Describe expense management

In this unit, you'll learn about the core functionality of expense management, its streamlined features, and considerations for planning your implementation to enhance your organization's expense management capabilities.

Expense management capabilities are streamlined for your organization's expense management processes. You can use expense management to create automated workflows to collect payment method information and to be able to track how often the company credit card is used versus cash, for example. You can also import credit card purchases and monitor the money employees spend on your organization's expenses. You can use the expense policies and other out-of-the-box parameters to set up and manage Organization expenditures across categories and automate travel expense reimbursement.

In the Feature management workspace, you can enable the Expense reports reimagined feature to simplify the experience and reduce the time needed to complete expense reports. To customize the form fields' visibility, you can add a new Setup page and decide which data is required, optional, or unnecessary when expense reports are entered. When this feature is enabled, a new workspace for expenses opens.

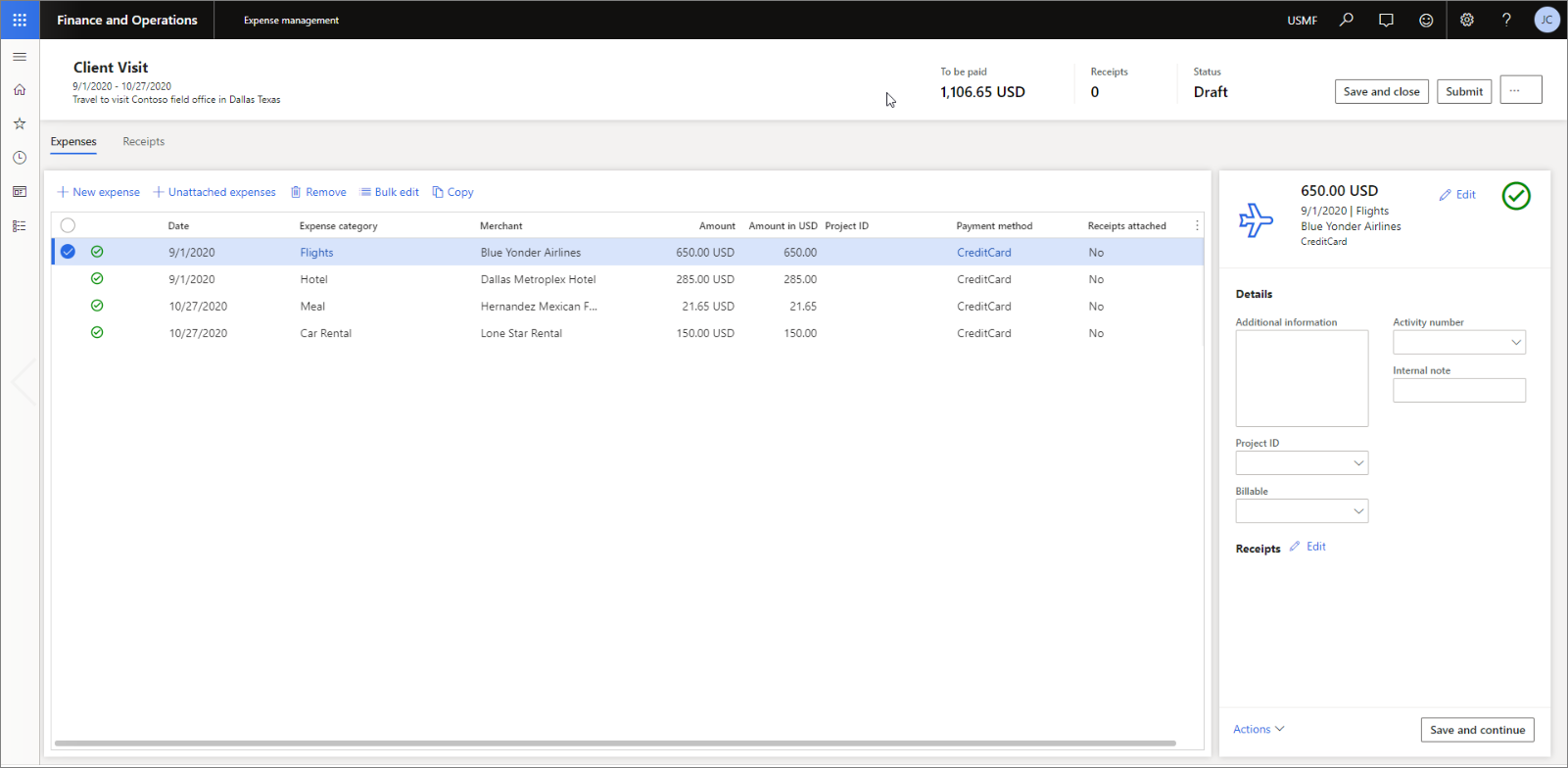

The Expense management workspace is the landing page for creating and submitting expense reports. The screenshot depicts an example expense report:

Other features of expense reports include:

Space for tracking expenditures that helps you view your delegate's expenses.

Matching experience with receipts to help display receipts at the header level and improve the method of adding receipts to expense lines.

Modern read-only grid that allows you to display even more expense lines and more data columns. Itemized and broken lines, along with their parental expenses, will appear.

Streamlined expense editing pane.

The Expense reports reimagined feature gives you access to delegates' expenses through a modern Expense management workspace. It includes a simple and intuitive pane for editing expenses and an advanced error, warning, and policy messaging system. This messaging system ensures less downtime due to correcting or waiting for edits to submit an expense report successfully. If issues arise, the expense workflow can guide users to the error and offer suggestions on what to fix.

Expense management also offers gentle policy reminders to users to help the organization stay in compliance. To ensure that you're getting the full experience, make sure you use the Feature management workspace to enable the expense reports receipt matching feature.

Plan expense management

An organization must make decisions and act when setting up Expense management during the planning period before deployment.

You can store details regarding payment methods, required travel requisitions, expense reports, rules, and so on, in Expense management. All choices that you make during the configuration of cost management are based on the organization's hierarchy and financial background. Therefore, you must refer to the proper documentation for those areas of concern, such as specific tax rules for your organization or the location of the organization. These items could have specific rules and regulations that would need to be accounted for during the planning period.

Per diems

The employee per diem provided by your company must be specified. Because per diems are typically used to cover expenses such as meals, accommodation, and other incidental expenses, you can build guidelines that your company provides for per diem allowances. The per diem might depend on the time of year, the travel destination, or both.

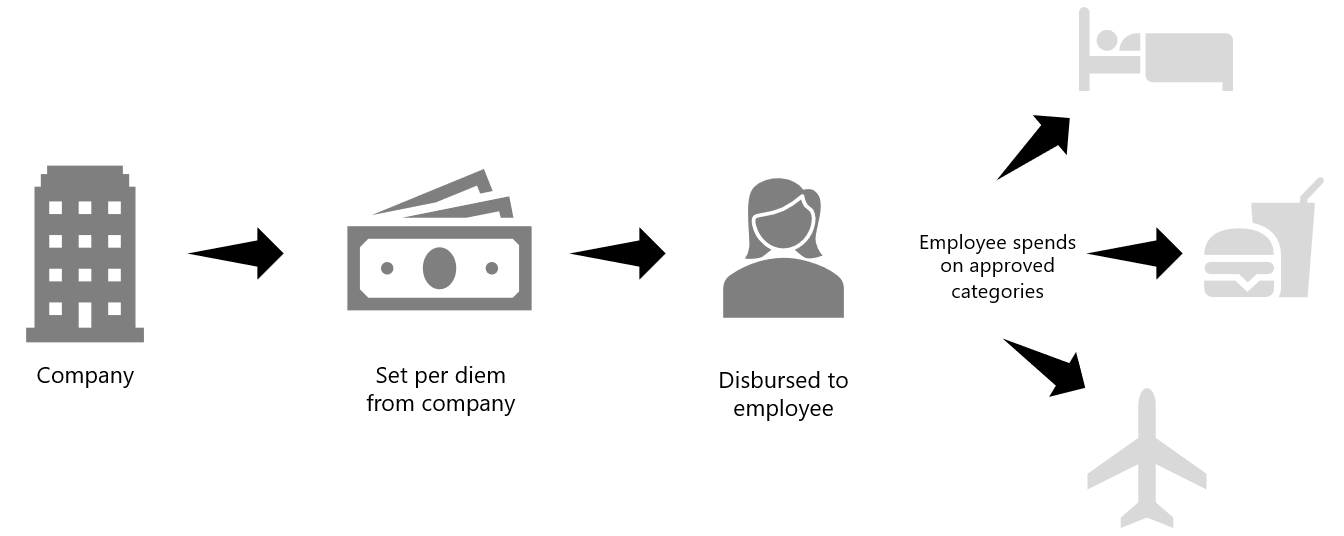

When you consider a per diem clause, you can specify that a portion of the per diem rate is withheld if a worker receives free meals or services. You can also determine per diem rate thresholds and set the minimum and the maximum number of hours that are added to a worker's travel by the per diem rate. The diagram depicts the per diem process:

Implement per diems

You must make several decisions regarding the implementation of per diems. Ask yourself the following questions.

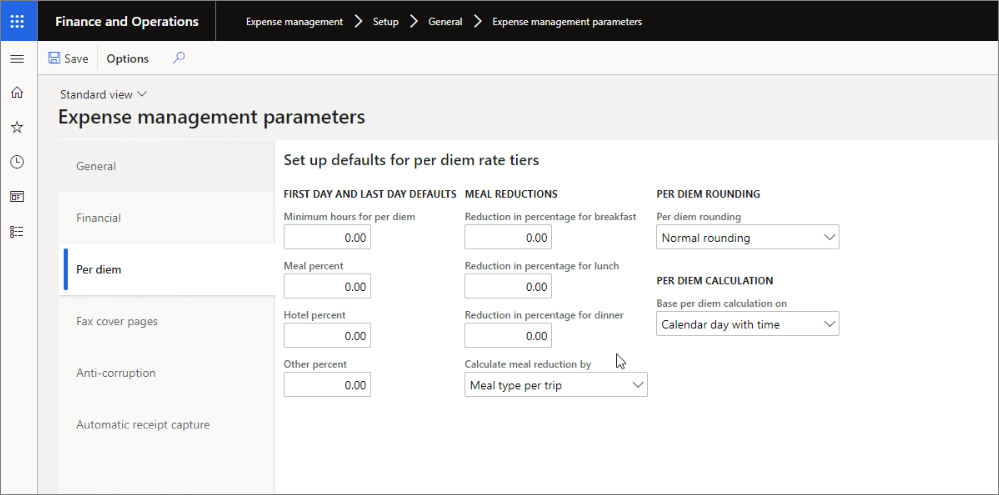

Default per diem rules for the first and last days:

What is the minimum number of hours that an employee can claim for a day and still receive a per diem?

Is there a reduction in the amount offered for meals, hotels, or other expenses for the first day and last day? If a reduction occurs, what is the percentage of the reduction?

Default per diem rules:

Is a percentage reduction offered in the per diem allowance for each meal if, for example, the meal is complimentary? If a reduction is offered, what is the reduction percentage for each meal?

Is the meal reduction calculated for each day, for each trip, or by the number of meals each day?

Should per diem amounts be rounded in the regular manner or rounded up?

Are per diems calculated on 24 hours or a workday?

The following screenshot depicts the parameter settings for the per diem configuration in the Expense management module.

Per diem rules that are based on location:

Do per diem rates vary according to location? Which locations are included?

If per diem rates vary according to location, for each location, what percentage amount is provided for the following types of expenses?

Meals

Hotel

Other expenses

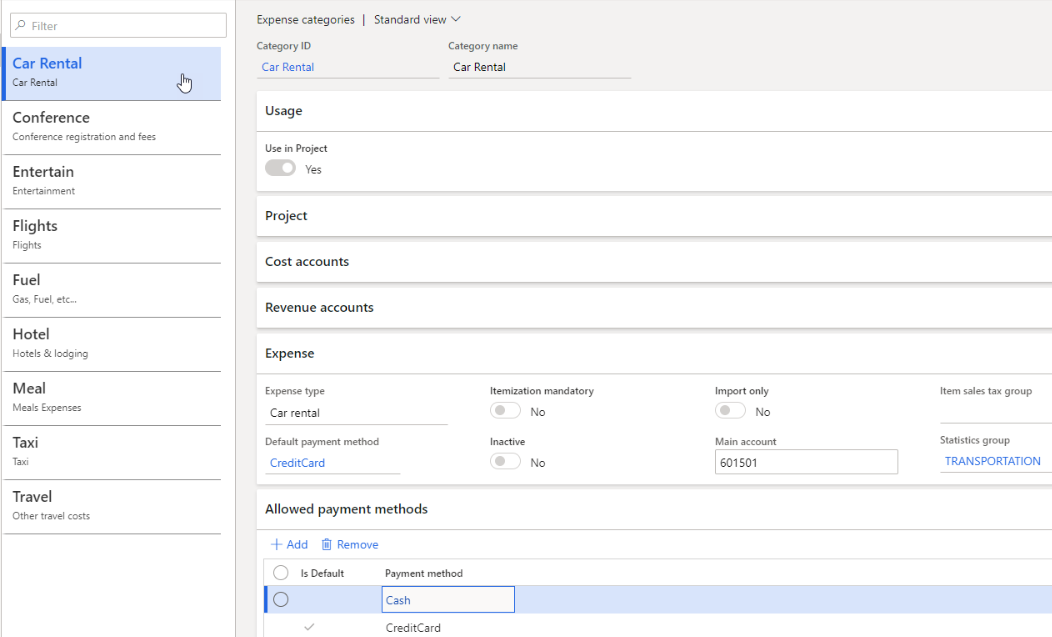

Payment methods

You must specify the payment methods employees are required to use when you allow them to incur expenses on behalf of your company. For instance, you might allow workers to use cash or a corporate credit card. You could also allow employees to use personal credit cards and then reimburse them.

Policies

Policies help guarantee that employees stay within budget, provide all required information, and spend money only as they need to.

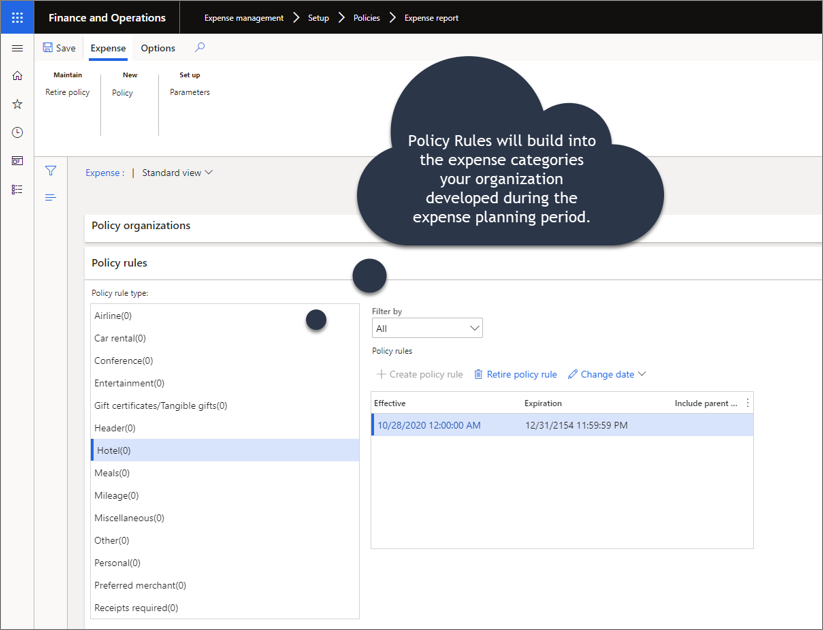

Policy rules build into the expense categories the organization developed during the expense planning period. The screenshot depicts the Policy organizations page:

Note

The expense categories can be shared between Project and Expense, or Project and Production, but not between Expense and Production.

Some widely used expense categories, depicted in the screenshot, include airfare, lodging, meals, and ground transportation.

Consider the following questions when you establish expense categories for an organization:

What is the type of expense? Categories for flights, hotels, or mileage are examples.

Can the expense category also be used in Project management and accounting?

Which default payment method should be selected for the expense category?

Which account is the default for the expense category?

Next, let's explore fixed asset management.