Introduction to cash flow forecasts

In Business Central, you can use the cash flow forecast to generate predictions of a company's cash flow. A company's cash flow indicates its financial solvency and reveals whether the company can meet its financial obligations in a timely manner.

To make sure that a company is solvent, a future-oriented planning instrument is necessary. Building on the currency assets of the previous period, the program creates a periodic compilation and calculation of the forecasted operational revenues and expenses. Then, the program calculates the cash surplus or the cash deficit. According to these results, the company can make adjustment measures, such as a credit reduction for a surplus or borrowing if there is a deficit.

In Business Central, the following sources can be used to calculate a cash flow forecast:

Receivables

Payables

Liquid funds

Manual expenses/revenues

Sales/Purchase orders

Fixed assets budgets/disposals

Service orders

G/L budgets

Jobs

Taxes

Azure AI Forecast

The Cash Flow Forecast feature can use Microsoft Azure Machine Learning to model various scenarios and give you insights into what to expect. Machine learning is a data science technique that allows computers to use existing data to forecast future behaviors, outcomes, and trends. By using machine learning, computers learn without being explicitly programmed.

Set up a cash flow forecast

Setting up the cash flow forecast function in Business Central includes the following steps:

Set up the chart of cash flow accounts.

Create cash flow payment terms.

Configure the Cash Flow Setup page.

Set up the chart of cash flow accounts

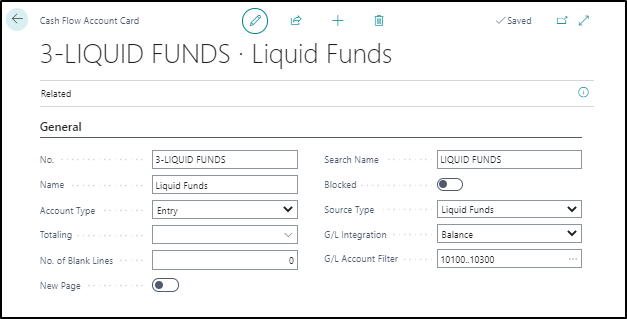

The most basic feature of cash flow is the chart of cash flow accounts in which all cash flow forecast entries are registered. In the cash flow forecast, the program arranges the individual values that affect the cash flow of your company by using the cash flow accounts. These accounts can be set up by following the high-level structure of your financial chart of accounts.

It's important that you create at least one account for each source (receivables, payables, and so on) that you want to include in your cash flow forecast.

To set up the chart of cash flow accounts, follow these steps:

Select the Search for Page icon in the top-right corner of the page, enter chart of cash flow accounts, and then select the related link.

Select New.

In the No. field, enter a number.

In the Name field, enter a name.

In the Account Type field, select one of the following options:

Entry

Heading

Total

Begin-Total

End-Total

In the Source Type field, select one of the sources.

The G/L integration is only relevant when a cash flow account is integrated with the general ledger. The G/L Integration field has the following options:

Balance - The current balance of the general ledger accounts that are used in the cash flow forecast calculation. This option is typically used for liquid funds.

Budget - The budgeted entries of the general ledger that are used in the cash flow forecast calculation. This option is typically used to include relevant profit and loss (P/L) budget values.

Both - Includes both the balance and budget options.

The G/L Account Filter field should be specified if the G/L Integration is set. Enter the general ledger accounts from where the balance and/or the budget entries should be derived.

You can also set up the chart of cash flow accounts by using the assisted setup. This process is explained in the following unit.

Set up cash flow payment terms

In addition to the standard payment terms of customers and vendors, you can specify your own methods of payment for the cash flow forecast in the Cash Flow Payment Terms Code field. This field is available on the customer and vendor card.

To set up cash flow payment terms for a customer, follow these steps:

Select the Search for Page icon in the top-right corner of the page, enter customers, and then select the related link.

Open the customer card.

Expand the Payments FastTab.

Select Show more to display all fields.

Fill in the Cash Flow Payment Terms Code field by selecting an option from the Payment Terms table.

Configure the Cash Flow Setup page

On the Cash Flow Setup page, you can configure the following information:

Automatic Update Frequency - Specifies the automatic update frequency of the cash flow forecast. At the same time, the chart on the role center for the cash flow forecast with the Show in Chart on Role Center field enabled is also automatically updated. The options are Never, Daily, and Weekly.

Accounts - You use the fields on the Accounts FastTab to specify which accounts must be used for the entries in the sales, purchases, fixed assets, jobs, and tax areas.

Cash Flow Forecast No. Series - Specifies the number series that is used in cash flow forecasts.

Taxable Period - Specifies how often tax payment is registered. The options are Monthly, Quarterly, Accounting Period, and Yearly.

Tax Payment Window - Specifies a date formula for calculating how soon after the previous tax period finished that the tax payment is registered. For example, you can enter 20D into the field, which will indicate that the tax payment should be registered 20 days after the previous tax period finished.

Tax Bal. Account Type - Specifies the type of balancing account that your taxes are paid to. The options are Vendor and G/L Account.

Tax Bal. Account No. - Specifies the balancing account that your taxes are paid to. This field is only available when the Tax Bal. Account Type field is set to G/L Account.

Azure AI - On the Azure AI FastTab, you can manually configure the connection to Azure AI. However, instead of doing this manually, you can also use the associated assisted setup, which is explained in the following unit.