Standard Audit File for Tax (SAF-T) for Denmark

This article describes how to prepare Microsoft Dynamics 365 Finance to work with the Standard Audit File for Tax (SAF-T) report and generate the file in XML format according to the requirements for SAF-T in Denmark.

Note

The One voucher functionality introduces a limitation on further SAF-T reporting for some scenarios that are subject to SAF-T. Specifically, a bank statement scenario must be posted by using different vouchers for transactions that have different counteragent accounts. We recommend that you set the Allow multiple transactions within one voucher option on the General ledger parameters page to No in your legal entity if you post transactions that are part of the SAF-T report. For information about One voucher functionality, see One voucher.

Setup

To start to work with the SAF-T report for Denmark, complete the following steps.

- Turn on features in Feature management.

- Import Electronic reporting configurations.

- Set up application-specific parameters for the SAF-T Format (DK) configuration.

- Select the SAT-T format in General ledger parameters.

- Create a contact person for your company.

- Configure the Registration number of the legal entity.

- Configure Standard chart of accounts.

Turn on features in Feature management

In the Feature management workspace, on the All tab, find and select the following features in the feature list:

- Standard Audit File for Tax (SAF-T) electronic report

- Optimize datasets memory consumption at ER reports runtime

Select Enable now.

Import Electronic reporting configurations

In Finance, import the following versions or later of these Electronic reporting (ER) configurations from the Global repository.

For more information about how to download ER configurations, see Download ER configurations from the Global repository.

| ER configuration name | Type | Version | Description |

|---|---|---|---|

| Standard Audit File (SAF-T) | Model | 164 | The common data model for different audit reports. |

| SAF-T General model mapping | Model mapping | 164.354 | The model mapping that provides general data source mapping. |

| SAF-T Format (DK) | Format | 164.21 | The XML format that represents the SAF-T report in accordance with the requirements for Denmark. |

Import the most recent versions of the configurations. The version description usually includes the number of the Microsoft Knowledge Base (KB) article that explains the changes that were introduced in the configuration version.

Important

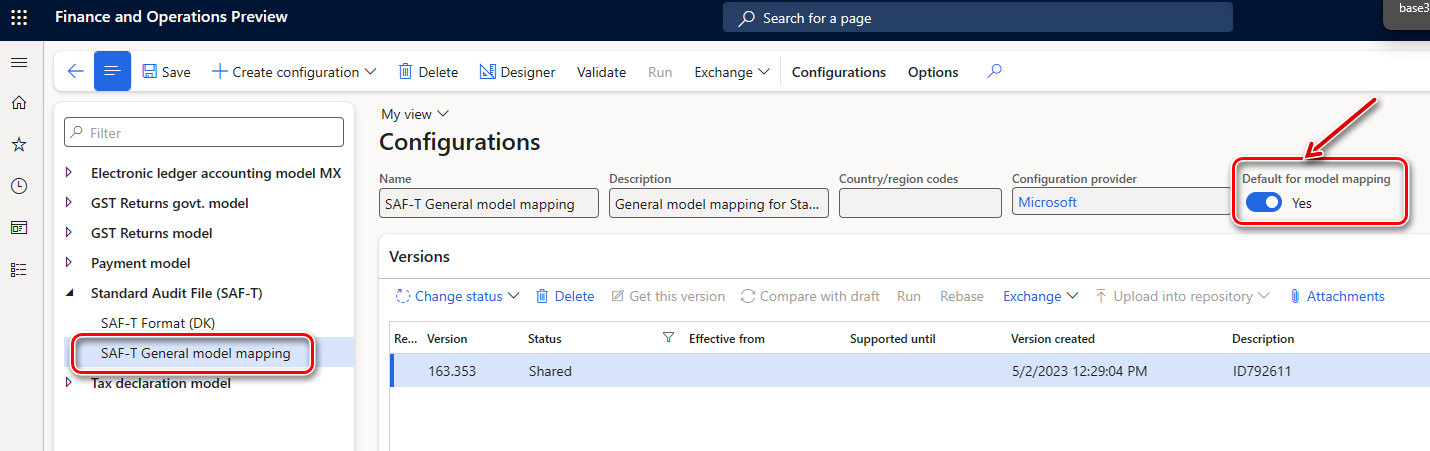

After all the ER configurations from the previous table are imported, set the Default for model mapping option to Yes for the SAF-T General model mapping configuration.

The SAF-T General model mapping configuration provides general data source mapping for the following master data:

- GeneralLedgerAccounts – General ledger.

- Customers – Purchasers and other debtors.

- Suppliers – Suppliers and other creditors.

- TaxTable – Tax type tables that are used in the legal entity's accounting system. Examples include value-added tax (VAT), corporate income tax, and excise taxes.

- UOMTable – Table for units of measurement.

- AnalysisTypeTable – Data tables for analytical accounting. This data is used to provide details of transaction data. Examples include unit costs, additional costs, a cost center, or a project.

- MovementTypeTable – Stock movement types.

- Products – Products and services.

- PhysicalStock – Data about the stock that's contained in the file.

The SAF-T General model mapping configuration also provides general data source mapping for the following transactional data:

- GeneralLedgerEntries – General ledger entries.

- Sales invoices – Initial sales documents.

- PurchaseInvoices – Accounting documents for purchases and acquisitions.

- Payments – Payments.

- MovementOfGoods – Information about the movement of goods. For example, movement occurs when goods are recorded, when goods are written off after they're sold or used in production, and when finished products, determined loss, and defective goods are recorded.

- AssetTransactions – Economic transactions or events for tangible or intangible economic assets, and for financial assets.

Set up application-specific parameters for the SAF-T Format (DK) configuration

We recommend that you enable the Use application specific parameters from previous versions of ER formats feature in the Feature management workspace. When this feature is enabled, parameters that are configured for the earlier version of an ER format automatically become applicable for the later version of the same format. If this feature isn't enabled, explicitly configure the application-specific parameters for each format version. The Use application specific parameters from previous versions of ER formats feature is available in the Feature management workspace starting in Finance version 10.0.23. For more information about how to set up the parameters of an ER format for each legal entity, see Set up the parameters of an ER format per legal entity.

We also recommend that you enable the Accelerate the ER labels storage feature in the Feature management workspace. This feature helps improve network bandwidth utilization and overall system performance because, in most cases, ER labels of a single language are used when you work with a single ER configuration. The Accelerate the ER labels storage feature is available in the Feature management workspace as of Finance version 10.0.25. For more information about how to set up the parameters of an ER format for each legal entity, see Performance.

- In the Electronic reporting workspace, open the Configurations page.

- In the configuration tree, under Standard Audit File (SAF-T), select SAF-T Format (DK).

- Make sure that you're working in the company that you want to set up the application-specific parameters for.

- Select Configurations > Application-specific parameters, and then, on the Action Pane, select Setup.

- In the list on the left, select the last version of the configuration.

- Provide the mapping for the ReportTaxCodes_LOOKUP lookup field. Define the mapping between the sales tax codes that are used by the company and the standard tax codes of Denmark.

- Select the value Other as the last condition in the list. The Tax Code column must be set to *Not blank*.

- In the Line column, verify that Other is the last condition in the table. At least one line that has *Not blank* values must be set up.

- When you've finished setting up the lookup fields, in the State field select Completed, and then save the configuration.

Select the SAT-T format in General ledger parameters

- Go to General ledger > Setup > General ledger parameters.

- On the Standard Audit File for Tax FastTab, in the Standard Audit File for Tax (SAF-T) field, select SAF-T Format (DK).

Create a contact person for your company

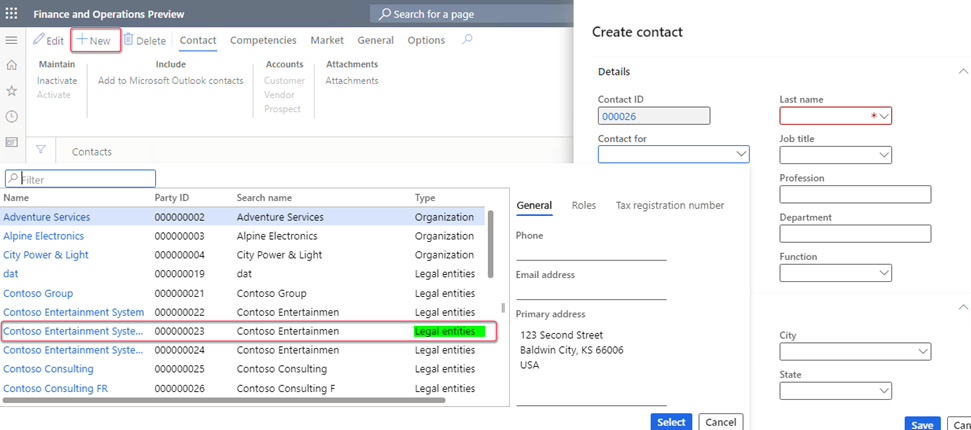

The Company node of the SAF-T report must include information for a contact. This node is located under the Header node. To set up contact information that will be reported to SAF-T, follow these steps.

- Go to Sales and marketing > Relationships > Contacts > All contacts.

- Select New to create a new contact for your legal entity. Be sure to select Legal entity in the Contact for field.

- Check the Party ID value to make sure that you select the legal entity that SAF-T will be reported from.

Configure the registration number of the legal entity

To generate a SAF-T, you must configure the registration number.

- Go to Organization administration > Organizations > Legal entities.

- Select the legal entity, and then select Registration IDs.

- Select or create the address in Denmark, and then, on the Registration ID FastTab, select Add.

- In the Registration type field, select the registration type that's dedicated to Denmark, and that uses the VAT Id registration category.

- In the Registration number field, enter the tax number.

- On the General tab, in the Effective field, enter the date when the number becomes effective.

For more information about how to set up registration categories and registration types, see Registration IDs.

Configure a standard chart of accounts (Standardkontoplan)

In the Danish SAF-T report, main accounts that are used in Finance must be associated with Danish standard accounts. Use the consolidation account groups and additional consolidation accounts functionality to create this association.

- Create a consolidation account group. For example, create a group that's named Standardkontoplan.

- Add accounts to the consolidation account group. In the Consolidation account field, specify a standard account. This value is reported in the StandardAccountID element of SAF-T under the Master data > GeneralLedgerAccounts > Account node. In the Consolidation account name field, optionally specify the standard account name or description. This value isn't used in SAF-T.

Generate the SAF-T report

Go to General ledger > Inquiries and reports > Standard Audit File for Tax (SAF-T) > Standard Audit File for Tax (SAF-T).

In the Electronic report parameters dialog box, set the following fields.

Field name Description From date and To date Specify the start and end dates of the period that the report should include data for. The start date is reflected in the Header > SelectionCriteria > PeriodStart node of the SAF-T. The end date is reflected in the Header > SelectionCriteria > PeriodEnd node. The period for one file or one part of a file can't be shorter than one month or longer than a reporting period. Print zero balance This checkbox affects the data that's reported in the MasterFiles > GeneralLedgerAccounts node of the SAF-T. Select this checkbox to include all the main accounts of your company, including main accounts that have a zero balance during the specified period. Clear the checkbox to include only main accounts that have a non-zero balance or transactions during the specified period. Export all Customers This checkbox affects the data that's reported in the MasterFiles > Customers node of the SAF-T. Select this checkbox to include all the customers of your company, including customers that have a zero balance during the specified period. Clear the checkbox to include only customers that have a non-zero balance or transactions during the specified period. Export all Suppliers This checkbox affects the data that's reported in the MasterFiles > Suppliers node of the SAF-T. Select this checkbox to include all the suppliers of your company, including suppliers that have a zero balance during the specified period. Clear the checkbox to include only suppliers that have a non-zero balance or transactions during the specified period. Export all Analysis types This checkbox affects the data that's reported in the MasterFiles > AnalysisTypeTable node of the SAF-T. Select this checkbox to include all the dimensions of your company. Clear the checkbox to include only dimensions that are used in transactions that are reported during the specified period. Export all Products This checkbox affects the data that's reported in the MasterFiles > Products node of the SAF-T. Select this checkbox to include all the products of your company, including products that have zero physical stock during the specified period. Clear the checkbox to include only products that have non-zero physical stock or transactions during the specified period. Export all Sales tax codes This checkbox affects the data that's reported in the MasterFiles > TaxTable node of the SAF-T. Select this checkbox to include all the sales tax codes of your company. Clear the checkbox to include only sales tax codes that are used in transactions that are reported during the specified period. Consolidation account group Select the consolidation account group that you set up earlier to configure the standard chart of accounts (Standardkontoplan). Header Comment Specify your comment to SAF-T. The value of this field is reported in the HeaderComment element of SAF-T under the AuditFile > Header node. The element can contain any additional generic comments about the audit file. The maximum length is 256 characters. Tax Accounting Basis The value of this field is reported in the TaxAccountingBasis element of SAF-T under the AuditFile > Header node. Select one of the following values:

- Invoice Accounting

- Cash Accounting

- Delivery

- Other

Tax Entity The value of this field is reported in the TaxEntity element of SAF-T under AuditFile > Header node. Select one of the following values:

- Company

- Division

- Branch reference

On the Run in the background FastTab, you can specify parameters of the batch job and run the report in batch mode.

When an electronic report is generated in batch mode, you can find related batch information and the generated output file as an attachment by going to Organization administration > Electronic reporting > Electronic reporting jobs. For more information about how to configure a destination for each ER format configuration and its output component, see Electronic reporting (ER) destinations.

Select OK to generate the report.

Export attachments

As of Finance version 10.0.40, the Export attachments feature is available in Document management. Use this feature to export files that are attached to records of tables in Finance to supplement your SAF-T file as required. For more information, see Export attachments.

Selection of tables to export attachments for is company-specific and might depend on the particular request. For example, to supplement sections of source documents that are reported in SAF-T, select the following set of tables in Finance to export attachments.

| Table name | Table label | SAF-T source document section |

|---|---|---|

| CustInvoiceJour | Customer invoice journal | SalesInvoices |

| ProjInvoiceJour | Project invoice | |

| VendInvoiceJour | Vendor invoice journal | PurchaseInvoices |

| CustTrans | Customer transactions | Payments |

| VendTrans | Vendor transactions | |

| BankAccountTrans | Bank transactions | |

| InventTrans | Inventory transactions | MovementOfGoods |

| CustTrans | Customer transactions | |

| VendTrans | Vendor transactions | |

| AssetTrans | Fixed asset transactions | AssetTransactions |

反馈

即将发布:在整个 2024 年,我们将逐步淘汰作为内容反馈机制的“GitHub 问题”,并将其取代为新的反馈系统。 有关详细信息,请参阅:https://aka.ms/ContentUserFeedback。

提交和查看相关反馈