你当前正在访问 Microsoft Azure Global Edition 技术文档网站。 如果需要访问由世纪互联运营的 Microsoft Azure 中国技术文档网站,请访问 https://docs.azure.cn。

常见云迁移业务案例

你的组织在运营上依赖于信息技术 (IT),且很可能在创建和供应其产品上也依赖 IT。 这意味着一项巨大的支出。 将 IT 资源迁移到云可以节省成本。

但是,必须仔细考虑和规划云迁移。 为云迁移创建业务案例有助于促进财务团队和其他业务领域提供支持。 它还有助于加速云迁移并提升业务敏捷性。

业务案例可展示环境的技术和财务时间线。 开发业务案例包括制定需要考虑技术注意事项的财务计划,并与业务成果保持一致。

业务案例的关键要素

规划业务案例时,需要考虑几个关键要素。

环境范围:在构建环境的本地图景时,应同时从技术角度和财务角度考虑如何在环境范围内实现两个领域的一致性。 需要确保用于计划的技术环境与财务数据匹配。

基线财务数据:收集所需财务数据时的常见问题包括:

- 目前在环境中运行的成本是多少?

- 平均一年在服务器上花费多少?

- 要在各数据中心运营类别中花费多少(例如电力或租赁成本)?

- 下一次硬件刷新是在什么时候?

本地成本方案: 如果不迁移到云,请预测本地成本。

本地成本的 Azure 方案: 在 Azure 方案中迁移到云时预测本地成本。 将环境转移到云需要资源和时间,因此在业务案例中提供相关说明非常重要。 包括云提供的所有核心优势。

迁移时间线和 Azure 成本:预测给定环境的迁移时间线和估计成本。 考虑如何优化并充分利用 Azure 投资。 例如,使用预留实例、纵向扩展和缩减容量、使用 Azure 混合权益以及调整资源大小。

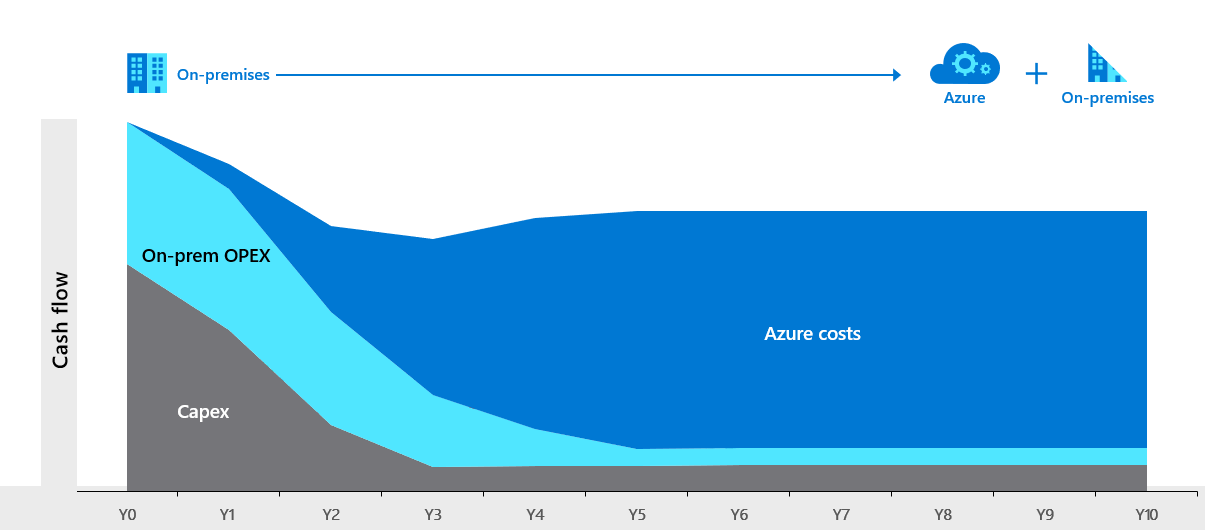

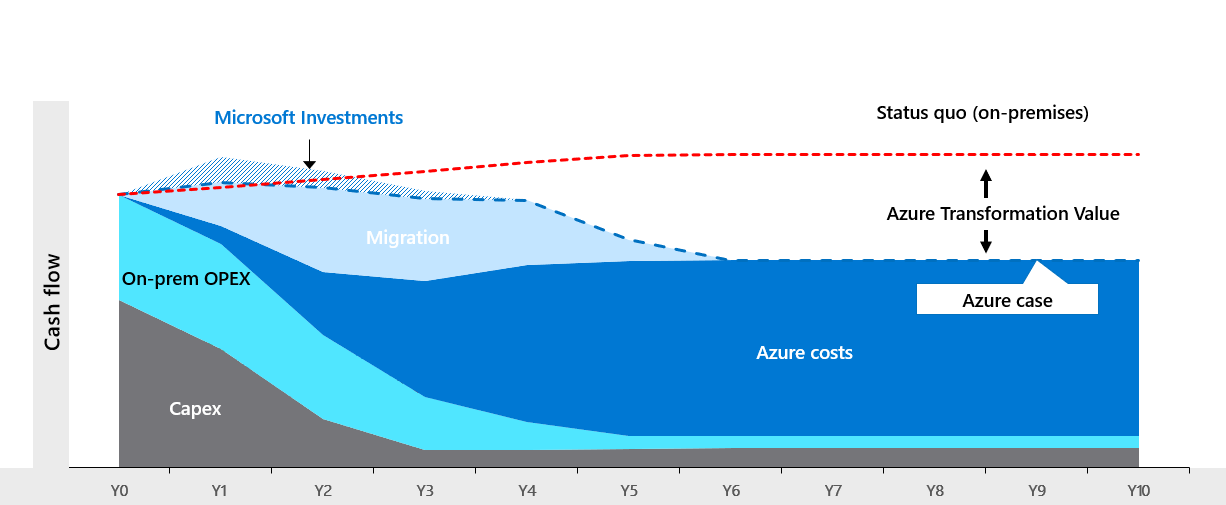

业务案例不只是一个瞬间视图。 它是涵盖一段时间的计划。 迁移到云时,成本开始降低。 可以预测与云迁移计划相关的本地支出随时间逐渐减少的走势。

确定了本地工作负载和成本结构后,便可以制定优化的 Azure 消耗计划。

最后一步是将云环境与本地或现状方案进行比较,以便评估迁移到云的好处。 Azure 视图将显示随时间推移而降低的本地成本、Azure 环境成本以及与云迁移相关的任何成本。

云节省

将资源迁移到云可以节省组织资金。 云计费模型不同于本地计费模型,可以创造有成效的节省机会,从而降低成本。 节省的成本可以随后重新投入到新技术计划中。

云成本具有灵活性,可通过以下方式来降低:

Azure 混合权益:使用此许可权益可降低在云中运行工作负荷的成本。 可以在 Azure 上使用本地的启用了软件保障的 Windows Server 和 SQL Server 许可证。 此权益还适用于 RedHat 和 SUSE Linux 订阅。

现成虚拟机:对于可能中断且不需要在特定时间范围内完成的工作负荷,可以使用提供大幅度折扣的现成虚拟机。 例如,高性能计算场景、批量处理作业、可视对象渲染应用程序、开发/测试环境,包括持续集成和持续交付工作负载,或大规模无状态应用程序。

预留:提前预留资源可获取工作负荷折扣。 作为回报,Microsoft 将助你节省高达 72% 的成本,以此作为向你提供的折扣。

用于计算的 Azure 节省计划: Azure 计算节省计划是一种灵活的成本节省计划,通过一年或三年的合同,可大幅节省即用即付价格。 符合条件的计算服务包括虚拟机、专用主机、容器实例、Azure 高级函数和 Azure 应用服务。 无论区域、实例大小或操作系统如何,这些计算服务都会节省成本。 若要进一步优化成本和灵活性,可以将 Azure 节省计划与 Azure 预留相结合。 有关详细信息,请参阅 Azure 节省计划概述和 Azure 节省计划文档。

Azure 开发/测试定价: 利用 折扣费率进行开发和测试。 它包括 Azure 虚拟机的 Microsoft 软件费用和其他服务的特殊开发/测试定价。

扩展安全更新:即使SQL Server 2008 和 SQL Server 2008 R2 的支持生命周期已结束,仍可继续获得支持。 可以将本地 SQL Server 实例迁移到 Azure 虚拟机、Azure SQL 数据库,或保留在本地并购买扩展安全更新。 迁移到 Azure VM 即可获得免费的扩展安全修补程序。

工具和计算器

有许多有价值的工具和计算器可用于帮助准备云迁移的业务案例。

Azure 总拥有成本 (TCO) 计算器:使用 TCO 计算器,估算将工作负荷迁移到 Azure 后可以实现的成本节省情况。

可以输入本地基础结构的详细信息,包括服务器、数据库、存储、网络、许可设想和成本。 计算器会从 Azure 服务创建一个匹配项,以便创建一个宽泛的初始 TCO 比较。 但是,需要谨慎看待 TCO 计算器的结果,因为本地服务器列表通常很复杂,在考虑 Azure 时可以采取优化步骤。

零售费率价格 API:使用零售费率价格 API 检索所有 Azure 服务的零售价格。 以前,检索 Azure 服务价格的唯一方法是使用 Azure 定价计算器或使用 Azure 门户。 此 API 提供所有 Azure 服务的零售费率,且无需身份验证。 使用 API 来了解面向不同区域和不同 SKU 的 Azure 服务价格。 还可以借助编程 API 创建自己的工具,用于内部分析和 SKU 和区域范围的价格比较。

Azure VM 成本估算器:借助此 Power BI 模型,你可以通过优化 VM 的 Azure 套餐和权益(例如 Azure 混合权益和预留实例)来估算与即用即付定价相比节省的成本。

下载以下文件以使用 Power BI 模型:

Azure 定价计算器:使用定价计算器估算 Azure 产品的每小时或每月成本。

合作伙伴工具集:Microsoft 合作伙伴在 Azure 市场中提供了可以帮助创建迁移成本分析的工具。

解决方案评估:在参与解决方案评估的过程中,从 Microsoft 解决方案评估专家或合格合作伙伴处获取帮助。

Azure 迁移和现代化计划:加入此计划,获取云迁移旅程每个阶段的指导和专家帮助。 迁移基础结构、数据库和应用,以便自信地开展下一步工作。

了解 Azure

Microsoft Learn 培训 为 Azure 提供了许多学习路径,你可能希望在构建业务案例时考虑这些路径。

- 通过“Azure 成本管理 + 计费”来控制 Azure 支出和管理账单。

- Microsoft Azure 架构良好的框架 - 成本优化

- 计划和管理 Azure 成本

- 使用 Azure 成本管理分析成本并创建预算

- 使用 Azure 成本管理以 Microsoft 合作伙伴的身份配置和管理成本

后续步骤

详细了解如何共享迁移到云的策略和业务案例:

反馈

即将发布:在整个 2024 年,我们将逐步淘汰作为内容反馈机制的“GitHub 问题”,并将其取代为新的反馈系统。 有关详细信息,请参阅:https://aka.ms/ContentUserFeedback。

提交和查看相关反馈