Define a tax configuration and deploy it to legal entities

Go to Tax > Setup > Tax Configuration > Tax Setup.

Select New.

In the Tax Setup field, enter a value.

In the Description field, enter a value, and then select Save.

Select Configurations.

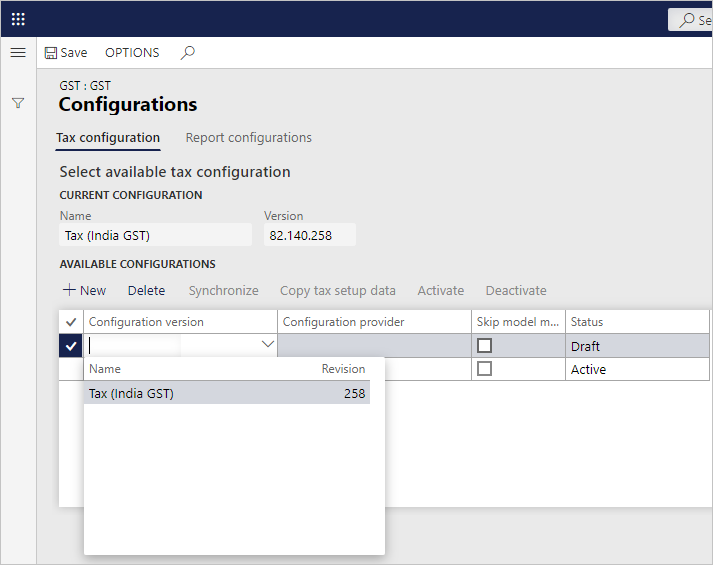

On the Tax configuration tab, in the Available configurations section, select New.

In the Configuration version field, select a value.

The new tax configuration is listed in the Available configurations grid.

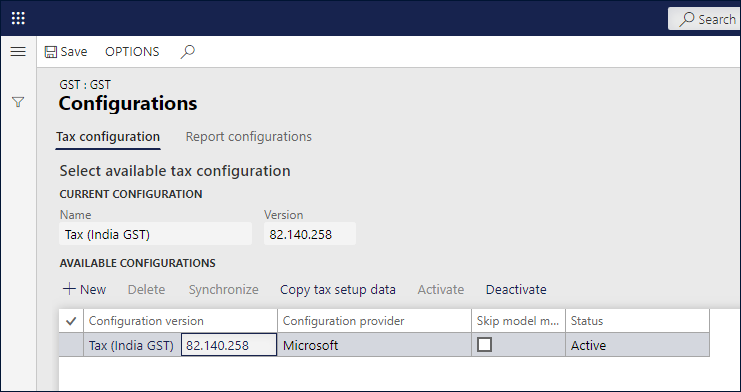

Select Save, and then select Synchronize.

Select Activate.

The configuration that you activated is updated as the current configuration.

[NOTE] It's suggested to mark Skip model mapping if the configuration is the standard configuration (which is provided by Microsoft), or extended configuration without adding/modifying model mapping.

Select the Report configurations tab.

The Available configurations grid lists the configurations that are related to the report.

Select the Select check box.

In the Report controller field, select a value.

Select Save, and then select Close.

On the Companies FastTab, create a record.

In the Companies field, select a value.

Note

Only one legal entity can be assigned to each tax configuration.

Save the record.

Select Activate to activate the configuration for the company.

Update the configuration version

Select Deactivate.

Select Configurations.

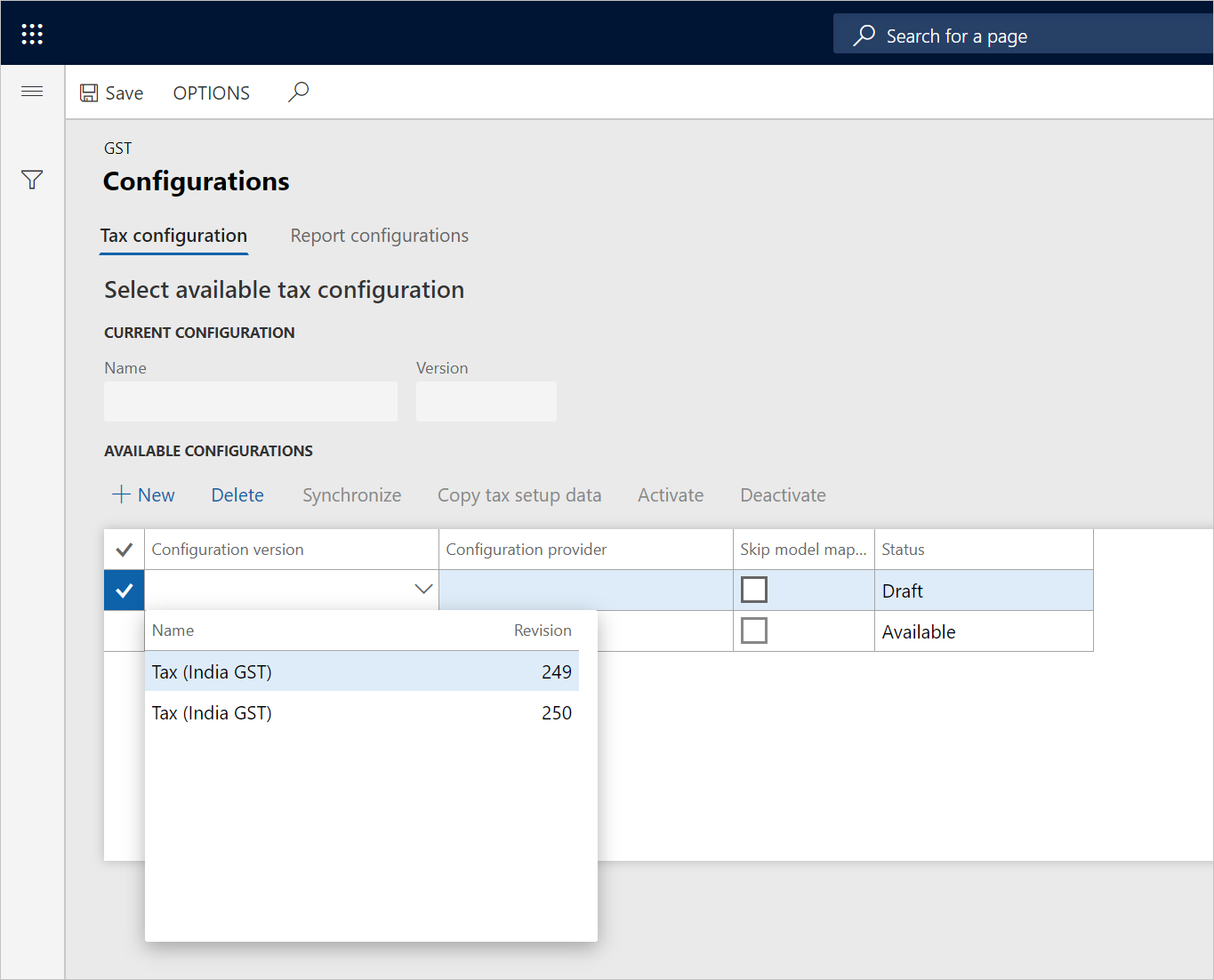

On the Tax configuration tab, in the Available configurations section, select New.

In the Configurations field, select a value.

The new tax configuration is listed in the Available configurations grid.

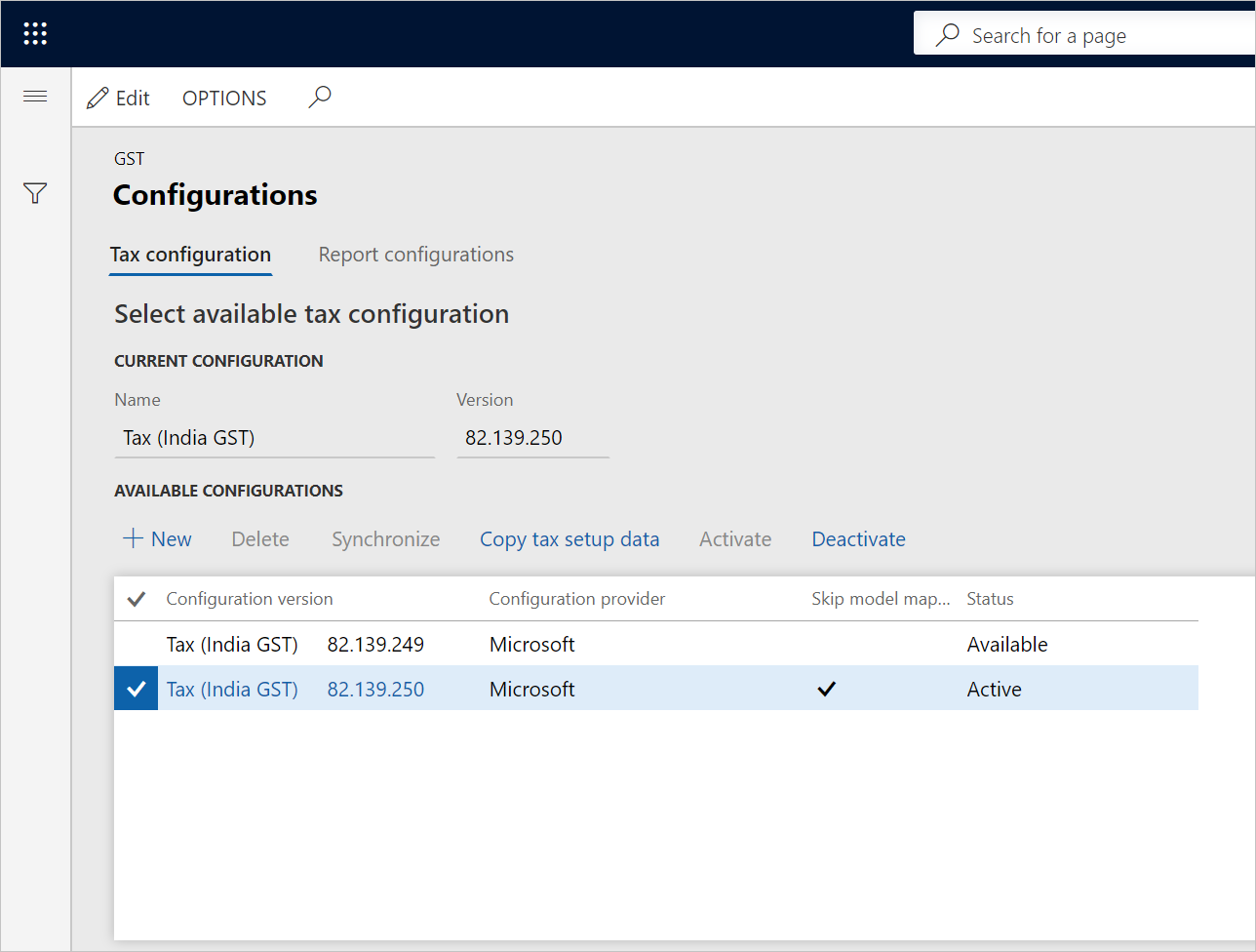

Select Save.

Select the record, and then select Synchronize.

Select Activate.

The configuration that you activated is updated as the current configuration.

Select Save, and then select Close.

反馈

即将发布:在整个 2024 年,我们将逐步淘汰作为内容反馈机制的“GitHub 问题”,并将其取代为新的反馈系统。 有关详细信息,请参阅:https://aka.ms/ContentUserFeedback。

提交和查看相关反馈