Manage prepayments and prepayment invoices

Watch this video to learn how you can work with prepayments.

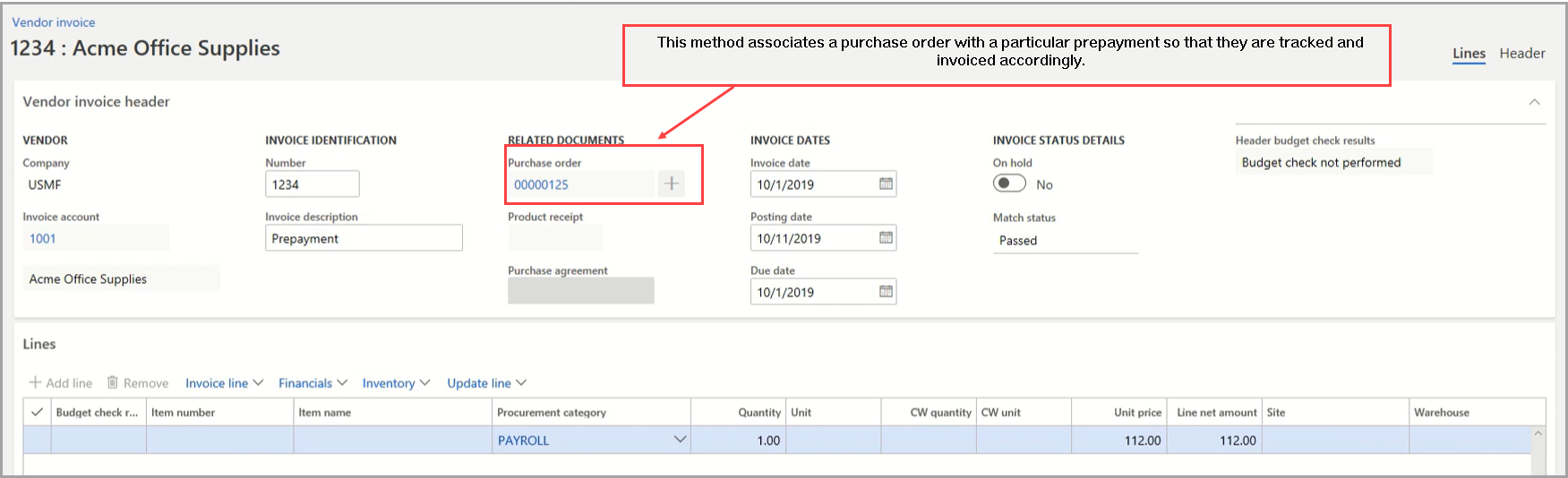

Organizations can use two methods for prepayments, and it’s important to understand the contrasts between the two methods.

- Prepayment invoice

- Prepayment journal voucher

Prepayment invoicing - You create a prepayment invoice that is associated with a purchase order.

Businesses might issue prepayments to vendors for goods or services before those goods or services are fulfilled. To minimize risk, you can track prepayments by defining the prepayment on a purchase order.

As shown in the screenshot above, this prepayment from the vendor Acme Office Supplies is associated with a purchase order which is defined in the Related Documents column.

Use prepayment invoicing in the following circumstances.

- A prepayment value is defined on the purchase order.

- Liability for the prepayment is held in the prepayment account, not the Accounts payable account. This is specified in the posting profiles as a part of the Accounts payable setup.

- The vendor balance doesn’t reflect the prepayment value throughout the process.

Prepayment journal voucher – For those organizations that don't want to track prepayments as closely or don't receive a prepayment invoice from their vendor.

You can create prepayment journal vouchers by creating journal entries and marking them as prepayment journal vouchers. For this method, you can't track which prepayments to a vendor are made against which purchase orders. However, you can mark a posted prepayment for settlement against a purchase order.

The screenshot below shows a vendor payment that has been specified for Lande Packaging Supplies, but it is not associated with a specific purchase order.

Use prepayment journal vouchers in the following circumstances.

- No prepayment value is defined on the purchase order.

- No prepayment invoice needs to be posted.

- Liability for the prepayment is held in the Accounts payable account. This account is determined by the posting profiles that are defined as a part of the Accounts payable setup.

- The vendor balance reflects the prepayment value throughout the process.

Scenario

The Purchasing agent, has created a purchase order for 100 televisions from a local television supplier. The Sales representative at the vendor has communicated to the Purchasing agent that a 10 percent prepayment is required before the order can be processed.

The Purchasing agent must create the purchase order and submit a request to the Accounts payable coordinator, to process the prepayment. When the Accounts payable coordinator has received the request, they must post the prepayment and print the check to the vendor.

When the televisions are delivered, the Accounts payable coordinator receives the invoice for the goods. They must now settle the invoice from the purchase order against the prepayment that was made previously.

Overview of the prepayment invoicing process

Prepayment invoices are a common business practice. A vendor issues prepayment invoices to require a deposit on the purchase before the purchase order is fulfilled.

For example, some vendors require a prepayment for custom goods or services. If a vendor issues an invoice that requests prepayment, you can use the prepayment invoicing feature. A prepayment value can be defined on the purchase order, a prepayment invoice is recorded and paid, and then the prepayment invoice is applied to the final invoice.

Follow these steps to create a prepayment.

- The purchasing agent creates, confirms, and then submits a purchase order that the vendor has requested prepayment for. The prepayment value is defined on the purchase order as part of the agreement.

- The vendor submits a prepayment invoice.

- The Accounts payable coordinator records the prepayment invoice against the purchase order, and then the prepayment invoice is paid.

- After the vendor delivers the goods or services, and the related vendor invoices have been received, the Accounts payable coordinator applies the prepayment amount that was already paid against the invoice.

- The Accounts payable coordinator pays and settles the remaining amount of the invoice.

Overview of the prepayment process

Accounting practices in many countries or regions require that prepayments from a customer or to a vendor are not posted to the usual summary accounts for the customer or vendor. Instead, these prepayments are posted to special ledger accounts for prepayments.

When a sales order or purchase order is created, an invoice is issued to the customer or from the vendor. When the invoice is paid, the prepayment and sales tax prepayment voucher on the prepayment ledger accounts are reversed, and the invoice amounts are automatically posted to the usual summary accounts.

To set up posting profiles for prepayments to vendors, follow this procedure.

- In Accounts payable > Setup > Accounts payable parameters, under the Ledger and sales tax FastTab, select the new posting profile under the Payment FastTab, by using the Posting profile for payment journal with prepayment parameter.

- Create a payment journal, and then create the new payment.

- You can flag the payment as a prepayment. If a payment is flagged as a prepayment, the payment is posted to the ledger accounts that are defined on the posting profile that you set up in steps 1 and 2. Also, if the payment is flagged as a prepayment, taxes are calculated. Some governments require that taxes be paid when a prepayment is recorded, even if an invoice doesn’t exist.

- Post the prepayment.

- Optional: You can settle the prepayment against the purchase order before you create the invoice. On the Purchase order page, on the Action Pane, use Settle transactions.

- After the vendor delivers the goods or services, record the invoice. If you settled the prepayment against the purchase order in step 5, the prepayment is automatically settled against the invoice that you created. If you didn't settle the prepayment against the purchase order, you can manually settle it against the invoice by using Settle transactions on the Vendor page.

- When the final invoice is created, you will be notified when prepayments exist. During the invoice marking process, the prepayments will be available to be marked and settled.

- The prepayment amount is then reversed out of the temporary Accounts payable ledger account. Also, if taxes were calculated, they are reversed because the invoice includes the actual taxes.