Globalization – India localization: Project and upgrade

Important

This content is archived and is not being updated. For the latest documentation, see Microsoft Dynamics 365 product documentation. For the latest release plans, see Dynamics 365 and Microsoft Power Platform release plans.

Note

These release notes describe functionality that may not have been released yet. To see when this functionality is planned to release, please review Summary of what’s new. Delivery timelines and projected functionality may change or may not ship (see Microsoft policy).

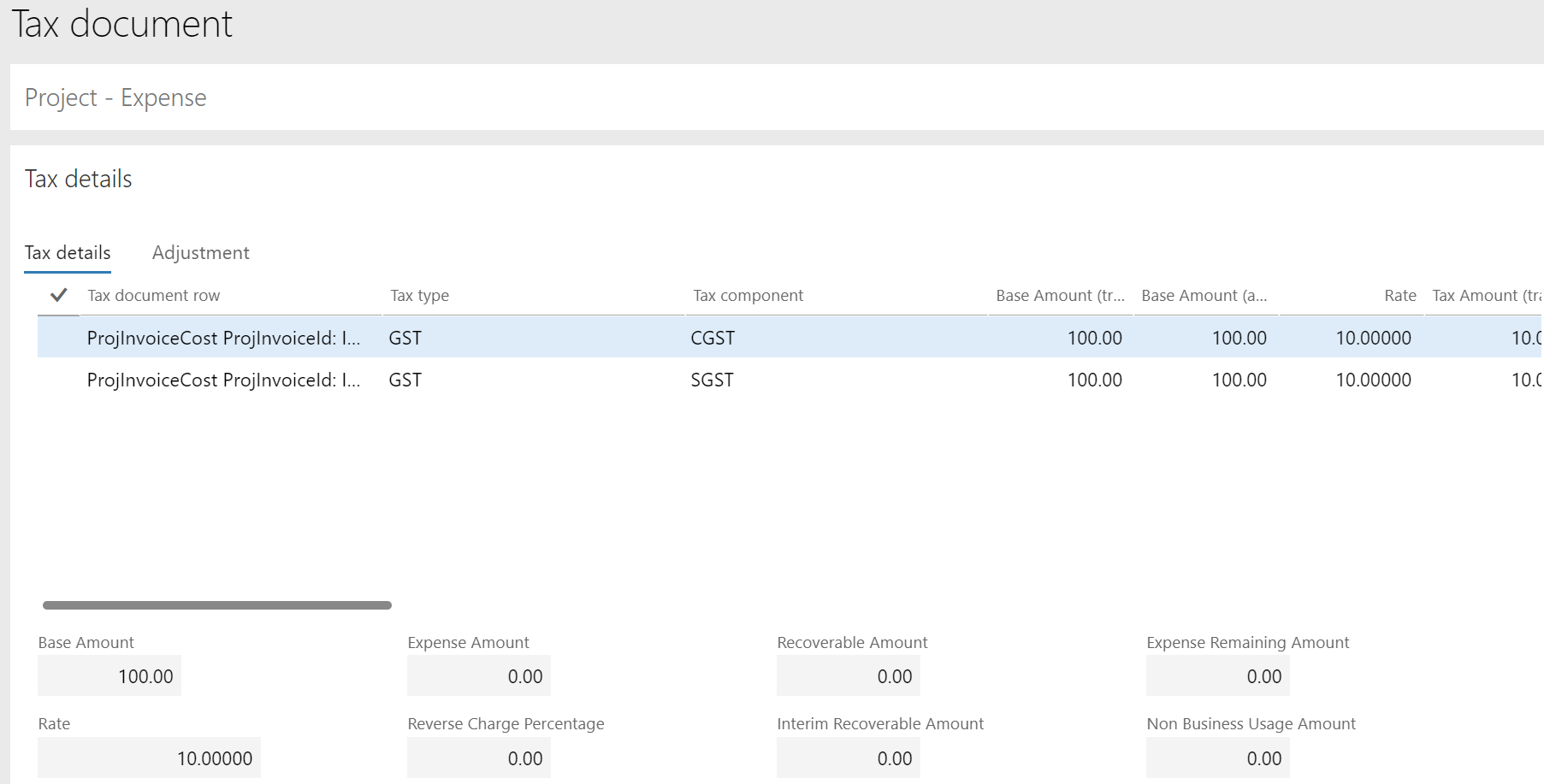

Project localization for India lets users manage Indian Goods and Services Tax (GST) for the Project management and accounting module.

Maintain Indian GST information in project contracts, project categories, and so on.

Calculate GST by using a configurable Global Tax Engine (GTE) for all tax-relevant project transactions, such as project quotations, expense journals, hour journals, item journals, fee journals, on-account transactions, project invoice proposals, and service management.

Print a Tax invoice for a project.

Localization upgrade for India lets current Microsoft Dynamics AX 2012 customers upgrade to Microsoft Dynamics 365 for Finance and Operations.

Project management and accounting for India