Microsoft volume licensing invoices

Important

This article applies only to non-Azure volume licensing (VL) invoices and explains the format of the invoice PDF and invoice recon file that are available to VL customers.

Volume licensing (VL) customers with non-Azure products bought under a direct VL agreement can access their invoice in the Microsoft 365 admin center. This invoice applies to all types of VL programs except Microsoft Products & Services Agreements (MPSA), Federal Government, Special agreements, and Select Plus agreements.

Before you begin

To access VL invoices in the Microsoft 365 admin center, you must satisfy the following conditions:

- You must be the Bill To contact for the corresponding contracts.

- You must be a Volume Licensing Service Center (VLSC) user.

View or download your bill

- In the Microsoft 365 admin center, go to the Billing > Your products page.

- Select the Volume licensing tab, then select Contracts.

- Find the contract you want to see invoices for, select the three dots (more actions), then select View Invoices.

- On the Invoices page, you see the list of invoices generated for that contract, and you can download the invoice PDF and invoice recon file. For information about the invoice recon file, see Overview of the invoice recon file later in this article.

Overview of the invoice PDF

Your invoice is a PDF that contains at least two pages.

Page one is the billing summary, and contains general information about the invoice, amount due, and payment instructions, if applicable. It also contains address information for your organization and high-level details about your order.

Page two and beyond lists the individual products in your order. The last page contains the Net Amount, Sales Tax, and Total, which correspond with the amounts shown in the Summary section on page 1.

Understanding your invoice

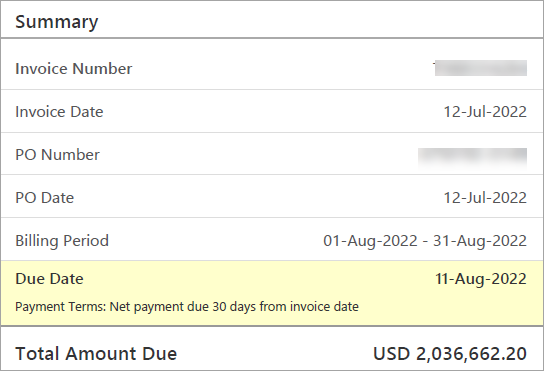

At the top of page one of your invoice is the Summary section.

The following table explains the terms in the Summary section of your invoice.

| Term | Description |

|---|---|

| Invoice Number | A unique number generated by Microsoft that identifies your spending for the corresponding billing period. |

| Invoice Date | The date Microsoft generated the invoice. |

| PO Number | The purchase order (PO) number that you specify. The PO number can't be updated on an invoice that is already paid. |

| PO Date | Generally, the date when the order was entered into Microsoft systems. |

| Billing Period | The date range covered by the invoice. |

| Due Date | The date when the invoice payment is due to Microsoft. |

| Payment Terms | Explains the arrangement for when the invoice payment is due. |

| Total Amount Due | The total amount of all charges for the specified billing period. |

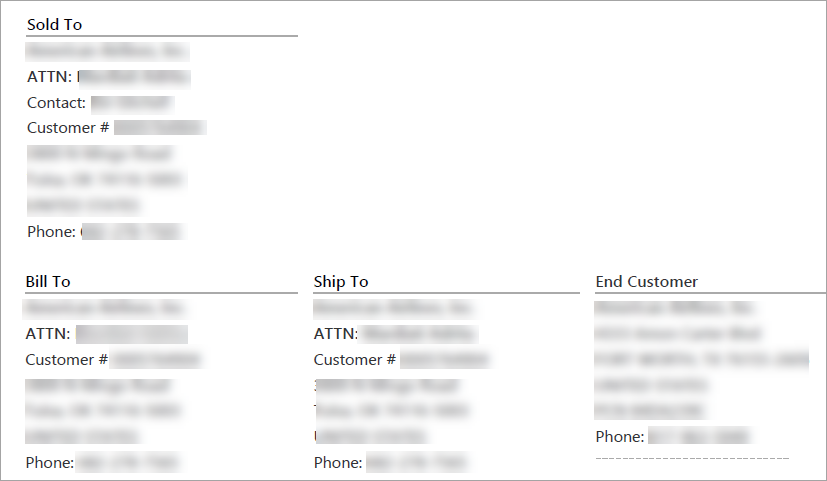

Addresses

The addresses shown on your invoice might be different, depending on the size and configuration of your organization.

The following table explains the terms for the addresses section of your invoice.

| Term | Description |

|---|---|

| Sold To | The name and address of the organization that bought the subscription. |

| Bill To | The address of your billing department. |

| Ship To | Contains details of the location where the products are shipped or used for tax exemption, if applicable. |

| End Customer | The address where the service is used. |

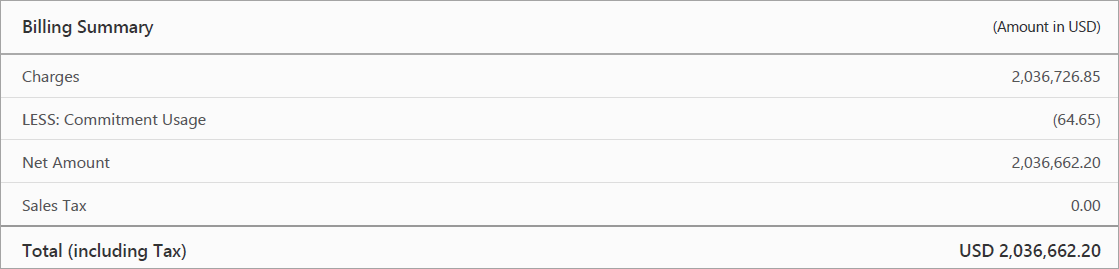

Billing Summary

The Billing Summary section gives the breakdown of the total amount due.

Total=Charges-Commitment Usage (if applicable)+Sales Tax

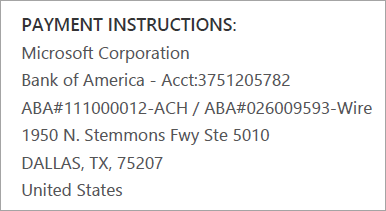

Payment Instructions

The PAYMENT INSTRUCTIONS section contains the account information you need to send your wire transfer payment.

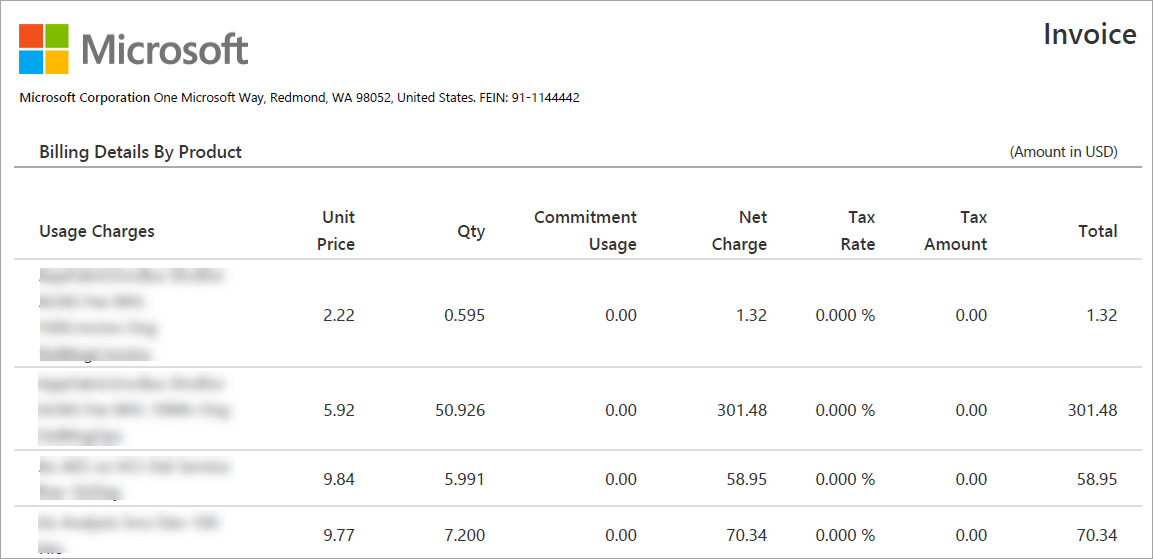

Billing Details By Product

Page two lists billing details by product, including unit price, quantity, commitment usage (if applicable), net charge, tax rate, tax amount, and total corresponding to each usage charge.

Overview of the invoice recon file

The invoice recon file is a CSV file that includes the same information as the Invoice in a format that facilitates quicker reconciliation. The following table explains the line-item details in the invoice recon file.

| Line item | Definition |

|---|---|

| Invoice Number | A unique number generated by Microsoft generated that identifies your spending for the corresponding billing period. |

| Invoice Date | The date Microsoft created the invoice. |

| Document Type | Determines whether it's an invoice or credit note. |

| Agreement Number | The contract number. |

| Bill To | Customer Number, Bill To Customer Name, and Bill To Customer Country are details of the billing department. |

| Sold To | Customer Number, Sold To Customer Name and Sold To Customer Country are details of the organization that bought the subscription. |

| Ship To | Customer Number, Ship To Customer Name, and Ship To Customer Country are details of the location to which the products are shipped or used for tax exemption, if applicable. |

| End Customer Name and End Customer Country | Details of the final consumer where the service is used. |

| Purchase Order Number | The purchase order (PO) number that you specify. |

| Billing Currency | Shows the currency chosen by the end customer in terms of payment. |

| Transaction Type | Reflects whether it's a debit invoice or a credit memo. |

| Line Item Number | The line ID for internal reference. |

| Usage Country | The location where the product is used. |

| Delivery | Tells how the invoice is delivered. |

| MS Part Number | A reference number for the product. |

| Item Name | The description of the purchased product. |

| Product Family | The logical categorization of products. |

| License Type | Reflects the terms of buying the product. |

| Price Level | The price categorization of product. |

| Billing Option | How frequently the customer is billed. The frequency options are upfront, monthly, every three months, every six months, or yearly. |

| Taxable | Indicates whether the product is taxable. |

| Pool | The classification of the product into a system, server, or application. |

| Service Period Start Date, Service Period End Date | Indicates the eligible service period. |

| Reason Code | A code used to indicate a credit or return of a product. |

| Description | The explanation of the reason code. |

| Quantity | The number of units bought or used. |

| Unit Price | The price per unit product. |

| Extended Amount | The quantity multiplied by the unit price. |

| Commitment Usage | The amount of monetary commitment that was used. |

| Net Amount | The extended amount minus the commitment usage. |

| Tax Rate | The tax rate applicable to the product based on the country/region of billing. |

| Tax Amount | The net amount multiplied by tax rate. |

| Total | The sum of the net amount and tax amount. |

| Is Third Party | Indicates whether the product or service is a third-party product. |

What type of invoices can I see?

You can see two types of invoices: debit invoice and credit memo.

Who receives VL invoices by email?

The Bill To contact for the contract receives invoices by email from microsoft-noreply@microsoft.com.

Be sure to add microsoft-noreply@microsoft.com to your safe senders list or modify any existing email rules to avoid emails landing in your junk folder.

How do I become a Volume Licensing Service Center (VLSC) user?

To register on VLSC, follow the steps in Frequently Asked Questions for sign-in.

What is the difference between invoice PDF and the invoice recon file?

The invoice PDF is a tax compliant document that provides a detailed bill for the selected billing period. The invoice recon file provides line-item level details for better reconciliation and analysis for the selected billing period.

What type of programs can I see invoices for?

For now, we support all types of VL programs except MPSA, Federal Government, Special agreements, and Select Plus agreements.

Why can't I see VL invoices in the Microsoft 365 admin center?

There are several reasons that you might not see an invoice:

- The invoice isn't ready yet.

- You don't have the correct role permissions to view invoices for the account you used to sign in to the admin center.

- The Invoice created date must be November 18, 2022, or later.

- Invoices created before November 18, 2022 aren't displayed.

- The invoice you're looking for relates to licenses purchased via a License Solution Partner, not directly from Microsoft.

- Only invoices where you're the Bill To contact are visible.

Why can I only see invoices for a few agreements?

You only have access to invoices for which you have the Bill To contact role on the corresponding contract.

Why can't I see old invoices?

You can only see invoices posted in the Microsoft 365 admin center starting on November 18, 2022.

How do I request permission to view the invoices?

Only the Bill To contact participant on the agreement can view the corresponding invoices. If you want to change anything, it must be changed at the agreement participant level. Contact your Microsoft partner for further information.

How often and when am I billed?

Depending on the billing frequency you choose when you bought your subscription, you receive an invoice either upfront, monthly, every three months, every six months, or yearly. The amount of time since the last invoice date is the Billing Period and is on page one of the invoice. This time represents the date range during which charges accrue for the current invoice. If you made a change to your subscription outside of this date range, like adding or removing licenses, the associated charges appear on the invoice for the next billing period.

Why is my total due different from last billing period?

If the amount billed is different than expected, that can happen for a few reasons:

- You added or removed licenses from your subscription. Licenses changed mid-term are shown on the next invoice. You might see a credit and rebill for the previous service period to account for this change. For details about what this looks like in your invoice, see page two of the invoice and the recon file.

- You opted for a ramped pricing model.

- Your subscription renewed for a new term and the license price changed.

What is the tax rate applied to my invoice?

The tax rate applied to the invoice depends on the country/region of billing. You can check the invoice recon file for the tax rate applied to each item. For more information, contact your Microsoft partner.

Who can I contact for questions related to pricing and the coverage period?

Contact your Microsoft partner for invoice support.

How do I report an error in the invoice data?

Contact your Microsoft partner for invoice support.

How can I make a request for the invoice PDF and recon file to be sent by mail?

This functionality isn't currently available.

How can I get help for reconciling credit for multiple invoices?

Contact your Microsoft partner for invoice support.

How do I contact support?

In the left navigation pane in the Microsoft 365 admin center, customers can create a support request by selecting Support > New Service request.

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for