Submit withholding tax

Appropriate roles: Account admin | Billing admin

Overview

Cloud Solution Provider (CSP) partners in some countries or regions receive invoices that include taxes. Some of these partners pay taxes to their local authority instead of Microsoft.

If you pay your taxes to the local authority, submit a withholding tax request, along with your tax certificate—to clear the taxed amount from previous invoices.

Important

Partners can submit withholding tax requests only for partially paid invoices.

For fully paid or unpaid invoices, submit the WHT request by opening a ticket with Microsoft support with the following information included:

- A completed copy of the Withholding Tax Credit Form (filled out)

- A signed or scanned copy of the Withholding Tax Certificate or Receipt

These cleared amounts are reflected in the Last payment column on the Billing page in Partner Center.

Submit a tax withholding request

Sign in to Partner Center and select Billing.

To upload a withholding tax receipt, you have two options:

Go to the Billing history page and select Submit new next to the invoice you want to upload the receipt. The Submit new link takes you to the Tax withholding request – new page.

Or, go to the Billing overview (NCE) page and select the download icon next to the invoice you want to upload the receipt. The New request link takes you to the Tax withholding request – new page.

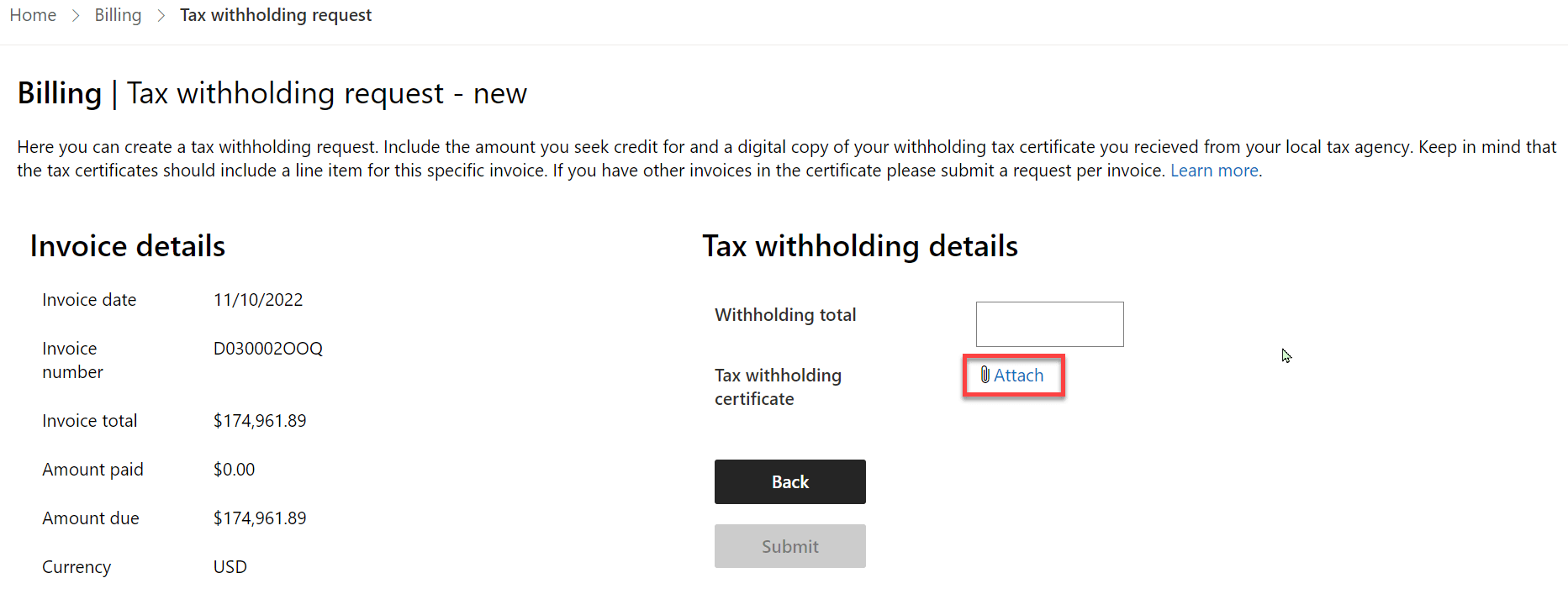

Review the invoice details to ensure that you're submitting the request for the correct invoice.

Enter the Withholding total under Tax withholding details.

Withholding total is the amount you expect to be credited.

Attach a tax certificate.

You must include a digital copy of your withholding tax certificate in your tax withholding request. You receive this certificate from your local tax agency when you pay your taxes to your local authority. The invoice tax amount in the withholding tax certificate must match total amount in your withholding tax request.

(Partners submitting German tax withholding requests must submit a hard copy of their tax withholding request. See German tax withholding.)

Important

- Amount totals must match the invoice line item from the attached tax certificate.

- The attached digital copy of tax certificate files must be a PDF, JPEG, PNG, or GIF.

- File names must not contain spaces or special characters.

- File sizes can't exceed 1 MB.

Submit the tax withholding request.

Your submitted request is either approved or it's sent back to you if corrections are needed.

If your request is sent back to you, change the withholding tax amount and replace the certificate if there's a problem with it.

To check the status of your requests, go to the Withholding tax page of the invoice from either the Billing overview (NCE) or Billing history page. However, the Billing history page also shows the status for the submitted invoice.

Update request and resubmit

The review team might require you to make corrections and resubmit a request before it can be approved. If they do, they'll change the status to Pending partner action.

To correct and resubmit the request, use the following steps:

Sign in to Partner Center and select Billing.

To review or update a request, you have two options:

Select Billing history. Find the tax withholding request. Requests that need attention have a status of Pending partner action. To see the request details, select the tax withholding request ID and status.

Or, select Billing overview (NCE). Select the download icon next to the invoice you want to update. To see the request details, select New request.

Under Status select Update and resubmit.

Read the reviewers' comments that describe what needs to be changed.

Make the corrections by either resubmitting an updated certificate or adjusting the withholding amounts.

Submit the request.

Submitting the request sends it back to the review team where they'll either approve it or ask for more changes.

Approved requests

Approved tax withholding requests are executed against your next invoice, writing off the owed amount.

Requests that are flagged as Completed are applied within 10 business days.

Cleared amounts are reflected on the Billing history or Billing overview (NCE) page.

The amounts cleared appear in the Paid amount or Last payment column next to the invoice the request was submitted towards.

Important

Previous invoices aren't regenerated or reissued. The clearance amount is simply applied to the previous month's payments.

Processing withholding tax requests takes about two days if the tax certificate and the amount are correct. If changes are required, processing takes longer because corrections must be made and resubmitted.

If you have questions about the withholding tax credit request process, submit a request to Partner support. You'll need the tax withholding request ID to resolve questions.

German tax withholding

Partners who submit German tax withholding requests must mail hard copies of their withholding tax certificate to the following address:

ATTN: EOC Tax Team Marianne Gannon Microsoft EMEA Operations Centre One Microsoft Place, South County Business Park Leopardstown, Dublin 18, Ireland

Questions and assistance about tax withholding requests

Partners should use the process described previously to submit new requests. They shouldn't use support requests. However, partners with questions about tax withholding requests can submit support requests.

Support requests are intended to help partners for existing requests, so they must have their Request ID to submit a new request.

Important

Partners don't need to contact support if their request status is Completed. This status appears in the Billing history next to the invoice for the submission or go to the Withholding tax page of the invoice from the Billing overview (NCE). Paid amount or Last payment amounts next to the invoice reflect the tax withholding amount within 10 days after the request is marked as Completed.

Important

Combine withholding tax receipts for different billing periods if multiple invoices are generated in a month and submit them as one receipt in Partner Center.

Next steps

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for