Convert to a new VAT rate

After completing the preparation and setup, you can perform the VAT rate conversion.

You must specify the new product posting groups for the new VAT rate. However, before you can perform the actual conversion, you should first run a test conversion.

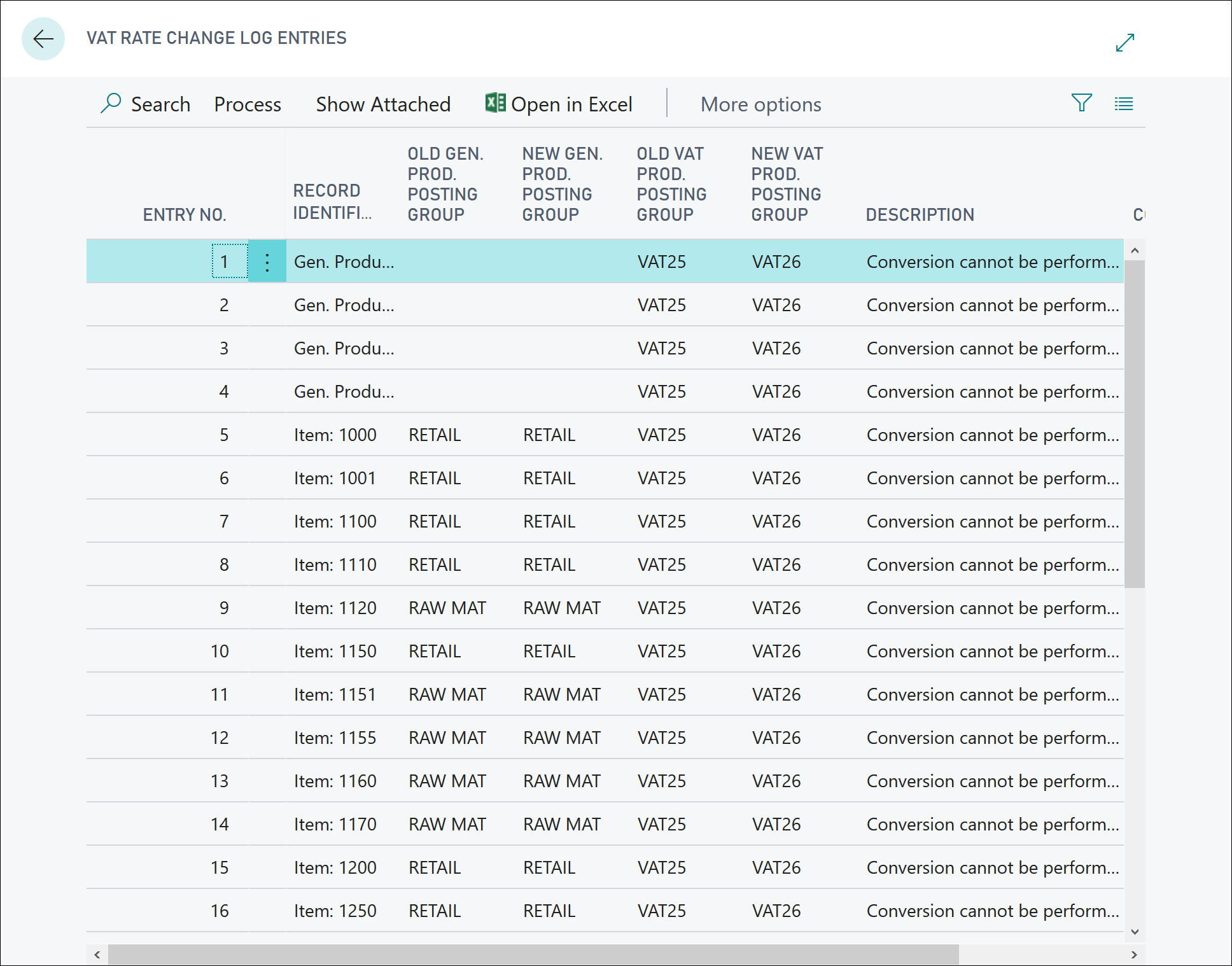

The test conversion creates VAT rate change log entries that you can use to verify the result of the conversion.

Before you can run the VAT rate change conversion, you must link the new product posting groups to the current ones. Linking the groups will help you define which old product posting group should be converted to which new product posting group.

You can link the old and new groups for both the general product posting group and the VAT product posting group.

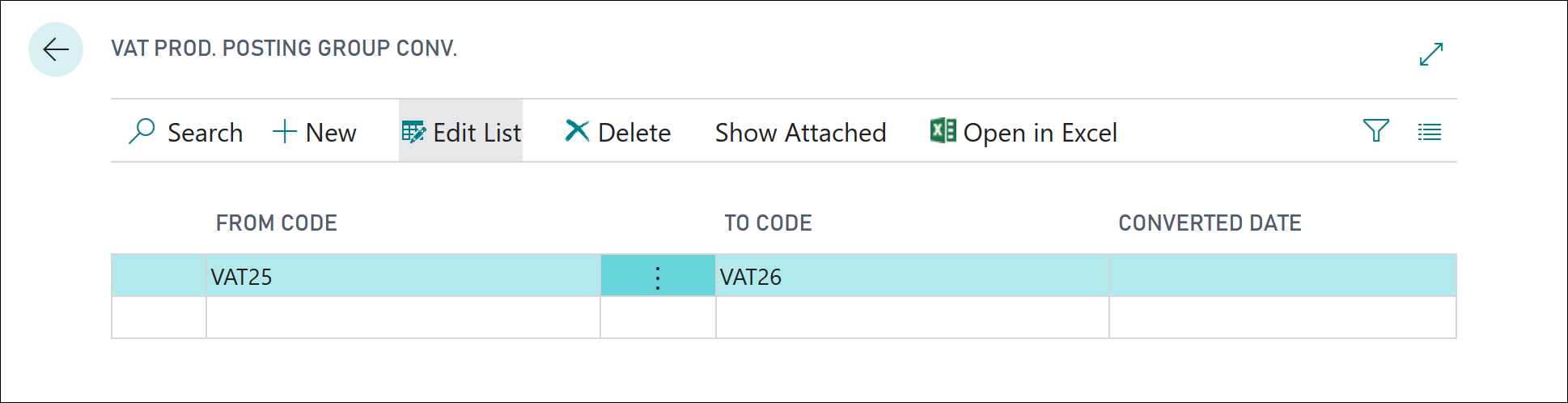

To link VAT product posting groups, follow these steps:

Select the search for page icon in the top-right corner of the page, enter vat rate change setup, and then select the related link.

In the Home tab on the ribbon, select VAT Prod. Posting Group Conv.

In the From Code field, select the current VAT product posting group.

In the To Code field, select the new VAT product posting group.

To link general product posting groups, follow these steps:

Select the search for page icon in the top-right corner of the page, enter vat rate change setup, and then select the related link.

In the Home tab on the ribbon, select Gen. Prod. Posting Group Conv.

In the From Code field, select the current general product posting group.

In the To Code field, select the new general product posting group.

To perform a VAT rate change test conversion, follow these steps:

Select the search for page icon in the top-right corner of the page, enter vat rate change setup, and then select the related link.

Verify that you have already set up the VAT product posting group conversion or the general product posting group conversion.

Clear the Perform Conversion check box.

Verify that the VAT Rate Change Tool Completed check box is cleared.

On the Home tab on the ribbon, select Convert.

A test conversion does not change the selected master data, journals, or documents.

Select the VAT Rate Change Log Entries on the ribbon to view the result of the test conversion.

After you have verified the test conversion, you can run the VAT rate change conversion as follows:

Select the search for page icon in the top-right corner of the page, enter vat rate change setup, and then select the related link.

Verify that you have already set up the VAT product posting group conversion or the general product posting group conversion.

Select the Perform Conversion check box.

In the Home tab on the ribbon, select Convert.

You can view the result of the conversion by selecting VAT Rate Change Log Entries to view the results of the conversion.

The selected master data, journals, and documents are also updated with the new product posting groups.