Document Intelligence US tax document models

Important

- Document Intelligence public preview releases provide early access to features that are in active development.

- Features, approaches, and processes may change, prior to General Availability (GA), based on user feedback.

- The public preview version of Document Intelligence client libraries default to REST API version 2024-02-29-preview.

- Public preview version 2024-02-29-preview is currently only available in the following Azure regions:

- East US

- West US2

- West Europe

This content applies to: ![]() v4.0 (preview) | Previous versions:

v4.0 (preview) | Previous versions: ![]() v3.1 (GA)

v3.1 (GA)

This content applies to: ![]() v3.1 (GA) | Latest version:

v3.1 (GA) | Latest version: ![]() v4.0 (preview)

v4.0 (preview)

The Document Intelligence contract model uses powerful Optical Character Recognition (OCR) capabilities to analyze and extract key fields and line items from a select group of tax documents. Tax documents can be of various formats and quality including phone-captured images, scanned documents, and digital PDFs. The API analyzes document text; extracts key information such as customer name, billing address, due date, and amount due; and returns a structured JSON data representation. The model currently supports certain English tax document formats.

Supported document types:

- W-2

- 1098

- 1098-E

- 1098-T

- 1099 and variations (A, B, C, CAP, DIV, G, H, INT, K, LS, LTC, MISC, NEC, OID, PATR, Q, QA, R, S, SA, SB)

- 1040 and variations (Schedule 1, Schedule 2, Schedule 3, Schedule 8812, Schedule A, Schedule B, Schedule C, Schedule D, Schedule E, Schedule

EIC, Schedule F, Schedule H, Schedule J, Schedule R, Schedule SE, and Schedule Senior)

Automated tax document processing

Automated tax document processing is the process of extracting key fields from tax documents. Historically, tax documents were processed manually. This model allows for the easy automation of tax scenarios.

Development options

Document Intelligence v4.0 (2023-10-31-preview) supports the following tools, applications, and libraries:

| Feature | Resources | Model ID |

|---|---|---|

| US tax form models | • Document Intelligence Studio • REST API • C# SDK • Python SDK • Java SDK • JavaScript SDK |

• prebuilt-tax.us.W-2 • prebuilt-tax.us.1098 • prebuilt-tax.us.1098E • prebuilt-tax.us.1098T • prebuilt-tax.us.1099A • prebuilt-tax.us.1099B • prebuilt-tax.us.1099C • prebuilt-tax.us.1099CAP • prebuilt-tax.us.1099DIV • prebuilt-tax.us.1099G • prebuilt-tax.us.1099H • prebuilt-tax.us.1099INT • prebuilt-tax.us.1099K • prebuilt-tax.us.1099LS • prebuilt-tax.us.1099LTC • prebuilt-tax.us.1099MISC • prebuilt-tax.us.1099NEC • prebuilt-tax.us.1099OID • prebuilt-tax.us.1099PATR • prebuilt-tax.us.1099Q • prebuilt-tax.us.1099QA • prebuilt-tax.us.1099R • prebuilt-tax.us.1099S • prebuilt-tax.us.1099SA • prebuilt-tax.us.1099SB • prebuilt-tax.us.1040 • prebuilt-tax.us.1040Schedule1 • prebuilt-tax.us.1040Schedule2 • prebuilt-tax.us.1040Schedule3 • prebuilt-tax.us.1040Schedule8812 • prebuilt-tax.us.1040ScheduleA • prebuilt-tax.us.1040ScheduleB • prebuilt-tax.us.1040ScheduleC • prebuilt-tax.us.1040ScheduleD • prebuilt-tax.us.1040ScheduleE • prebuilt-tax.us.1040ScheduleEIC • prebuilt-tax.us.1040ScheduleF • prebuilt-tax.us.1040ScheduleH • prebuilt-tax.us.1040ScheduleJ • prebuilt-tax.us.1040ScheduleR • prebuilt-tax.us.1040ScheduleSE • prebuilt-tax.us.1040Senior |

Document Intelligence v3.1 supports the following tools, applications, and libraries:

| Feature | Resources | Model ID |

|---|---|---|

| US tax form models | • Document Intelligence Studio • REST API • C# SDK • Python SDK • Java SDK • JavaScript SDK |

• prebuilt-tax.us.W-2 • prebuilt-tax.us.1098 • prebuilt-tax.us.1098E • prebuilt-tax.us.1098T |

Document Intelligence v3.0 supports the following tools, applications, and libraries:

| Feature | Resources | Model ID |

|---|---|---|

| US tax form models | • Document Intelligence Studio • REST API • C# SDK • Python SDK • Java SDK • JavaScript SDK |

• prebuilt-tax.us.W-2 • prebuilt-tax.us.1098 • prebuilt-tax.us.1098E • prebuilt-tax.us.1098T |

Input requirements

For best results, provide one clear photo or high-quality scan per document.

Supported file formats:

Model PDF Image:

JPEG/JPG, PNG, BMP, TIFF, HEIFMicrosoft Office:

Word (DOCX), Excel (XLSX), PowerPoint (PPTX), and HTMLRead ✔ ✔ ✔ Layout ✔ ✔ ✔ (2024-02-29-preview, 2023-10-31-preview) General Document ✔ ✔ Prebuilt ✔ ✔ Custom extraction ✔ ✔ Custom classification ✔ ✔ ✔ (2024-02-29-preview) For PDF and TIFF, up to 2000 pages can be processed (with a free tier subscription, only the first two pages are processed).

The file size for analyzing documents is 500 MB for paid (S0) tier and 4 MB for free (F0) tier.

Image dimensions must be between 50 x 50 pixels and 10,000 px x 10,000 pixels.

If your PDFs are password-locked, you must remove the lock before submission.

The minimum height of the text to be extracted is 12 pixels for a 1024 x 768 pixel image. This dimension corresponds to about

8-point text at 150 dots per inch (DPI).For custom model training, the maximum number of pages for training data is 500 for the custom template model and 50,000 for the custom neural model.

For custom extraction model training, the total size of training data is 50 MB for template model and 1G-MB for the neural model.

For custom classification model training, the total size of training data is

1GBwith a maximum of 10,000 pages.

Try tax document data extraction

See how data, including customer information, vendor details, and line items, is extracted from invoices. You need the following resources:

An Azure subscription—you can create one for free.

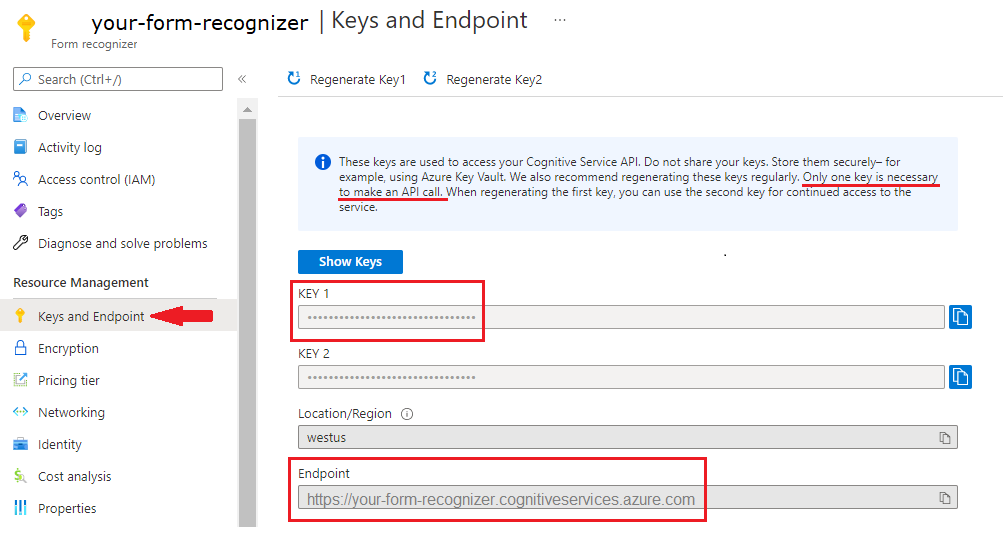

A Document Intelligence instance in the Azure portal. You can use the free pricing tier (

F0) to try the service. After your resource deploys, select Go to resource to get your key and endpoint.

Document Intelligence Studio

On the Document Intelligence Studio home page, select the supported tax document model.

You can analyze a sample tax document or upload your own files.

Select the Run analysis button and, if necessary, configure the Analyze options :

Supported languages and locales

See our Language Support—prebuilt models page for a complete list of supported languages.

Field extraction W-2

The following are the fields extracted from a W-2 tax form in the JSON output response.

| Name | Type | Description | Example output | dependents |

|---|---|---|---|---|

W-2FormVariant |

String | IR W-2 Form variant. This field can have the one of the following values: W-2, W-2AS, W-2CM, W-2GU, or W-2VI |

W-2 | |

TaxYear |

Number | Form tax year | 2021 | |

W2Copy |

String | W-2 tax copy version along with printed instruction related to this copy | Copy A—For Social Security Administration | |

Employee |

object | Object that contains social security number, name, and address | ||

ControlNumber |

string | W-2 control number. IRS W-2 field d | 0AB12 D345 7890 | |

Employer |

Object | Object that contains employer identification number, name, and address | ||

WagesTipsAndOtherCompensation |

Number | Wages, tips, and other compensation amount in USD. IRS W-2 field 1 | 1234567.89 | |

FederalIncomeTaxWithheld |

Number | Federal income tax withheld amount in USD. IRS W-2 field 2 | 1234567.89 | |

SocialSecurityWages |

Number | Social security wages amount in USD. IRS W-2 field 3 | 1234567.89 | |

SocialSecurityTaxWithheld |

Number | Social security tax withheld amount in USD. IRS W-2 field 4 | 1234567.89 | |

MedicareWagesAndTips |

Number | Medicare wages and tips amount in USD. IRS W-2 field 5 | 1234567.89 | |

MedicareTaxWithheld |

Number | Medicare tax withheld amount in USD. IRS W-2 field 6 | 1234567.89 | |

SocialSecurityTips |

Number | Social security tips amount in USD. IRS W-2 field 7 | 1234567.89 | |

AllocatedTips |

Number | Allocated tips in USD. IRS W-2 field 8 | 1234567.89 | |

VerificationCode |

Number | W-2 verification code. IRS W-2 field 9 | 1234567.89 | |

DependentCareBenefits |

Number | Dependent care benefits amount in USD. IRS W-2 field 10 | 1234567.89 | |

NonQualifiedPlans |

Number | Non qualified plans amount in USD. IRS W-2 field 11 | 1234567.89 | |

IsStatutoryEmployee |

String | Part of IRS W-2 field 13. Can be true or false | true | |

IsRetirementPlan |

String | Part of IRS W-2 field 13. Can be true or false | true | |

IsThirdPartySickPay |

String | Part of IRS W-2 field 13. Can be true or false | true | |

Other |

String | Content of IRS W-2 field 14 | SICK LV WAGES SBJT TO $511/DAY LIMIT 1356 | |

StateTaxInfos |

Array | State tax-related information. content of IRS W-2 field 15 to 17 | ||

LocaleTaxInfos |

Array | Local tax-related information. Content of IRS W-2 field 18 to 20 |

Field extraction 1098

The following are the fields extracted from a 1098 tax form in the JSON output response. The 1098-T and 1098-E forms are also supported.

| Name | Type | Description | Example output |

|---|---|---|---|

| TaxYear | Number | Form tax year | 2021 |

| Borrower | Object | An object that contains the borrower's TIN, Name, Address, and AccountNumber | |

| Lender | Object | An object that contains the lender's TIN, Name, Address, and Telephone | |

| MortgageInterest | Number | Mortgage Interest amount received from payers/borrower(s) (box 1) | 1,234,567.89 |

| OutstandingMortgagePrincipal | Number | Outstanding mortgage principal (box 2) | 1,234,567.89 |

| MortgageOriginationDate | Date | Origination date of the mortgage (box 3) | 2022-01-01 |

| OverpaidInterestRefund | Number | Refund amount of overpaid interest (box 4) | 1,234,567.89 |

| MortgageInsurancePremium | Number | Mortgage insurance premium amount (box 5) | 1,234,567.89 |

| PointsPaid | Number | Points paid on purchase of principal residence (Box 6) | 1,234,567.89 |

| IsPropertyAddressSameAsBorrower | String | Is the address of the property securing the mortgage the same as the payer's/borrower's mailing address (box 7) | true |

| PropertyAddress | String | Address or description of the property securing the mortgage (box 8) | 123 Main St., Redmond WA 98052 |

| MortgagedPropertiesCount | Number | Number of mortgaged properties (box 9) | 1 |

| Other | String | Additional information to report to payer (box 10) | |

| RealEstateTax | Number | Real estate tax (box 1) | 1,234,567.89 |

| AdditionalAssessment | String | Added assessments made on the property (box 10) | 1,234,567.89 |

| MortgageAcquisitionDate | date | Mortgage acquisition date (box 11) | 2022-01-01 |

Field extraction 1099-NEC

The following are the fields extracted from a 1099-nec tax form in the JSON output response. The other variations of 1099 are also supported.

| Name | Type | Description | Example output |

|---|---|---|---|

TaxYear |

String | Tax Year extracted from Form 1099-NEC. | 2021 |

Payer |

Object | An object that contains the payer's TIN, Name, Address, and PhoneNumber | |

Recipient |

Object | An object that contains the recipient's TIN, Name, Address, and AccountNumber | |

Box1 |

number | Box 1 extracted from Form 1099-NEC. | 123456 |

Box2 |

boolean | Box 2 extracted from Form 1099-NEC. | true |

Box4 |

number | Box 4 extracted from Form 1099-NEC. | 123456 |

StateTaxesWithheld |

array | State Taxes Withheld extracted from Form 1099-NEC (boxes 5, 6, and 7) |

Field extraction 1040 tax form

The following are the fields extracted from a 1040 tax form in the JSON output response. The other variations of 1040 are also supported.

| Name | Type | Description | Example output |

|---|---|---|---|

TaxPayer |

Object | An object that contains the taxpayer's information such as SSN, Last Name, and Address | |

Spouse |

Object | An object that contains the spouse's information such as SSN, surname, and first name and initials Name | |

Dependents |

array | An array that contains a list of dependents including information such as Name, SSN, and Credit Type | |

ThirdPartyDesignee |

object | An object that contains information about the third-party designee | |

SignatureDetails |

object | An object that contains information about the signee such as phone numbers and emails | |

PaidPreparer |

object | An object that contains information about the preparer. | |

FillingStatus |

String | Value can be one of noSelection, single, marriedFilingJointly, marriedFillingSeparately, headOfHousehold, qualifyingSurvivingSpouse or multiSelection. | single |

FilingStatusDetails |

object | An object that contains information about the filing status. | |

NameOfSpouseOrQualifyingPerson |

String | Name Of Spouse Or Qualifying Person extracted from Form 1040. | John Smith |

PresidentialElectionCampaign |

String | Value can be one of noSelection, taxpayer, spouse, or multiSelection. | Taxpayer |

PresidentialElectionCampaignDetails |

object | An object that contains details about the presidential election campaign. | |

DigitalAssets |

String | Value can be one of noSelection, yes, no or multiSelection. | yes |

DigitalAssetsDetails |

object | An object that contains details about the digital assets. | |

ClaimStatus |

String | Value can be one of noSelection, taxpayerAsDependent, spouseAsDependent, spouseItemizesSeparatelyOrDualStatusAlien or multiSelection. | taxpayerAsDependent |

ClaimStatusDetails |

object | An object that contains details about the claim status. | |

TaxpayerAgeBlindness |

String | Value can be one of noSelection, above64, blind or multiSelection. |

above64 |

TaxPayerAgeBlindnessDetails |

object | An object that contains details about the taxpayer age blindness. | |

SpouseAgeBlindness |

String | Value can be one of noSelection, above64, blind or multiSelection. |

above64 |

TaxPayerAgeBlindnessDetails |

object | An object that contains details about the spouse age blindness. | |

MoreThanFourDependents |

boolean | More Than Four Dependents extracted from Form 1040. | true |

Box1a |

number | Box 1a extracted from 1040. |

123456 |

| Based on the provided JSON structure and converting it into the same table format as requested, the result is as follows: | |||

Box1b |

number | Box 1b extracted from 1040. |

123456 |

Box1c |

number | Box 1c extracted from 1040. |

123456 |

Box1d |

number | Box 1d extracted from 1040. |

123456 |

Box1e |

number | Box 1e extracted from 1040. |

123456 |

Box1f |

number | Box 1f extracted from 1040. |

123456 |

Box1g |

number | Box 1g extracted from 1040. |

123456 |

Box1h |

number | Box 1h extracted from 1040. |

123456 |

Box1i |

number | Box 1i extracted from 1040. |

123456 |

Box1z |

number | Box 1z extracted from 1040. |

123456 |

Box2a |

number | Box 2a extracted from 1040. |

123456 |

Box2b |

number | Box 2b extracted from 1040. |

123456 |

Box3a |

number | Box 3a extracted from 1040. |

123456 |

Box3b |

number | Box 3b extracted from 1040. |

123456 |

Box4a |

number | Box 4a extracted from 1040. |

123456 |

Box4b |

number | Box 4b extracted from 1040. |

123456 |

Box5a |

number | Box 5a extracted from 1040. |

123456 |

Box5b |

number | Box 5b extracted from 1040. |

123456 |

Box6a |

number | Box 6a extracted from 1040. |

123456 |

Box6b |

number | Box 6b extracted from 1040. |

123456 |

Box6cCheckbox |

boolean | Box 6c Checkbox extracted from 1040. |

true |

Box7Checkbox |

boolean | Box 7 Checkbox extracted from 1040. | true |

Box7 |

number | Box 7 extracted from 1040. | 123456 |

Box8 |

number | Box 8 extracted from 1040. | 123456 |

Box9 |

number | Box 9 extracted from 1040. | 123456 |

Box10 |

number | Box 10 extracted from 1040. | 123456 |

Box11 |

number | Box 11 extracted from 1040. | 123456 |

Box12 |

number | Box 12 extracted from 1040. | 123456 |

Box13 |

number | Box 13 extracted from 1040. | 123456 |

Box14 |

number | Box 14 extracted from 1040. | 123456 |

Box15 |

number | Box 15 extracted from 1040. | 123456 |

Box16FromForm |

string | Value can be one of noSelection, 8814, 4972, other or multiSelection. | 8814 |

Box16FromFormDetails |

object | Object that contains details about the Box 16 | |

Box16OtherFormNumber |

string | Box 16 Other Form Number extracted from 1040. | 8888 |

Box16 |

number | Box 16 extracted from 1040. | 123456 |

Box17 |

number | Box 17 extracted from 1040. | 123456 |

Box18 |

number | Box 18 extracted from 1040. | 123456 |

Box19 |

number | Box 19 extracted from 1040. | 123456 |

Box20 |

number | Box 20 extracted from 1040. | 123456 |

Box21 |

number | Box 21 extracted from 1040. | 123456 |

Box22 |

number | Box 22 extracted from 1040. | 123456 |

Box23 |

number | Box 23 extracted from 1040. | 123456 |

Box24 |

number | Box 24 extracted from 1040. | 123456 |

Box25a |

number | Box 25a extracted from 1040. |

123456 |

Box25b |

number | Box 25b extracted from 1040. |

123456 |

Box25c |

number | Box 25c extracted from 1040. |

123456 |

Box25d |

number | Box 25d extracted from 1040. |

123456 |

Box26 |

number | Box 26 extracted from 1040. | 123456 |

Box27 |

number | Box 27 extracted from 1040. | 123456 |

Box28 |

number | Box 28 extracted from 1040. | 123456 |

Box29 |

number | Box 29 extracted from 1040. | 123456 |

Box31 |

number | Box 31 extracted from 1040. | 123456 |

Box32 |

number | Box 32 extracted from 1040. | 123456 |

Box33 |

number | Box 33 extracted from 1040. | 123456 |

Box34 |

number | Box 34 extracted from 1040. | 123456 |

Box35Checkbox |

boolean | Box 35 Checkbox extracted from 1040. | true |

Box35a |

number | Box 35a extracted from 1040. |

123456 |

Box35b |

number | Box 35b extracted from 1040. |

123456 |

Box35c |

string | Value can be one of noSelection, checking, savings, or multiSelection. | checking |

Box35cDetails |

object | Object that contains details about Box 35c |

|

Box35d |

number | Box 35d extracted from 1040. |

123456 |

Box36 |

number | Box 36 extracted from 1040. | 123456 |

Box37 |

number | Box 37 extracted from 1040. | 123456 |

Box38 |

number | Box 38 extracted from 1040. | 123456 |

HasAssignedThirdPartyDesignee |

string | Value can be one of noSelection, yes, no or multiSelection. | yes |

HasAssignedThirdPartyDesigneeDetails |

object | Object that contains information on what was selected for the assigned third-party designee |

The tax documents key-value pairs and line items extracted are in the documentResults section of the JSON output.

Next steps

Try processing your own forms and documents with the Document Intelligence Studio.

Complete a Document Intelligence quickstart and get started creating a document processing app in the development language of your choice.

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for