Impair a right-of-use asset

The right-of-use (ROU) asset is a lessee's right to use an asset over the life of a lease. For leases that are recognized on the balance sheet of the company, the ROU asset is amortized, on a straight-line basis, with the depreciation for the same amount each month.

The depreciation of the lease impacts the Profit and loss statement by debiting interest expense. The balance sheet is impacted by crediting the accumulated ROU asset account for financial leases. For operating leases, depreciation will credit the lease expense account.

Throughout the duration of an ROU asset lease, if the leased asset becomes impaired, you can record the impairment and adjust the depreciation schedule accordingly. You can also view the new asset balance and financial entry before posting the transaction.

To record an impairment, follow these steps:

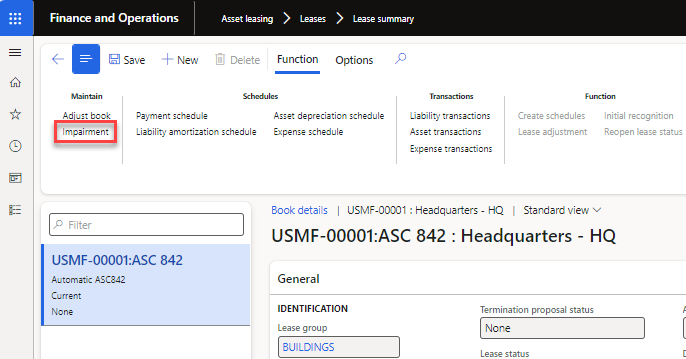

Go to Asset leasing > Leases > Lease summary page.

Select the impaired lease and then select Books in the Action Pane.

On the Action Pane, select Impairment.

In the dialog box that appears, in the Impairment amount field, enter the amount of the asset impairment. To decrease the ROU asset, you should enter a positive value.

In the Transaction date field, enter the date when the impairment entry should be posted.

In the Periods remaining field, enter the remaining number of months to amortize.

Set the Close book option to Yes to close the lease book. You can't undo this action. Entries can't be posted against closed leases, and closed leases can't be adjusted.

Select Post to create or post the impairment entry.

To view the impaired asset depreciation schedule, open the asset depreciation schedule for that lease book. The asset will now be depreciated on a straight-line basis over the number of months that you entered in the Periods remaining field.

To view the impairment expense journal entry, select Asset leasing journals on the Action Pane of the impaired lease book. The system will create a journal entry that debits the impairment expense posting account and credits the lease asset posting account.

To view the new carrying value of the ROU asset, select Asset transactions on the Action Pane of the lease book.