Introduction

By using Dynamics 365 Finance and its tax components, businesses can maintain tax rates, unit-based fees, and withholding tax, in addition to preparing and processing many types of indirect taxes such as sales tax, value-added tax (VAT), and goods and services tax (GST).

The Tax module offers many different options for tax calculation, posting and reporting, and works as follows:

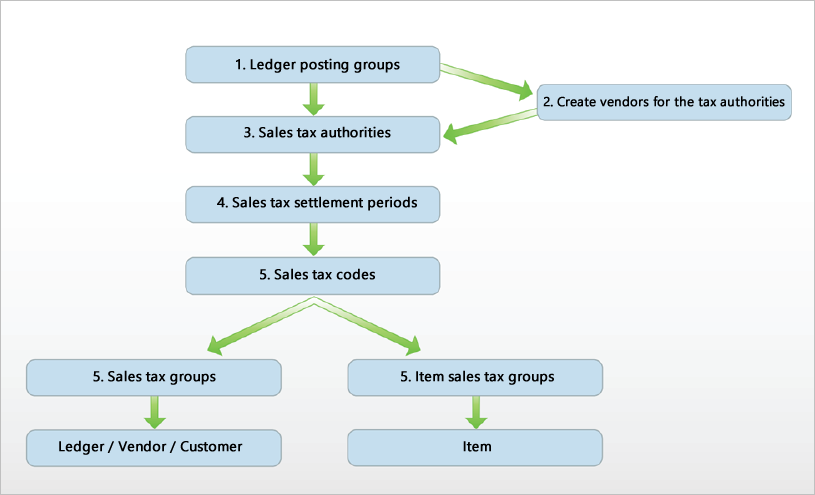

- The user specifies where to post sales taxes by entering a ledger account in the Ledger posting groups.

- The user specifies the sales tax authorities by using the Sales tax authorities page.

- The user specifies when and how frequently to settle under sales tax settlement periods.

- The user defines how much to collect or pay as a certain amount or percentage. The user sets this up under the Sales tax codes.

- The system determines whether sales tax should be imposed on a sale or purchase order through a combination of the Sales tax group and the Item sales tax group.

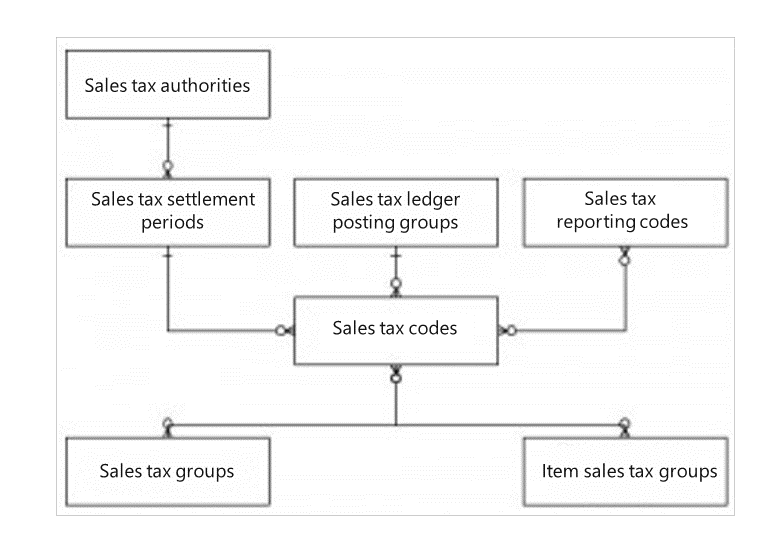

The following diagram shows the entities of the tax setup and how they are related.

You can default a Sales tax group to either a ledger account, customer, or vendor, and then default the Item sales tax group to an item.

When you buy an item from a vendor or sell an item to a customer, the system must calculate all the applicable sales taxes.

The calculated sales tax in Finance is based on the sales tax codes included in both tax groups that are attached to the customer or vendor and the item.

When you attach a settlement period and posting group to the tax codes, you specify how to post and pay the taxes. Finally, you can set up the tax reporting on the sales tax code. Sales taxes are collected on behalf of the tax authority when you sell taxable goods and services.

If you follow the steps in this sequence, you can configure the tax components in Finance.

Vendors collect taxes on behalf of the tax authority when you buy taxable goods and services. Sales taxes that are paid to vendors are debited to a sales tax receivable account. This field is not available if the Apply sales tax taxation rules option is selected in the General ledger parameters page. Instead, sales taxes that are paid to vendors are debited to the same account as the purchase.

The Use tax option must be selected for the Sales tax code in the Sales tax group that is used in the transaction, and it must be selected to post Use tax. This field will not be available if the Apply sales tax taxation rules option is selected in the General ledger parameters page.

If the Apply sales tax taxation rules option is selected in General ledger parameters, the offset is posted to the transaction’s expense account.

The balance will be created when the Settle and post sales tax job is processed. If the Tax authority for the settlement period is associated with a vendor account, the balance is posted to the vendor account instead.

The values of the Vendor cash discount and Customer cash discount fields are optional and, if no account is entered, the main account on Cash discount codes will be used. It can be beneficial to use different accounts for each Ledger posting group if you are using the Reverse sales tax on cash discount option on Sales tax groups.