Lab - Configure a new legal entity

Read this first - before you start the lab!

Important

For this lab, you CANNOT sign in with your own credentials. Use the following steps to sign in to your lab environment with the correct credentials.

Ensure that you are signed in to Microsoft Learn.

Select Launch VM mode or Sign in to launch VM mode in this unit.

In the Resources tab on the lab side bar, select the T icon next to Password in the MININT box, to have the administrator password for the Virtual Machine entered for you.

Select Enter.

Microsoft Edge will open. Wait for it to navigate to the Sign in page for finance and operations.

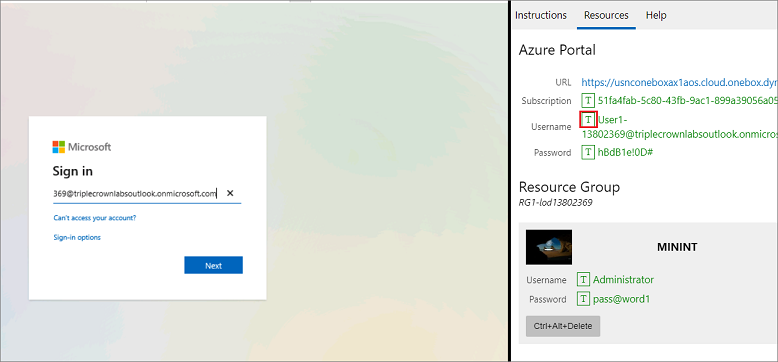

On the Microsoft Sign in page in finance and operations, place your mouse cursor into the Username field.

On the Resources tab of the lab side bar, below the Azure portal heading, select the T icon next to Username, then press Enter.

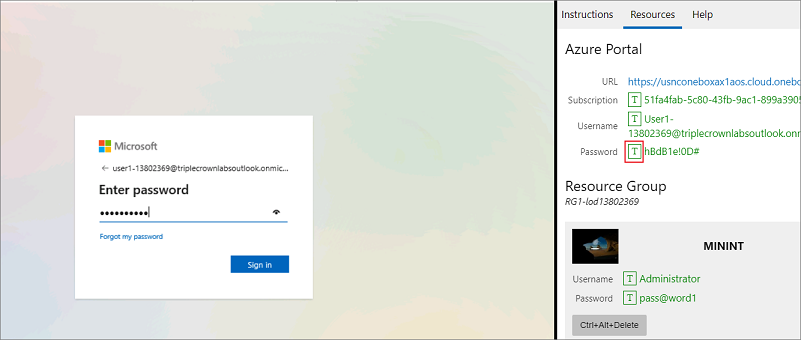

Your mouse cursor will now be in the Password page.

On the Resources tab of the lab side bar, below the Azure portal heading, select the T icon next to select Password, then press Enter.

Don't stay signed in or store the password on the virtual machine.

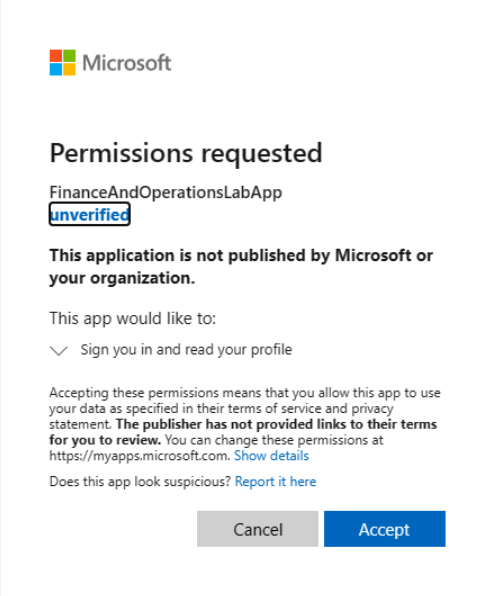

Select Accept in the Permissions requested page.

To see the lab instructions, select the Instructions tab on the lab side bar.

You can now begin your work on this lab.

Scenario

A legal entity is an organization that is identified through registration with a legal authority. Legal entities can enter into contracts and are required to prepare statements that report on their performance.

You will create a legal entity in finance and operations apps.

- Go to Organization administration > Organizations > Legal entities.

- Select New.

- In the Name field, type a value.

- In the Company field, type a value.

- In the Country/region field, enter or select a value.

- Select OK.

- In the General section, provide the following general information about the legal entity: Enter a search name if it is required.

- If this legal entity is being used as a consolidation company, set the Use for financial consolidation process slider to Yes.

- If this legal entity is being used as an elimination company, set the Use for financial elimination process slider to Yes.

- Expand the Addresses section.

- Select Edit and enter address information, such as the street name and number, postal code, and city.

- Select OK.

- Expand the Contact information section.

- To enter a new Contact information record, select Add. To modify an existing communication record, select Advanced.

- Enter information about methods of communication, such as email addresses, URLs, and telephone numbers.

- Expand the Statutory reporting section, and enter the registration numbers that are used for statutory reporting.

- Expand the Registration numbers section, and enter any information required by the legal entity.

- Expand the Bank account information section, and enter bank accounts and routing numbers for the legal entity.

- Expand the Foreign trade and logistics section, and enter shipping information for the legal entity.

- Expand the Number sequences section to view the number sequences that are associated with the legal entity.

- Expand the Dashboard Image section to view or change the logo and/or dashboard image that is associated with the legal entity.

- Expand the Tax registration section, and enter the registration numbers that are used to report to tax authorities.

- Expand the Tax 1099 section, and enter 1099 information for the legal entity. (This is only necessary for a US-based company.)

- Select Save.

Go to the next lab instructions from the lab environment

Select the Next button in the bottom-right corner of the lab side bar.