Cost objects

Cost objects are financial dimensions that you analyze within cost accounting. Dimension mappings help when you're consolidating multiple legal entities. You can map dimension values that are used in the different legal entities to a single value to provide a consistent view of the data. Additionally, you can define dimension hierarchies on the cost objects to use for reporting and to help make individual nodes within the hierarchy more secure.

A cost object is a collector for costs. It's a financial dimension. The list of members in a cost object is imported from the values for the financial dimension. What makes cost objects different from the dimensions is the ability to link or map values from one cost object (dimension) to another cost object (dimension). These mappings can help you link values that should be combined for consolidation. Cost objects are used in policies and dimension hierarchies.

Create a cost object

To create a cost object, follow these steps.

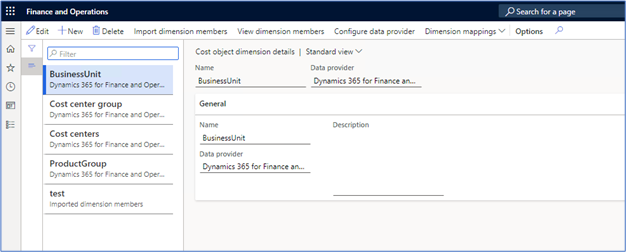

Go to Cost accounting module > Dimensions > Cost object dimensions.

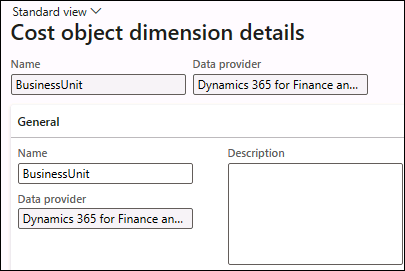

When you set up a cost object, select the data that's provided on the Cost object page. Provide a Name and a Description.

Set up a data provider by selecting the Configure data provider menu item.

Specify the financial dimension to which the cost object is mapped. You can create multiple cost objects for the same financial dimension.

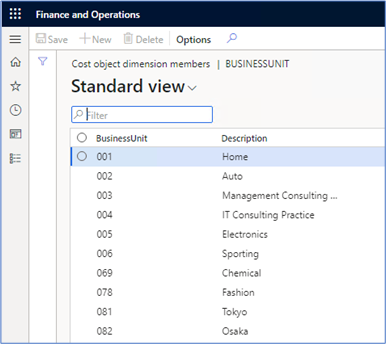

Import the dimension members (dimension values). Select the Import dimension members menu item. Unless you have many dimension values, you can run this operation without creating a batch job.

When you import the dimension members, you can view the members by using the View dimension members menu item. You can't change this list.

You can define a cost object that isn't related to a dimension by selecting the Imported dimension members option from the Data provider dropdown menu.

Select the Configure data provider menu.

You can import the values for imported dimension members by using the Data Management Framework. The framework uses the Imported cost object dimension members data entity. This entity allows you to define statistical elements and group cost objects to reduce the amount of detail that appears within reports.

Set up a cost object

When analyzing costs, you'll use cost element dimensions to determine where costs flow. You can use cost objects, also known as cost object dimensions, to determine where to assign costs.

You can include products, projects, resources, departments, cost centers, and geographical regions as the cost object. Typically, cost objects should be any type of object that you want to estimate, allocate costs to, or measure directly. It helps you to quantify costs and perform profitability analysis.

To create a new cost object, go to Cost accounting > Setup and then open Get started. You'll need to implement the following list as guided in the left panel.

- Welcome - Select the Next button in the lower part of the screen.

- Data connector – General ledger - Select the legal entity and then the Next button.

- Cost element - Select the main account types that you need to consider. Select the account types and then select the Next button.

- Cost accounting ledger - Select the Fiscal calendar, Exchange rate type, and Accounting currency to be used for cost accounting.

- Cost object - Choose the financial dimension that you need to use for your measure.

- Data connector – Budget - Select the budget model for the legal entity that you've created. You can also clear the budget data connector altogether.

You can refer to the created cost object from the Cost object dimension details page under Cost accounting > Dimensions.

Select the View dimension members button in the Action Pane to show the dimension values that are available for the financial dimension that you selected for the cost object.

To make the import of cost object dimension members easier, you can use data connectors to retrieve the values from the entities that you want to use as cost object dimensions. You can use the prebuilt data connectors or custom data connectors that you build.

Cost accounting supports integration of data from source systems through a set of data connectors:

- Imported transactions (preconfigured)

- Dynamics 365 Finance (preconfigured)

- Dynamics AX (configuration required)

Cost categories

The function of a cost category in Cost accounting is equivalent to the function of a chart of accounts in General ledger. Cost amounts are posted to cost categories through general ledger postings or cost accounting postings.

Each cost category must have one of the following three cost types assigned to it:

Primary costs - Represent the flow of costs from financial accounting to cost accounting. Primary costs are always posted directly, and you can set up primary costs to be identical to the profit and loss, revenue, or costs of the general ledger accounts. When the cost categories are the same as general ledger accounts, they're created automatically as primary costs. Not all main accounts can be represented as cost elements, depending on the business needs. Examples of primary cost elements are:

- Costs of goods sold (COGS)

- Indirect material cost

- Personnel costs

- Energy costs

Secondary costs - Represent the flow of costs internally because these costs are created and used only in Cost accounting. You can't post secondary costs directly. You'd use secondary costs to post allocations and overhead calculation. When you set up allocations, cost categories that are secondary costs are mandatory. Examples of secondary cost elements are:

- Production cost

- Production, material, and marketing overhead

Service categories - Use this cost type to post quantities. Service categories are linked with the production cost categories or the project categories.

When a cost category is created manually in Cost accounting, the local account option is enabled automatically, and you can use the cost category in cost accounting only. You can't use cost category numbers later as account numbers for general ledger accounts.

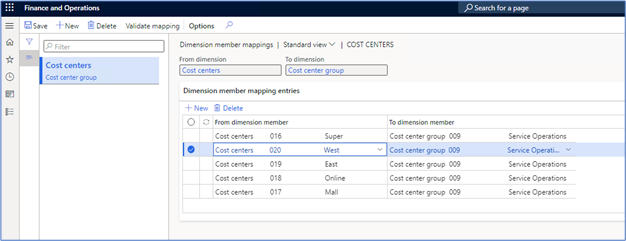

Dimension mappings

Dimension mappings allow you to link multiple dimension values to a single value for reporting. This scenario is common when different legal entities maintain data by using different detail levels and you need to consolidate the data for reporting. The mapped to dimension provides a consistent value that you can use regardless of legal entity.

To create dimension mappings, select the Dimension mappings menu item from the Cost object dimension page and then select Configure mappings from this dimension or Configure mappings to this dimension.

If the cost units in one company must roll up to cost units in another, select Configure mappings to this dimension after you've selected the cost unit dimension. Select the New button and then select Cost center groups as the To dimension. Then, add all mappings that you need to work with.

In this example, assume that one legal entity records customer service against individual channels while another records at a single cost center of Service Operations. You can link all individual channels to the same cost center group for analysis.

This type of mapping is commonly done with main accounts for consolidation. It allows for cross-company reporting with a standardized set of main accounts (represented as cost elements). Cost accounting also allows you to map financial dimensions (represented as cost objects). You can create as many mappings as you need by creating more cost objects and cost elements from the same data and then defining different mappings for each. You can use this mapping for the cost element to support the incorporation of a cross-company accounting scenario.

Dimension hierarchies

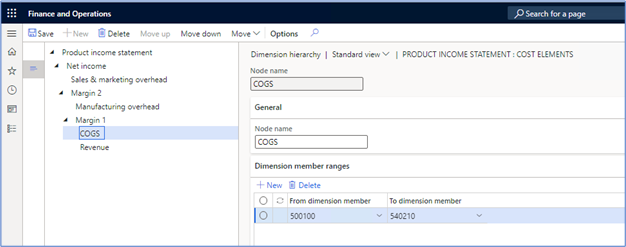

A hierarchy is a tree with specific values/value ranges of the dimension that's specified for each leaf node. The following screenshot is a simple P&L statement hierarchy based on main accounts (cost elements). You can build the same type of hierarchical structure for any cost object (financial dimension).

You can use dimension hierarchies for cost elements, statistic elements, and cost objects. These hierarchies are considered dimensions for analysis purposes.

Two types of dimension hierarchies are:

- Classification hierarchies - Use this type for rules and reporting. You need to specify each dimension value within the hierarchy.

- Categorization hierarchies - Allow for a dimension value to be specified multiple times in the hierarchy or not at all. These hierarchies are used for reporting only.

To create a hierarchy, go to the Cost accounting module, select the Dimensions group, and then select Dimension hierarchies. Select the New button to create a hierarchy and then select the type for the hierarchy.

Note

Cost objects can only use the Classification hierarchy type.

Secure a hierarchy

If you want to limit access to specific nodes in the hierarchy to specific users, you can add the users to the User FastTab for the hierarchy. This tab is only visible if you set the value of the Access list hierarchy option to Yes.

You can only add individual users (not user groups) on this tab. Only users whom you've specified will have access to the specified node and child nodes.