Set up fixed assets

This article provides an overview of the setup of the Fixed assets module.

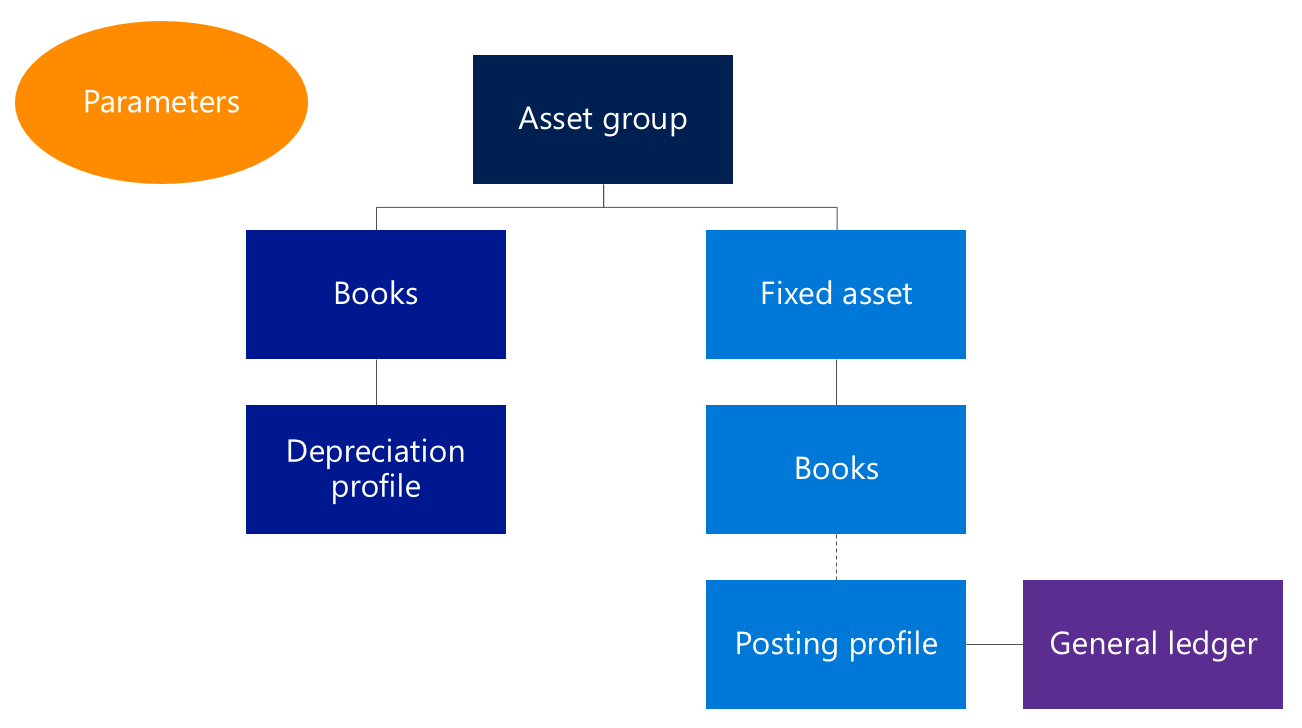

Parameters control the general behavior in Fixed assets. Fixed asset groups let you group your assets and specify default attributes for every asset that is assigned to a group. Books are assigned to fixed asset groups. Books track the financial value of a fixed asset over time by using the depreciation configuration that is defined in the depreciation profile.

Fixed assets are assigned to a group when they are created. By default, the books that are assigned to the fixed asset group are then assigned to the fixed asset. Books that are configured to post to the general ledger are associated with a posting profile. Ledger accounts are defined for each book in the posting profile and are used when fixed asset transactions are posted.

Depreciation profiles

You should first set up depreciation profiles. In the depreciation profile, you configure how the value of an asset is depreciated over time. You must define the method of depreciation, the depreciation year (calendar year or fiscal year), and the frequency of depreciation. For more information, see Set up and create depreciation profiles.

Books

After you set up depreciation profiles, you must create the required books for your assets. Each book tracks an independent financial lifecycle of an asset. Books can be configured to post associated transactions to the general ledger. This configuration is the default setting, because it's typically used for corporate financial reporting. Books that don't post to the general ledger post only to the Fixed asset subledger and are typically used for tax reporting purposes.

A primary depreciation profile is assigned to every book. Books also have an alternative or switchover depreciation profile, if this type of profile is applicable. To automatically include the fixed asset book in depreciation runs, you must enable the Calculate depreciation option. If this option isn't enabled for an asset, the depreciation proposal skips the asset.

You can also set up derived books. The specified derived transactions are posted against the derived books as an exact copy of the primary transaction. Therefore, derived transactions are typically set up for acquisitions and disposals, not for depreciation transactions. For more information, see Set up value models.

An option on the Fixed assets parameters page lets you turn the locking functionality on or off. This feature is enabled in the Feature management workspace.

Fixed asset posting profiles

After you set up books, you can create the posting profile. The posting profile must be defined by book, but it can also be defined at a more detailed level. For example, you can define the posting profile for the combination of a book and a fixed asset group, or even for an individual fixed asset book. By default, the ledger accounts that are defined are used for your fixed asset transactions.

You must define the ledger accounts that are used during the disposal processes, both disposal sales and disposal scraps. At the time of disposal, the fixed asset transactions that were previously posted are reversed out of the original accounts. The net amounts are then moved to the appropriate account for gain and loss for asset disposal. To help guarantee that transactions are correctly reversed, you must set up accounts for each type of transaction that you use in your business. The main account should be the original account that you set on the posting profile for the transaction type, and the offset account should be your gain and loss for disposal account. The exception is the net book value. In this case, both the main account and the offset account should be set to the gain and loss for disposal account. For more information, see Set up fixed asset posting profiles.

Fixed asset groups

The Fixed asset group field is the only required field when you create a fixed asset. The value of this field determines the default value of several informational fields for the asset. Books are set up so that a default book is assigned to each asset in a group. In this way, attributes that you set for the books can be specific to a group of assets. These attributes include the service life and the depreciation convention.

You can also define special depreciation allowances, or bonus depreciation, for a specific combination of a fixed asset group and a book. You must assign a priority to the special depreciation allowance to specify the order that allowances are calculated in when multiple allowances are assigned to a book. For more information, see Set up fixed asset groups.

Journal names

On the Journal names page, you must create the journal names that should be used with the Fixed assets journal. You must set the Journal type field to Post fixed assets. Set the Voucher series field so that the journal names are used for the Fixed assets journal. Fixed assets journals shouldn't use the One voucher number only setting, because a unique voucher number is required for several automated processes, such as transfers and splits.

Fixed asset parameters

The last step is to update the fixed asset parameters.

The Capitalization threshold field determines the assets that are depreciated. If a purchase line is selected as a fixed asset, but it doesn't meet the specified capitalization threshold, a fixed asset is still created or updated, but the Calculate depreciation option is set to No. Therefore, the asset won't be automatically depreciated as part of the depreciation proposals.

One important option is named Automatically create depreciation adjustment amounts with disposal. When you set this option to Yes, the asset depreciation is automatically adjusted, based on the depreciation settings at the time of asset disposal. Another option lets you deduct cash discounts from the acquisition amount when you acquire fixed assets by using a vendor invoice.

The Lock asset books in a depreciation journal parameter lets you lock asset books in a depreciation journal. When depreciation transactions are being posted, the system will verify that the same asset book hasn’t been added to more than one depreciation journal. If it has, that asset book will be locked and posting will stop. If an asset book ID is in a locked journal, it will be unlocked automatically when posting is complete for the original journal. You can also unlock the journal manually.

The Post disposal transactions in detail determines which disposal scrap/sale to consider which detailed disposal posting of acquisition to Acquisition this year and Acquisition prior years.

- If this option is set to Yes, the disposal sale/scrap posting process will validate the posting profile that the posting profile has all posting types.

- If this option is set to No, the disposal scrap/sale posting process will validate the posting profile that Acquisition value is defined in the posting profile.

[!NOTE]

You can’t define the both options of posting types Acquisition value and Acquisition this year or Acquisition prior year in the disposal sale/scrap at the same time to ensure accurate disposal posting.

On the Purchase orders FastTab, you can configure how assets are created as part of the purchasing process. The first option is named Allow asset acquisition from Purchasing. If you set this option to Yes, asset acquisition occurs when the invoice is posted. If you set this option to No, you can still put a fixed asset on a purchase order (PO) and invoice, but the acquisition won't be posted. Posting must be done as a separate step, from the Fixed assets journal. The Create asset during product receipt or invoice posting option lets you create a new asset during posting. Therefore, the asset doesn't have to be set up as a fixed asset before the transaction. The last option, Check for fixed assets creation during line entry, applies only to purchase requisitions.

You can configure reason codes so that they're required for changes to a fixed asset or for specific fixed asset transactions.

Finally, on the Number sequences tab, you define number sequences for fixed assets. The Fixed asset number sequence can be overridden by the Fixed asset group number sequence if it has been specified.

For more information, see Create a fixed asset.

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for