Enable customer payment predictions

This unit explains how to successfully turn on and set up the Customer payment predictions feature. By enabling this feature in the Feature management workspace, and by entering configuration settings on the Finance insights configuration page, you can view the probability of payment for open transactions.

To enable and set up Customer payment predictions, follow these steps:

Turn on the Customer payment predictions feature:

- Open the Feature management workspace.

- Select Check for updates.

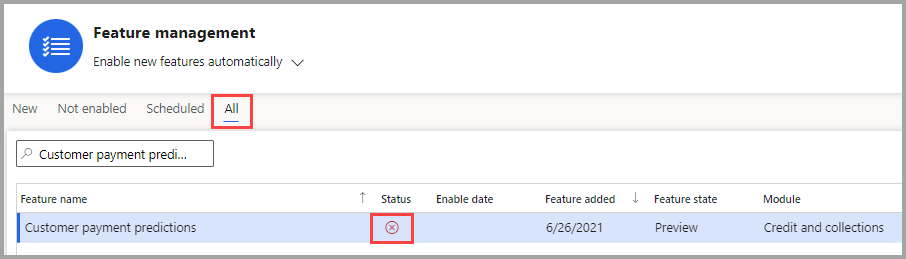

- Select the All tab and then search for Customer payment predictions.

- Turn on the feature by selecting Enable now. If the prerequisite steps have been completed, this feature will now be turned on.

If a circle with a red X appears under the Status column, then Finance insights still needs to be set up.

Set up the Customer payment insights feature:

- Go to Credit and collections > Setup > Finance insights > Customer payment predictions.

- On the Finance insights configuration page, select the Customer payment predictions tab.

- Select View the data fields used in the prediction model to open the Data fields for prediction model page. On this page, you can view the default list of fields that are used to create the AI prediction model for customer payment predictions.

To create a payment prediction model by using the default fields that are viewed in Data fields used in the prediction model, set the Enable feature option to Yes on the Customer payment predictions page.

For the Customer payment predictions feature to work properly, over 100 transactions must be spread between the On-time, Late, and Very late periods. The transactions should include free text invoices, sales orders, and customer payments and be within the previous six to nine months.

For the system to determine what goes in the Late versus Very late category, you need to specify what amount of time after the due date is considered Very late. To change the Very late transaction period, change the number of days under the Very late transaction period section of the page and then select Update. If this setting is modified after the AI prediction model has already been created, a new model will be generated and the old one will be deleted.

For each open invoice, the system predicts the probability of payment in three categories:

- On time – This category includes payments that are predicted to be paid on or before the transaction due date.

- Late – This category includes payments that are predicted to be paid after the transaction due date but before the start of the Very late transaction period.

- Very late – This category includes payments that are predicted to be paid after the start of the Very late transaction period.

To create the prediction model, go to the bottom of the Finance Insights configuration page, and under the AI model section, select Create prediction model. The Prediction model section on the Finance insights configuration page shows the status of the prediction model.

At any time while the prediction model is being created, you can select Reset model creation to restart the process.

The Customer payment predictions feature has now been set up and is ready to be used.