create RR even w/o Earnings and BIEE/EIEB to generate revenue recognition transactions for projects that have billings in excess of earnings (BIEE) or earnings in excess of billings (EIEB) and have no revenue to recognize.

You can modify the path name where the log file will be saved after you generate revenue recognition transactions. The log file will list any errors that are encountered. See Configure general settings for billing customers in the Project Accounting Billing Guide for more information.

In the One Transaction Per options, specify whether to generate one revenue recognition transaction per customer, contract, or project. The option that you select also will limit revenue recognition to the customers, contracts, or projects that are assigned to the revenue recognition cycle and Click Process.

Enter or modify a revenue recognition transaction

You can enter a revenue recognition transaction manually. However, we recommend that you use a revenue recognition cycle to generate a batch of revenue recognition transactions for you. After the batch of revenue recognition transactions has been generated, you can modify the transactions, as necessary. See Use a revenue recognition cycle to generate revenue recognition transactions for more information.

The data that you can enter depends on the permissions that you’ve been granted. See Grant revenue recognition transaction entry permissions for more information.

Revenue recognition is for cost categories and Project fees for Cost Plus and Fixed Price projects, and for Service fees used in Time and Materials projects. You can recognize revenue for Open, Completed, or Closed contracts and projects. See Contract, project, and cost category statuses in the Project Accounting Cost Management Guide for more information.

The amount of revenue that you will recognize for a project depends on how you’ve selected to calculate revenue for the project and the percentage complete calculation for individual cost categories in the project budget. See Percentage complete and revenue recognition calculations for more information.

You can use the Revenue Recognition Inquiry window (Inquiry > Project > PA Transaction Documents > Revenue Recognition) to view posted or saved revenue recognition transactions.

- Open the Revenue Recognition Entry window. Transactions > Project > Billing > Revenue Recognition

A screenshot of a cell phone Description automatically generated

(IMAGE PACRRE2.jpg)

Enter a document number and date.

You can enter a cutoff date. Revenue will be recognized for project costs and fees with dates on or before the cutoff date.

Select the customer for the projects that you’re recognizing revenue for.

Enter or select a batch ID. See Use a revenue recognition cycle to generate revenue recognition transactions and also Manually create a batch for transactions for more information.

In the scrolling window, select the projects to recognize revenue for, or select All Projects to display all projects for the customer. You can select a project and choose Edit > Delete Row to delete the project from the scrolling window.

You can select a project and click the Project No. expansion button to open the Revenue Recognition More Info window to view actual costs and earned, and recognized revenue for the project.

The calculations displayed in the FORMULAS USED part of the Revenue Recognition More Info window are only for projects that use Cost-to-Cost accounting method.

Revenue will be recognized for all cost categories and fees for a project. However, you can specify the revenue to recognize for individual cost categories or fees.

Select a project and click the Budget expansion button to specify the revenue to recognize for individual cost categories in the project budget. See Specify revenue to recognize for cost categories in a project budget for more information.

Select a project and click the Fees expansion button to specify the revenue to recognize for individual fees assigned to the project. See Specify revenue to recognize for fees for more information.

You can click Recognize All to recognize revenue for all projects listed in the scrolling window using all cost categories and fees for the projects. Amounts in the To Recognize columns will be updated. You also can click Do Not Recognize All to reduce amounts in the To Recognize columns to zero. If you modify the cutoff date, modify forecast cost or billing amounts for a project, or change a project status, you can click Recalculate to recalculate revenue for all projects listed in the scrolling window.

Click Distribution to modify the allocation of transaction amounts to specific posting accounts. See Review and modify posting account distributions for transactions for more information.

If the transaction is in a batch, click Save. Otherwise, click Post.

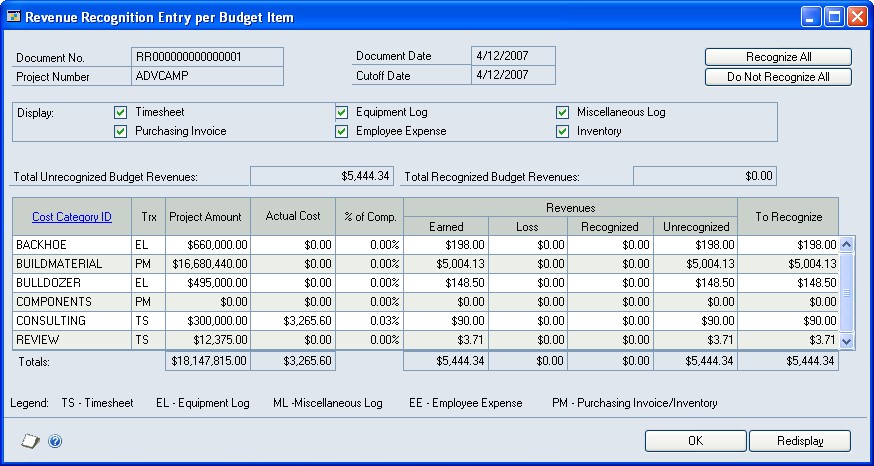

Specify revenue to recognize for cost categories in a project budget

You can specify the revenue to recognize for individual cost categories in a project budget. Revenue recognition is for cost categories in Cost Plus and Fixed Price project budgets. See Enter or modify a revenue recognition transaction for more information.

You can recognize revenue for Open, Completed, or Closed contracts and projects.

See Contract, project, and cost category statuses in the Project Accounting Cost Management Guide for more information.

The amount of revenue that you will recognize for a cost category depends on how you’ve selected to calculate revenue for the project and the percentage complete calculation for individual cost categories in the project budget. See Percentage complete and revenue recognition calculations for more information.

- Open the Revenue Recognition Entry per Budget Item window. Transactions > Project > Billing > Revenue Recognition > Budget expansion button

(IMAGE PACRRBUG.jpg)

Select the cost transactions to display cost categories for in the scrolling window. Click Redisplay to update the scrolling window.

In the To Recognize column, modify the amount of revenue to recognize for a cost category and Click OK.

You can click Recognize All to recognize revenue for all cost categories listed in the scrolling window. Amounts in the To Recognize column will be updated. You also can click Do Not Recognize All to reduce amounts in the To Recognize column to zero.

Specify revenue to recognize for fees

You can specify the revenue to recognize for individual fees assigned to a project. Revenue recognition is for Project fees for Cost Plus and Fixed Price projects, and for Service fees used in Time and Materials projects.

You can recognize revenue for Open, Completed, or Closed contracts and projects.

See Contract, project, and cost category statuses in the Project Accounting Cost Management Guide for more information.

Open the Revenue Recognition Entry per Fee Item window. Transactions > Project > Billing > Revenue Recognition > Fee expansion button

Select whether to display Project or Service fees in the scrolling window. Click Redisplay to update the scrolling window.

In the To Recognize column, modify the amount of revenue to recognize for a fee and Click OK.

You can click Recognize All to recognize revenue for all fees listed in the scrolling window. Amounts in the To Recognize column will be updated. You also can click Do Not Recognize All to reduce amounts in the To Recognize column to zero.

Part 3: Reports and utilities

This part of the documentation includes information for the accounting manager about reports in Project Accounting and how to create, group, and print them. It also includes information about how to enter adjusting transactions to reverse and correct cost transaction line item entries, and how to delete posted cost and billing transactions and Closed contracts. The documentation also includes information about how to use various accounting utilities.

Chapter 5, “Reports,” includes information about how to create, group, and print reports. It also includes information about the various reports in Project Accounting.

Chapter 6, “Adjusting transactions,” includes information about how to enter adjusting transactions to reverse—or to reverse and correct—line item entries on posted timesheets, employee expense transactions, equipment logs, or miscellaneous logs.

Chapter 7, “Transaction and record deletion,” includes information about how to delete posted cost and billing transactions, and how to delete Closed contracts.

Chapter 8, “Accounting utilities,” includes information about how to use various utilities to clear paid billing invoices from lookup windows, recalculate project budget totals by fiscal period, and delete project budget totals that aren’t within fiscal years.

Chapter 5: Reports

This part of the documentation includes information for the accounting manager about how to create, group, and print reports. It also includes information about the various reports in Project Accounting.

The following topics are discussed.

Create and print report options

Create report groups

Report destinations and formats

Reports list

Project Accounting standard reports

Project Accounting Microsoft SQL Server Reporting Services reports

Create and print report options

Before you can print most Project Accounting reports, you need to specify a report option. A report option is a set of saved parameters for a particular report that you can use to print the report, rather than reenter each parameter. A typical report option specifies information about sorting, restriction, printing, and the type of information to display on the report. You can create 32 report options.

Open a reports window. For this example, use a Project Maintenance report. Reports > Project > Maintenance

Select a report type from the drop-down list. For this example, select Customer List.

Click New, or highlight a report option and click Modify to set up the report parameters. For this example, click New; the Project Maintenance Report Options window opens.

Each report option window contains different selections, appropriate to the type of information available to display on the report.

Specify a name for the option.

Specify a sorting method and items to include or exclude.

To enter a range, select a type of information from the Ranges list, and then enter the beginning of the range in the From field and the end of the range in the To field.

Click Insert to add the range to the Restrictions list. Specify additional ranges, if necessary. The report will contain only records that include data within the range selected.

You can create only one restriction for each type of information. For example, if you enter a restriction to print records for the first five of 25 users, you can’t enter another restriction to print records for the last 10 users.

- To select printing destinations, click Destination. Reports can be printed to the screen, to the printer, to a file, or to any combination of these options. If you mark Ask Each Time, you can select printing options each time you print this report option.

If you mark File, you can specify a file name and format, and whether to replace any previous versions of the file, or append new information to an existing file. for more information, see Report destinations and formats.

Save the destination information and the report option, and return to the original report window.

Select the report option and click Insert.

Click Print.

Create report groups

You can use report groups to print a group of report options in a single step.

Before completing this procedure, you must specify report options for the reports in the group. For more information, see Create and print report options .

Only reports created using Microsoft Dynamics GP report options can be grouped. Customized reports created using Report Writer or Crystal Reports can’t be added to groups.

Open a report group window. Reports > Project > Groups

Select a report category and report.

To include a report option in a group, select the option and click Insert. You can add up to 32 report options to a single group.

Click Save to save the group. If you’re saving a new report group, the Save window will open, where you can specify a name for the group.

Click Print.

After you have created report groups, you can select them from the Project Group list and click Print.

Report destinations and formats

You can print reports to a printer, the screen, a file, or a combination of these destinations.

If you print to the printer, the report is printed to the default printer that’s been set up for your operating system, unless the report has been assigned to a named printer. Refer to the “Printers” chapter in the System Administrator’s Guide (Help > Printable Manuals) for more information.

If you print to the screen, the report appears on the screen and you then can choose to print to the printer. In addition, if you’re using an e-mail system that’s compliant with MAPI (Microsoft’s Messaging Application Program Interface), you can send any report that you print to the screen in an e-mail message.

If you print to a file, you can select a file format.

The following table lists more information about the file formats that you can select.

| File format | Description |

|---|---|

| Tab-delimited | The tab-separated ASCII character format used by spreadsheet programs, such as Microsoft Excel®. |

| Comma-delimited | The standard comma-separated ASCII character format used by database programs. |

| Text | Text with no formatting. Use this option only if the application you’ll use to read the report can’t read any other format. |

| HTML | A format that can be viewed in a Web browser. |

| XML Data | A text file that contains an XML representation of the report layout and all the report data. Choose this format if you want to process the report using an external application. |

| Adobe PDF | This format is available if you have the PDFWriter printer driver installed (included with Acrobat 5 and earlier), or Acrobat Distiller from Acrobat 6 or later. PDF (Portable Document Format) files can be read using Adobe Reader software available from Adobe. |

| Word Document | The Microsoft Office Open XML (.docx) file format used by Word 2007 or later. You can select this format if you select Template as the report type. |

You can select a printing destination in different ways, depending on which printing method you use.

If you print a report by choosing File > Print or clicking Print while a window is open, the Report Destination window appears, where you can select a destination. (You can select a preferred default destination—Printer or Screen— in the User Preferences window.)

You can select printing options and destinations for posting journals and other reports in the Posting Setup window. You can select to be asked each time where a specific report or journal should be printed to, or you can select specific printing destinations to be used each time, such as to the screen, to a file, or to a printer.

For analysis, history, and setup reports and posting journal reprints, you select the destination when you create the report options needed to print these reports.

Reports list

You can open the Report List window for Project Accounting by clicking the Project button in the navigation pane and then clicking Report List. The reports list contains reports, SmartList favorites, and custom reports.

Project Accounting standard reports

You can print various standard reports in Project Accounting, including trial balance, employee utilization, cash budget, earned value analysis, performance, and billing reports. You also can print statements and reports about change orders.

Trial balance

Use the PA Detailed Trial Balance Reports window (Reports > Project > Detailed Trial Balance) to print a detailed trial balance, summary trial balance, or trial balance worksheet. Trial balances are used to illustrate that debits equal credits for a range of accounts.

To print a detailed trial balance, you must select the Create a Journal Entry Per

Transaction option for the Project series in the Posting Setup window (Microsoft Dynamics GP menu > Tools > Setup > Posting > Posting). See the System Setup documentation (Help > Printable Manuals) for more information.

Employee utilization

Use the Employee Utilization Report Options window (Reports > Project > Employee Utilization) to print utilization reports that list the billable and nonbillable time, rates, and billing amounts for employees in a given year, month, or the year to-date.

| Report | Description |

|---|---|

| Annual Employee Utilization | A list of billable and non-billable time, rates, and billing amounts for employees in a given year. |

| Annual Utilization-Department | A list of billable and non-billable time, rates, and billing amounts for employees in a given year by department. |

| Annual Utilization-Position | A list of billable and non-billable time, rates, billing amounts, percentage of utilization, and realization. This report sorts the employees by their positions. |

| Monthly Employee Utilization | A list of billable and non-billable time, rates, and billing amounts for employees in a given month. |

| Monthly Utilization-Department | A list of billable and non-billable time, rates, and billing amounts for employees in a given month by department. |

| Monthly Utilization-Position | A list of billable and non-billable time, rates, and billing amounts for employees in a given month by position. |

| YTD Employee Utilization | A list of billable and non-billable time, rates, and billing amounts for employees in a given year to date. |

| YTD Utilization-Department | A list of billable and non-billable time, rates, and billing amounts for employees in a given year to date by department. |

| YTD Utilization-Position | A list of billable and non-billable time, rates, and billing amounts for employees in a given year to date by position. |

Cash budget

Use the Budget Report Options window (Reports > Project > Budget) to print a cash budget report for your company, customer, contract, or project for the fiscal period that you select.

Earned value analysis

Use the Project Status Report Options window (Reports > Project > Project Status) to print an earned value analysis report to view a measurement of project performance. Earned value measures the cost of work performed and whether the actual costs incurred are on budget.

Statements

Use the Statement Report Options window (Reports > Project > Statement) to print statements for customers. The statements will include a summary of accounts receivable information.

Performance

Use the Performance Report Options window (Reports > Project > Performance) to print reports that list work in progress and also contract revenue and write-down amounts. You also can print a report listing Closed contracts.

| Report | Description |

| Aged Work-In-Progress List | Work in progress for all aging periods and the balances or work in progress for each customer for each period. |

| Aged Work-In-Progress | Work in progress for all aging periods and the balances or work in progress for each project for each period. |

| Aged Work-In-Progress | Work in progress for all aging periods and the balances or work in progress for each contract for each period. |

| Aged Work-In-Progress | Work in progress for all aging periods and the balances or work in progress for each cost category in project budgets for each period. |

| Fee List - Project | A list of all fees for all projects for each customer. |

| Invoice Register | Lists all billing invoices that have been posted in Accounts Receivables for the current period. |

| Pre-Billing Worksheet - CP/FP | A list of pre-billing worksheets for Cost Plus or Fixed Price projects. You can print two types of pre-billing worksheets: in process, or those that include saved billing invoices and billable, or those that include all billing invoices. |

| Pre-Billing Worksheet - TM | A list of pre-billing worksheets for Time and Materials projects. You can print two types of pre-billing worksheets: in process, or those that include saved billing invoices and billable, or those that include all billing invoices. |

| Retention - Customer | A list of Retentions fee amounts for contracts for specified customers. |

| Retention - Project | A list of Retentions fee amounts for each contract for the company. |

| Work in Progress | A list of projects in progress. |

Project Accounting Microsoft SQL Server Reporting Services reports

You can view Project Accounting Reporting Services reports from the Reporting Services Reports list. You can access the Reporting Services Reports list from the navigation pane or from an area page in the Microsoft Dynamics GP application window. This report list appears if you specified the location of your Reporting Services reports using the Reporting Tools Setup window. See your System Setup Guide (Help >> Contents >> select Setting up the System) for more information.

The following Reporting Services reports are available for Project Accounting.

Trial balance

| Report name | Description |

|---|---|

| Project Accounting Aged Trial Balance | Provides a receivables aged trial balance for selected projects. |

| Project Accounting Detail Trial | Displays General Ledger account balances and all transactions that affect each account for the period that you specified. |

Balance

Employee utilization

| Report name | Description |

|---|---|

| Monthly Employee Utilization by Employee | Displays utilization by a single employee or by multiple employees as of a certain date. |

Project status

| Report name | Description |

|---|---|

| Project Accounting Closed Projects | Provides details on closed projects. |

| Project Accounting Profit and Loss | Provides the profit and loss for a project or range of projects during a selected period of time. |

| Project Cost Breakdown | Details the costs associated with a project. |

Billing

| Report name | Description |

|---|---|

| Pre-Billing Worksheet - CP/FP (Billable) | Displays a pre-billing worksheet for Cost Plus/Fixed Price type projects that are billable. |

| Pre-Billing Worksheet - CP/FP (In Process) | Displays a pre-billing worksheet for Cost Plus/Fixed Price type projects that are in process. |

| Pre-Billing Worksheet - Fee (Billable) | Displays a pre-billing worksheet for Time and Material type projects that are billable. |

| Pre-Billing Worksheet - T&M (Billable) | Displays a pre-billing worksheet for Time and Materials type projects that are in process. |

| Pre-Billing Worksheet - T&M (In Process) | Displays a pre-billing worksheet for Cost Plus/Fixed Price type projects that are in process. |

Performance

| Report name | Description |

|---|---|

| Project Accounting Unbilled Expense vs Retainer | Compares the project retainer against the charged expenses and the retainer balance for a project. |

| Project Accounting Revenue Recognition Transactions | Displays the revenue recognition transactions for a project. |

| Project Accounting Budget vs. Actual with Variance | Provides the ability to group budget and actual expenditures for a project for selected cost categories and time period. |

| Project Accounting Combined History Report | Displays transaction details for cost transactions of any project or range of projects. |

| Projects in Progress | Lists the projects in process for a selected range. |

To print a Project Accounting Reporting Services report

In the navigation pane, choose the Project button, and then choose the Reporting Services Reports list.

Mark the report that you want to print.

In the Actions group, choose View to open the Report Viewer.

In the Report Viewer, select the specifications for the report and choose View Report.

After viewing the report, select a format and print the report.

Chapter 6: Adjusting transactions

This part of the documentation includes information for the accounting manager about how to enter adjusting transactions to reverse—or to reverse and correct— line item entries on posted timesheets, employee expense transactions, equipment logs, or miscellaneous logs.

You can’t adjust original entries for transactions that previously have been reversed or reversed and corrected.

The following topics are discussed.

Exceed total cost, quantity, or revenue on adjusting transactions

Reverse cost transaction line items

Reverse and correct cost transaction line items

Exceed total cost, quantity, or revenue on adjusting transactions

You can’t post adjusting transactions if one or more of the following criteria are true.

The total cost for the adjusting transaction exceeds the total cost specified for the cost category in the project budget and Exceed Total Budget Costs isn’t selected in the Timesheet Setup Options window, Employee Expense Setup Options window, Equipment Log Setup Options window, or Miscellaneous Log Setup Options window.

The total quantity for the adjusting transaction exceeds the total quantity specified for the cost category in the project budget and Exceed Total Budget Quantity isn’t selected in the Timesheet Setup Options window, Employee Expense Setup Options window, Equipment Log Setup Options window, or Miscellaneous Log Setup Options window.

An amount on the adjusting transaction exceeds the total revenue specified for the cost category in a Time and Materials project budget and Exceed Total Budget Revenue/Profit isn’t selected in the Timesheet Setup Options window, Employee Expense Setup Options window, Equipment Log Setup Options window, or Miscellaneous Log Setup Options window.

If you’re permitted to exceed total cost, quantity, or revenue for a cost category in a project budget and you’re required to enter a password for the permission, you must enter the password to post the adjusting transaction.

See Grant cost transaction data entry permissions in the Project Accounting Cost Management Guide for more information.

Reverse cost transaction line items

You can create adjusting transactions to reverse line items entered on timesheets, employee expense transactions, equipment logs, or miscellaneous logs.

Open a window to select cost transaction line items for adjustment.

Select the line items to display. Click Redisplay.

Select one or more line items and click Reverse to open the adjustment entry window.

In the adjustment entry window, you can modify the document date for the adjusting transactions that will be created.

You can enter a batch ID to save the adjusting transactions in a batch. Click Save to save the batch. Otherwise, click Post.

Reverse and correct cost transaction line items

You can create adjusting transactions to reverse and correct line items entered on timesheets, employee expense transactions, equipment logs, and miscellaneous logs.

Open a window to select cost transaction line items for adjustment.

Select the line items to display. Click Redisplay.

Select one or more transaction line items and click Correct to open the adjustment entry window.

In the adjustment entry window, you can modify the document date for the adjusting transactions that will be created.

Enter a batch ID to save the adjusting transactions in a batch.

You can select the project that the adjusting transactions are for, or select Use <None> Project to indicate that the transactions aren’t for a specific project.

You can select the cost category that the adjusting transactions are for. Select Allow Add Access on the Fly to add the cost category to project budgets if you’re not using the cost category in those budgets already.

For the unit cost, overhead amount or percentage, billing type, and billing rate or markup percentage, you can select Update to update amounts using current budget settings or select Override to enter specific amounts or percentages.

Click Save to save the batch or click Post to post the transactions.

If you’re not permitted to exceed total cost, quantity, or revenue for a cost category in a project budget, you can’t post the adjusting transaction. See Exceed total cost, quantity, or revenue on adjusting transactions for more information.

Chapter 7: Transaction and record deletion**

This part of the documentation includes information for the accounting manager about how to delete posted cost and billing transactions, and how to delete Closed contracts.

The following topics are discussed.

Delete Closed contracts

Delete posted cost transactions

Delete posted billing invoices and returns

Delete Closed contracts

You can delete Closed contracts.

Open the Mass Contract Delete window. Microsoft Dynamics GP menu > Tools > Utilities > Project > Mass Contract Delete

Select a range of contracts to delete. Select Print Deleted Contracts to print a report listing the contracts that were deleted after you delete them and Click OK.

Delete posted cost transactions

You can delete posted timesheets, employee expense transactions, equipment logs, miscellaneous logs, and inventory transfers.

Open the Remove Cost History window. Microsoft Dynamics GP menu > Tools > Utilities > Project > Remove Cost History

Select a range of contracts or projects or a range of dates to delete posted transactions for. Select the type of transactions to delete.

Select Print Report to print a list of the transactions that were deleted after you delete them and Click OK.

Delete posted billing invoices and returns

You can delete posted billing invoices and returns.

Open the Remove Billing History window. Microsoft Dynamics GP menu > Tools > Utilities > Project > Remove Billing History

Select a range of contracts or projects or a range of dates to delete posted billing transactions for.

Select Print Report to print a list of the transactions that were deleted after you delete them and Click OK.

Chapter 8: Accounting utilities

This part of the documentation includes information for the accounting manager about how to use various utilities to clear paid billing invoices from lookup windows, recalculate project budget totals by fiscal period, and delete project budget totals that aren’t within fiscal years.

The following topics are discussed.

Clear paid billing invoices from lookup windows

Recalculate project budget totals by fiscal period

Delete project budget totals that aren’t within fiscal years

Clear paid billing invoices from lookup windows

You can clear paid billing invoices from lookup windows.

Open the Paid Transaction Removal window. Microsoft Dynamics GP menu > Tools > Routines > Project > Paid Transaction Removal

Select a range of customers to clear paid billing invoices for. You can limit the range of customers to a range of customer classes.

Select Print Register to print a list of the paid billing invoices that were cleared after you clear them.

You can enter a cutoff date. Only transactions with a document date on or before the cutoff date will be cleared and Click Process.

Recalculate project budget totals by fiscal period

You can recalculate project budget totals by fiscal period. See Modify project budget amounts for a cost category by fiscal period in the Project Accounting Cost Management Guide for more information.

Open the Recreate Periodic window. Microsoft Dynamics GP menu > Tools > Utilities > Project > PA Recreate Periodic

Select the customers that you’re recalculating project budget totals for.

Select Recreate Periodics.

Select Print Report to print a list of the projects that you recalculated budget totals for after you recalculate them.

Click Process.

Click Done.

Delete project budget totals that aren’t within fiscal years

You can delete project budget totals that aren’t within fiscal years if, for example, you mistakenly entered a transaction using a date that isn’t within the fiscal years

that you’ve set up. See Modify project budget amounts for a cost category by fiscal period in the Project Accounting Cost Management Guide for more information.

Open the Recreate Periodic window. Microsoft Dynamics GP menu > Tools > Utilities > Project > PA Recreate Periodic

Select the customers that you’re deleting project budget totals for.

Select Delete Periodic Records Outside Fiscal Years.

Select Print Report to print a list of the projects that you deleted budget totals for after you delete them. Click Process and then Click Done.

Glossary

access list

An employee access list or an equipment access list. The list of employees who can enter transactions for a specific project, or the list of equipment that can be used when entering equipment log transactions for a specific project.

account

The type of record—asset, liability, revenue, expense or owner’s equity—traditionally used for recording individual transactions in an accounting system.

account balance

The difference between the debit amount and the credit amount of an account.

account format

The structure defined for account numbers, including the number of segments in the format and the number of characters in each segment.

account number

The identifying alphanumeric characters that have been assigned to an account.

account segment

A portion of the account format that can be used to represent a specific aspect of a business. For example, accounts can be divided into segments that represent business locations, divisions, or profit centers.

account segment number

A number that represents a particular area of a business or an account category. Using account 01-200-1100, for example, account segment number 01 might represent a particular site, 200 might represent a department located at that site, and 1100 might represent the Cash account for that site and that department. Descriptions can be entered for each account segment number and appear on General Ledger reports.

accounting method

A method used to calculate revenue for a project or contract. Accounting methods include: Completed, Cost-to-Cost, EffortExpended, Effort-Expended Labor Only, When Billed, and When Performed.

accrued revenue

Revenue that has been earned for actual project costs, but not collected. For Time and Materials projects, accrued revenue is based on forecast billing amounts for both saved and posted cost transactions. For Cost Plus and Fixed Price projects, revenue is accrued when you recognize revenue.

active employee

An employee whose records are active and that you can include in transactions that require employee IDs.

actual

A project budget amount that represents cost and billing amounts based on the transactions that you’ve entered. You can use actual amounts to measure project performance against forecast and baseline budget amounts.

adjusting transaction

A transaction that you can enter to reverse— or to reverse and correct—line item entries on posted timesheets, employee expense transactions, equipment logs, or miscellaneous logs.

adjustment

Increases or decreases to inventory quantities based on receivings or allocations.

age

To subtract the document date from the date you’re aging from to determine the age of the document.

aging

The process that determines the maturity of a document or account, or the number of days that the document or account has been outstanding. Aging places each transaction in the appropriate current or past-due aging category.

analysis

The process of evaluating the condition of an accounting record and possible reasons for discrepancies.

applying

The process of linking the payment amount to amounts from one or more documents that are being paid.

audit trail

A series of permanent records used to track a transaction to the point where it was originally entered in the accounting system. The audit trail can be used to verify the accuracy of financial statements by outside accountants or auditors.

bank card

A type of credit card whose payments may be treated as cash by the business receiving the payment. Bank cards differ from charge cards, whose payments must be collected from the company issuing the card before they can be considered received.

base unit of measure

Typically, the smallest quantity on a Unit of Measure schedule in which items can be bought or sold. The base unit of measure is common to all named quantities entered for a Unit of Measure schedule. For example, for the item “soda,” the base unit of measure might be “Can” because all the other units of measure are multiples of a single can.

baseline

A project budget amount used as a basis for comparison to measure project performance. Baseline amounts are entered to estimate cost and billing amounts for a project. You can measure project performance by comparing forecast and actual amounts against the baseline. Project managers typically refer to the cost baseline, which is created during cost budgeting. Baseline amounts for billing also are calculated in Project Accounting.

batch

A group of transactions identified by a unique name or number. Batches are used to conveniently group transactions, both for identification purposes and to speed the posting process.

batch posting

An option used to post a group of transactions identified by a unique name or number.

begin date

The date that you can begin entering cost transactions using a specific cost category in a project budget.

billable amount

An amount that you can bill customers for.

The default billing type for a cost category is STD, or Standard, meaning that transaction amounts that you enter using the cost category will be billable.

billing

To generate and print invoices to charge customers for items or services that have not been paid for.

billing currency

The currency used on a billing invoice.

billing cycle

A record that identifies when and how often to bill customers for projects. Billing invoices can be generated using billing cycles.

billing discounts

A percentage that is deducted from the overall billing amount for a contract or project.

billing format

A group of invoice formats that have been selected to be printed together when billing customers.

billing frequency

The frequency that a billing cycle will be used to create billing invoices for a customer.

billing invoice

A transaction that you can use to charge customers for items purchased and services rendered for a project. Also refers to the document that you print to send to the customer to bill them.

billing note

The information that you can type in the Billing Note window for contracts, projects, cost categories, fees, and cost transactions that will appear on billing invoices. You can click the billing note button adjacent to a field to enter a billing note.

billing rate

The amount that a customer is billed for a single unit quantity of an item or time.

billing return

A transaction that you can use to credit customers for amounts that have been billed using a billing invoice. You only can enter billing returns to credit customers for billed amounts for Time and Materials projects.

billing transaction

A billing invoice or billing return.

billing type