Cost groups

Cost groups provide the basis for segmenting and analyzing cost contributions in a manufactured item's calculated cost, such as the cost contributions for material, labor, and overhead.

Cost groups are used to categorize cost based on some common nature. This method simplifies reporting because you don't need to see every resource to get an overview. Also, cost groups are used in the Costing sheet to create overhead allocation rules such as rates and surcharges.

You can create cost groups and group the following related BOM costs:

- Resources

- Wages

- Materials

- Overheads

- Setup and run time in routing operations

When a BOM calculation is run, cost groups determine how expenses are distributed between the BOM components and the different cost groups. In other words, cost groups determine how much has been consumed in terms of resources, wages, overheads, and materials.

By using cost groups, you can calculate the sales price for the BOM. You can also assign one or more profit-settings to each cost group so that Supply Chain Management can calculate a suggested price for a manufactured item that is based on a cost-plus-markup approach. The profit-setting percentage specifies which percentage that the system will add to the cost price when the sales price is calculated.

Cost breakdown

You can set up cost breakdowns for manufactured and purchased items (such as material, labor, and overhead) that are not posted to the general ledger by inventory transactions. They can, however, optionally be identified in the inventory sub ledger.

Go to Inventory management > Setup > Inventory and warehouse parameters, and in the Cost breakdown field, select whether to identify the cost breakdown in the inventory subledger by selecting the Sub ledger value. The cost breakdown for a manufactured item, such as material, labor, and overhead, is available in a report for standard cost.

Note

This type of cost breakdown only applies to an item that is valued by Standard cost. Cost group is a general feature, but maintaining inventory with a cost breakdown in the sub ledger is only for Standard cost-based items.

The cost breakdown feature enables you to track the cost composition of items that are held at standard cost across production levels for planned, estimated, and actual costs. Product cost, production costs, inventories, Work in Process (WIP), cost of goods sold, and cost composition can be analyzed and rolled up in their original cost groups.

In planned cost, production estimate, production costing calculations, and user-defined cost groups that are linked to the resources enable the collection and classification of cost contributions. When valuing manufactured components' cost contributions at standard costs, the system inserts the summarized standard cost decomposition for each cost group. This process enables the compilation of the multilevel, rolled up cost decomposition for each cost group of the product and production cost.

Cost group segmentation has several synonyms within manufacturing environments, such as cost breakdown, cost decomposition, or cost classification. Cost group segmentation can serve several purposes:

Segmenting costs for different types of material, such as ingredients and packaging material for a canned goods product, based on the cost groups that are assigned to items.

Segmenting costs for different types of operations resources, such as different types of labor or machines, based on the cost groups that are assigned to cost categories that are related to operations resources and routing operations.

Segmenting costs for setup time and run time in routing operations, based on the cost groups that are assigned to cost categories that are related to the routing operations.

Segmenting costs for different types of overhead, such as labor-related and machine-related overhead, based on cost groups that are assigned to indirect costs in the costing sheet setup.

Acting as the basis for calculating various types of manufacturing overhead in the costing sheet setup. This overhead can include different types of overhead that are related to routing information about operations resources or information about setup time and run time. Manufacturing overhead can also be related to cost contributions of component material, reflecting a lean manufacturing philosophy that eliminates the need for routing information.

Cost group segmentation applies to a manufactured item's calculated cost, regardless of whether that cost was based on standard costs or planned costs. Cost group segmentation can also apply to variances for a standard cost item. A second inventory parameter defines whether variances are identified by cost group or just summarized.

Cost management > Inventory accounting policies setup > Cost groups

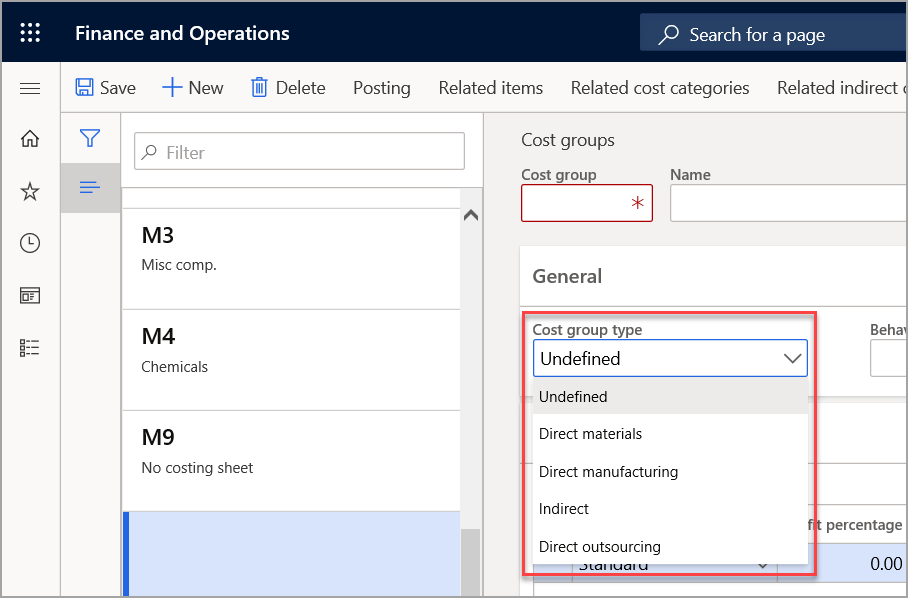

A cost group can be assigned a cost group type and a behavior for supplemental segmentation purposes.

Cost group type - Each cost group must be assigned a cost group type to indicate that the cost group applies to direct material, direct manufacturing, or direct outsourcing, or to designate it as indirect or undefined:

A cost group that is designated as Direct materials can be assigned to items.

A Direct manufacturing cost group can be assigned to cost categories.

A Direct outsourcing cost group can be assigned to a product type of service so that you can classify costs that are associated with the service purchase by subcontracting activities.

An Indirect cost group can be assigned to indirect costs for surcharges or rates. A cost group that is designated as undefined can be assigned to items, cost categories, or indirect costs.

Undefined is not specific to anything.

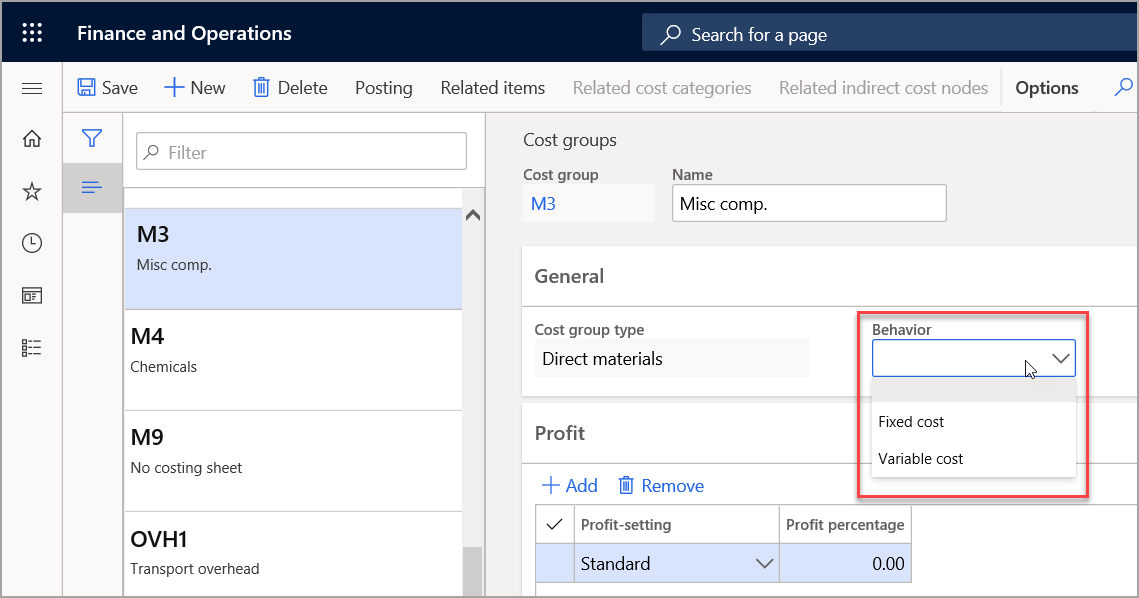

Behavior - Each cost group can optionally be assigned a behavior to indicate that the cost group applies to fixed costs or variable costs. A cost group that has a null value for behavior is treated as a variable cost. The assignment of a behavior serves only a reporting purpose.

A cost group can be defined as Fixed or Variable, depending on the resources that it represents in the cost composition. These definitions are referred to as the behavior of the cost group. The distinction is purely for reporting purposes, and it applies only when you use the Inventory value statement with standard cost breakdowns report.

At least one cost group of each cost group type must be set as the default type. If a resource is not assigned to a cost group, Supply Chain Management automatically assigns the default cost group.

You can also define the percentage for the Profit-settings field to have Supply Chain Management calculate the sales price when sales persons run BOM/Formula calculation in either sales quotation or sales orders.

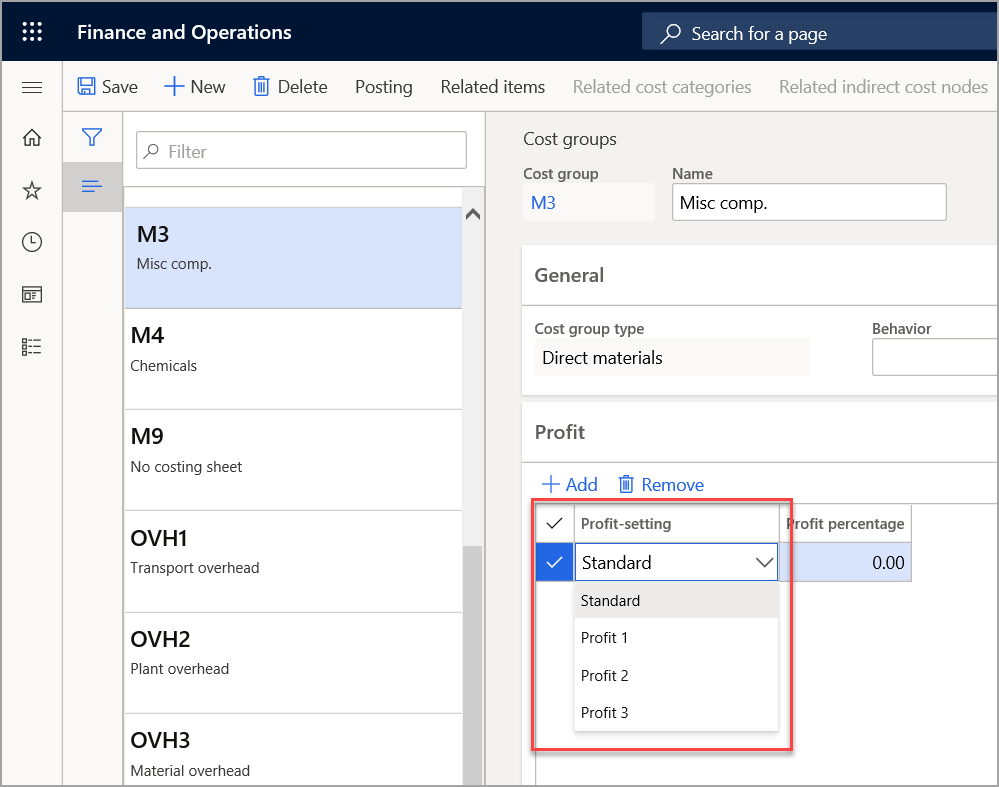

Profit-setting

The Profit-setting field on the Cost groups page on the Profit tab determines the size of the profit percentage that is attached to cost items or cost categories within each cost group. The field is also used to determine the sales price based on the calculated production cost when BOMs and cost categories for routes are calculated.

Legal entities can set up the following profit settings to be considered in BOM calculations:

Standard

Profit 1

Profit 2

Profit 3

You must specify profit settings when running a sales price calculation for a particular BOM. For each profit setting, you can also specify different profit-setting percentages.