Prepare periodic filings

Taxes are collected on a regular basis and must be reported to an agency (sales tax authority) that requires the collection of these taxes. The agencies are typically state or local governments.

Sales tax must be reported and paid to tax authorities at regulated intervals (monthly, quarterly, and so on). Dynamics 365 Finance provides functionality that lets you settle tax accounts for the interval and offset the balances to the tax settlement account, as specified in the ledger posting groups. You can access this functionality on the Settle and post sales tax page.

Review taxes owed to a sales tax authority

When you properly configure sales tax, transactions will capture the taxes owed for each tax code that applies. The settlement period defined on the sales tax code determines the periods required for settlement and who to pay collected taxes for that.

Authorities may require monthly settlement while others may require quarterly payments. Each unique authority and settlement period requires a settlement period definition.

The system has an inquiry page that you can use to periodically review all the detailed transactions for a tax code. To view this page, navigate to the sales tax code page and select the Sales tax code menu item. Then, select the Posted sales tax menu item within the Inquiries group. You can review transactions for a single tax code or all tax codes.

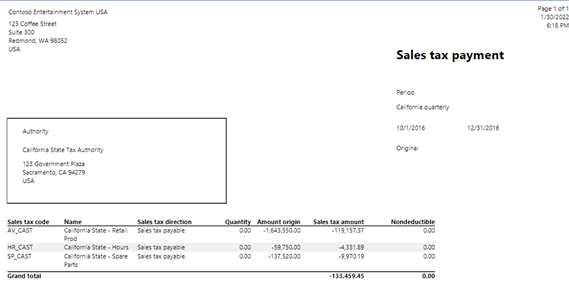

To determine how much to pay a sales tax authority for a particular settlement period, navigate to Tax, select Declarations, Sales tax, and then select Report sales tax for settlement period. The report does not create or post a journal, it just shows the amount to be paid. The following screenshot shows a sample report:

Settle taxes owed to a sales tax authority

A sales tax authority is linked to a vendor account that is used to create payments to a sales tax authority.

Select the Settle and post sales tax menu item from the Tax module to create and post a journal to settle taxes.

When you run the settlement, you specify a Settlement period, a From date, and a Transaction date. The transaction date is the last day of the settlement period. The transaction date becomes the due date for the payment to the sales tax authority. You can run an original settlement or corrections if you have made any type of change that affects the taxes owed. When complete, you receive the settlement report and a vendor transaction recording a liability for the vendor that is linked to the sales tax authority.

When reviewing sales tax transactions on the Sales tax payments page, if the Voucher column for the tax transaction has a value, the transaction has been settled and is available to be paid (or has already been paid). The system does not show that a transaction has been paid. Once the liability is recorded for the settlement, it stays in the vendor account for the sales tax authority until it is paid.

Pay sales taxes to sales tax authority

Paying the sales tax authority is like paying any vendor. A transaction on the vendor account records the sales tax liability. If you generate a payment proposal it will select this transaction for payment. You can pay the sales tax authority along with your other vendors.