Use VAT clauses on different document types

Important

This content is archived and is not being updated. For the latest documentation, see Microsoft Dynamics 365 product documentation. For the latest release plans, see Dynamics 365 and Microsoft Power Platform release plans.

| Enabled for | Public preview | General availability |

|---|---|---|

| Admins, makers, or analysts, automatically |  Nov 29, 2019 Nov 29, 2019 |

Dec 17, 2019 Dec 17, 2019 |

Business value

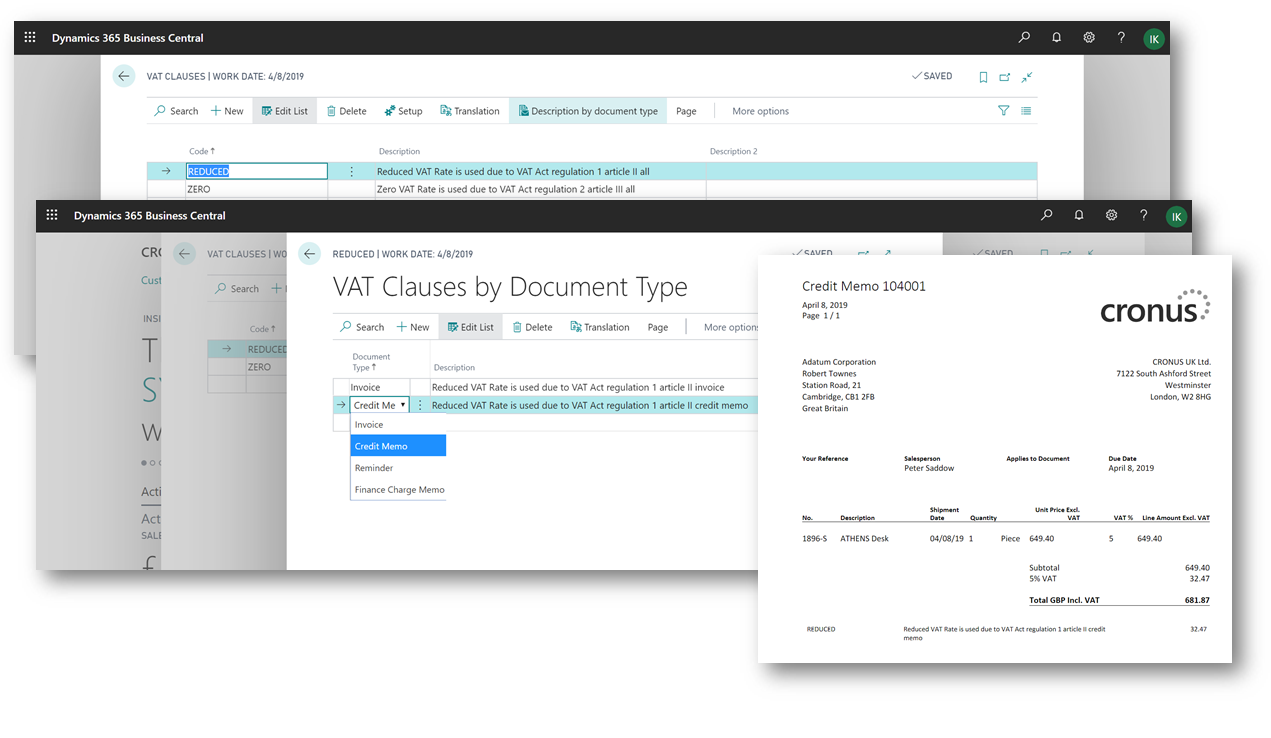

When non-standard VAT rates are used in different types of documents, such as invoices or credit memos, companies are usually required to include an exemption text (VAT clause) stating why a reduced VAT or zero VAT rate has been calculated.

Feature details

You can now define different VAT clauses to be included on business documents per the type of document, such as Invoice or Credit Memo.

Tell us what you think

Help us improve Dynamics 365 Business Central by discussing ideas, providing suggestions, and giving feedback. Use the forum at https://aka.ms/bcideas.

See also

Set Up Value-Added Tax (docs)